Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

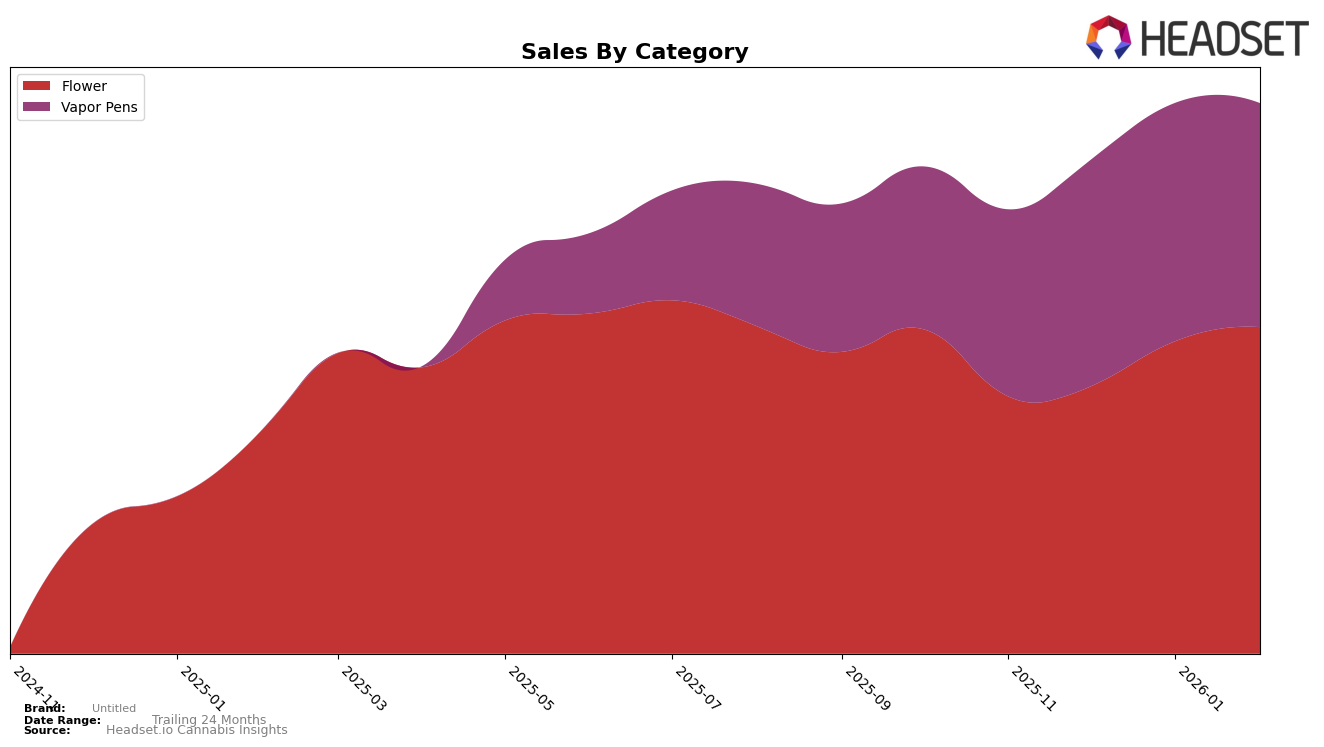

In New York, Untitled has shown a steady presence in the Flower category, maintaining a consistent ranking within the top 15 brands over the past few months. Starting at the 11th position in November 2025, Untitled experienced a slight dip to 12th in December but quickly regained momentum, climbing to 9th by January 2026 and holding that position through February. This upward trend is indicative of a successful strategy in increasing their market share and presence in the Flower category, reflecting a solid consumer base in the New York market.

In the Vapor Pens category, Untitled has also displayed a positive trajectory in New York. Initially ranked 10th in November 2025, the brand experienced a minor setback in December, slipping to 11th. However, they rebounded to 9th in January 2026 and further improved to 8th by February. This consistent climb in rankings suggests that Untitled's products in the Vapor Pens category are resonating well with consumers, potentially due to product innovation or effective marketing strategies. The brand's ability to maintain and improve its position in competitive categories like Flower and Vapor Pens highlights its adaptability and appeal in the evolving New York market.

Competitive Landscape

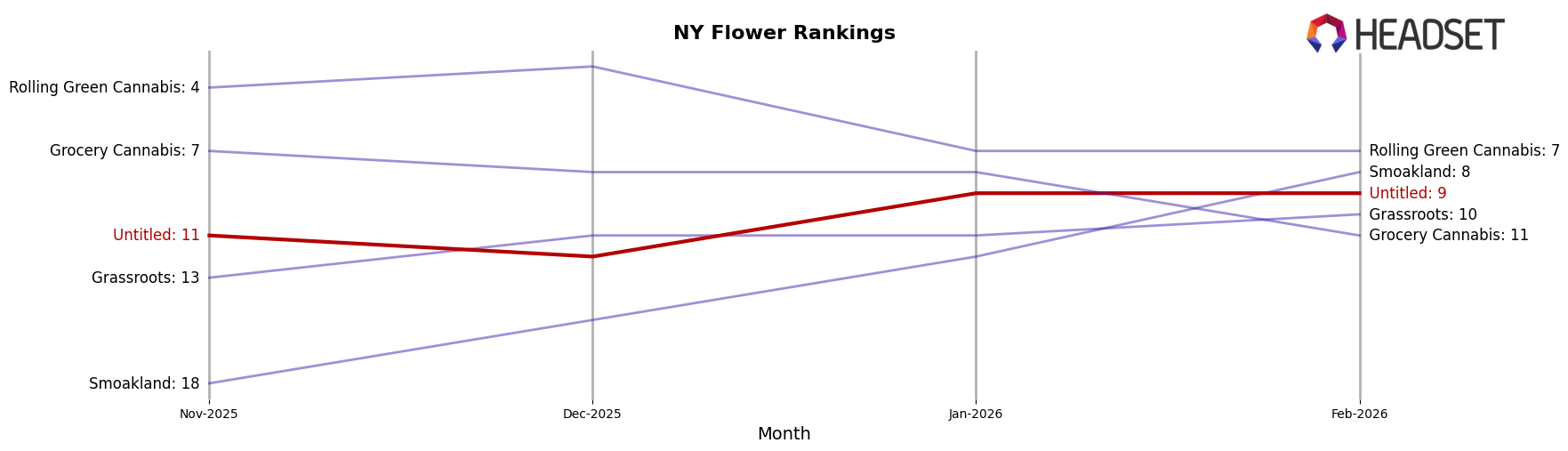

In the competitive landscape of the New York flower category, Untitled has shown a steady performance with a consistent rank of 9th place in January and February 2026, after a slight dip to 12th in December 2025. This stability in rank is notable given the dynamic shifts among its competitors. For instance, Smoakland has made a significant climb from 18th in November 2025 to 8th by February 2026, indicating a rapid increase in market presence. Meanwhile, Grassroots has maintained a steady improvement, reaching 10th place in February 2026. On the other hand, Rolling Green Cannabis experienced a drop from 3rd in December 2025 to 7th in February 2026, suggesting potential challenges in maintaining their earlier momentum. Grocery Cannabis also saw a decline from 8th to 11th place over the same period. Despite these fluctuations, Untitled's consistent sales growth, particularly the increase from December 2025 to February 2026, positions it as a resilient player in the market, capable of maintaining its competitive edge amidst the evolving dynamics.

Notable Products

In February 2026, the top-performing product for Untitled was Peach Ringz Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 6,244 units. White Gummy Distillate Cartridge (1g) followed closely in second place, while Baja Breeze Distillate Cartridge (1g) dropped from second in January to third in February. Golden Yuzu Distillate Cartridge (1g) maintained a consistent presence, ranking fourth after being third the previous month. Strawnana Distillate Reload Cartridge (1g) held steady at fifth place, showing no change from January. These rankings highlight a strong preference for distillate cartridges among consumers, with Peach Ringz emerging as a clear favorite this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.