Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

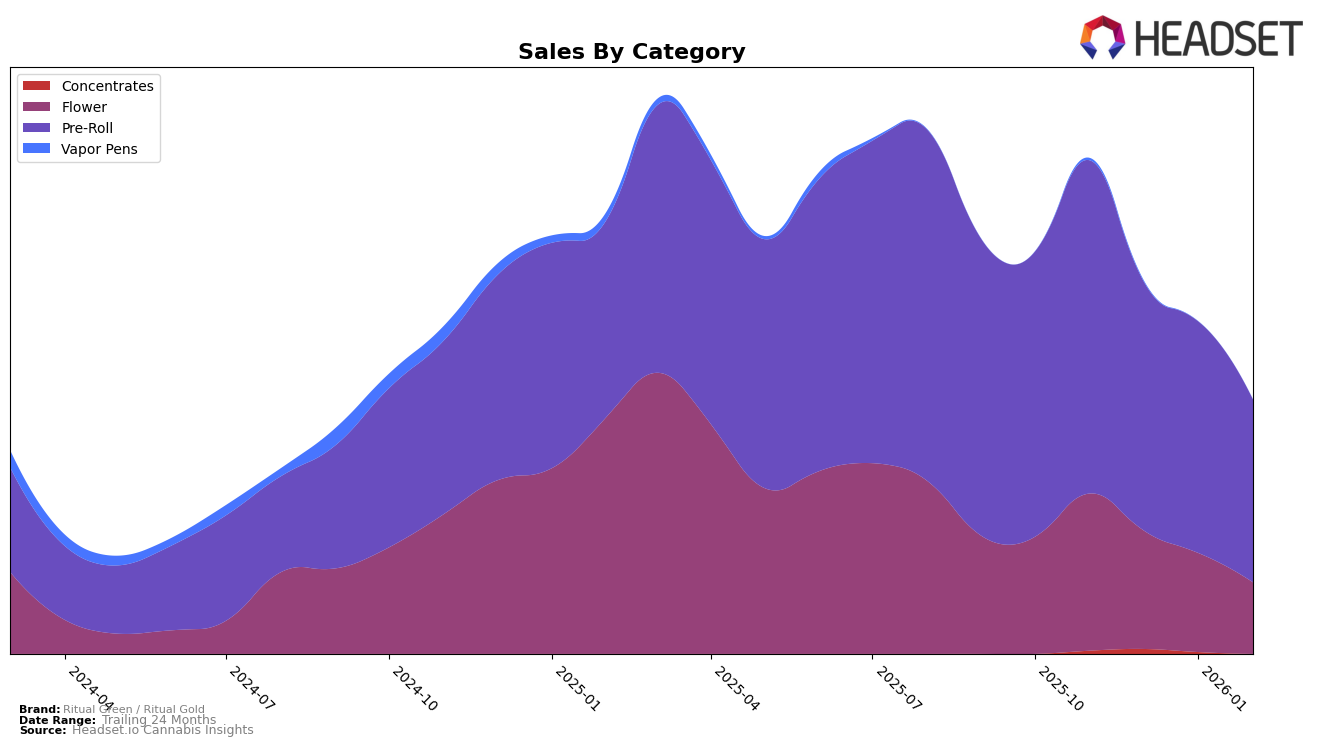

Ritual Green / Ritual Gold has shown a varied performance across different categories and provinces. In Alberta, the brand's Pre-Roll category has not broken into the top 30 rankings from November 2025 to February 2026, with its rank peaking at 55 in November 2025 and declining to 71 by February 2026. This indicates a challenging market environment for the brand in Alberta's Pre-Roll category, as maintaining or improving rank in such a competitive space is crucial. The decline in sales from November 2025 to February 2026 further underscores the difficulties faced in this market. Such a performance suggests that the brand may need to reassess its strategies or offerings in Alberta to gain a stronger foothold.

In contrast, Ritual Green / Ritual Gold has experienced more favorable outcomes in Saskatchewan. Within the Flower category, the brand maintained a presence in the top 20, although it experienced a gradual decline from 11th in November 2025 to 20th by February 2026. This decline, while not ideal, still reflects a relatively strong position in the market. Meanwhile, the Pre-Roll category in Saskatchewan showed resilience with ranks fluctuating between 6th and 9th, demonstrating a consistent demand for their products. This stable performance in Saskatchewan's Pre-Roll sector, despite some fluctuations, highlights the brand's ability to sustain consumer interest and suggests a potentially robust market presence compared to Alberta.

Competitive Landscape

In the competitive landscape of the Saskatchewan Pre-Roll category, Ritual Green / Ritual Gold has experienced notable fluctuations in its ranking over the past few months. Starting from a strong position at 6th place in November 2025, the brand saw a dip to 9th in December, maintaining this rank in January 2026, before recovering slightly to 7th in February. This movement is indicative of a dynamic market where competitors like Redecan and Space Race Cannabis have also shown variability in their standings, with Space Race Cannabis notably climbing to 4th place in December. Meanwhile, Doobie Snacks has been a standout performer, rising to 3rd place in both December and February. Despite these shifts, Ritual Green / Ritual Gold's sales have shown resilience, with a slight increase from January to February, suggesting a potential for stabilization or growth if they can leverage strategic marketing and product differentiation against competitors like Fuego Cannabis (Canada), which has seen a decline to 9th place in February.

Notable Products

For February 2026, the top-performing product from Ritual Green / Ritual Gold was the French Cookies Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its consistent number one rank with sales of 3683 units. Following closely, the Ritual Sticks - Blue Pave Pre-Roll 3-Pack (1.5g) held steady in second place, showing a slight decrease in sales compared to previous months. The Ritual Sticks - Strawberry Rizz Pre-Roll 3-Pack (1.5g) remained in third place, continuing its consistent performance from January. The Ritual Sticks - French Cookies Pre-Roll (0.5g) returned to the rankings in fourth place after a brief absence in December, while the Lemon Haze Pre-Roll (0.5g) made its debut in fifth place. Overall, the rankings for Ritual Green / Ritual Gold products showed stability with minor shifts, indicating a strong brand presence in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.