Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

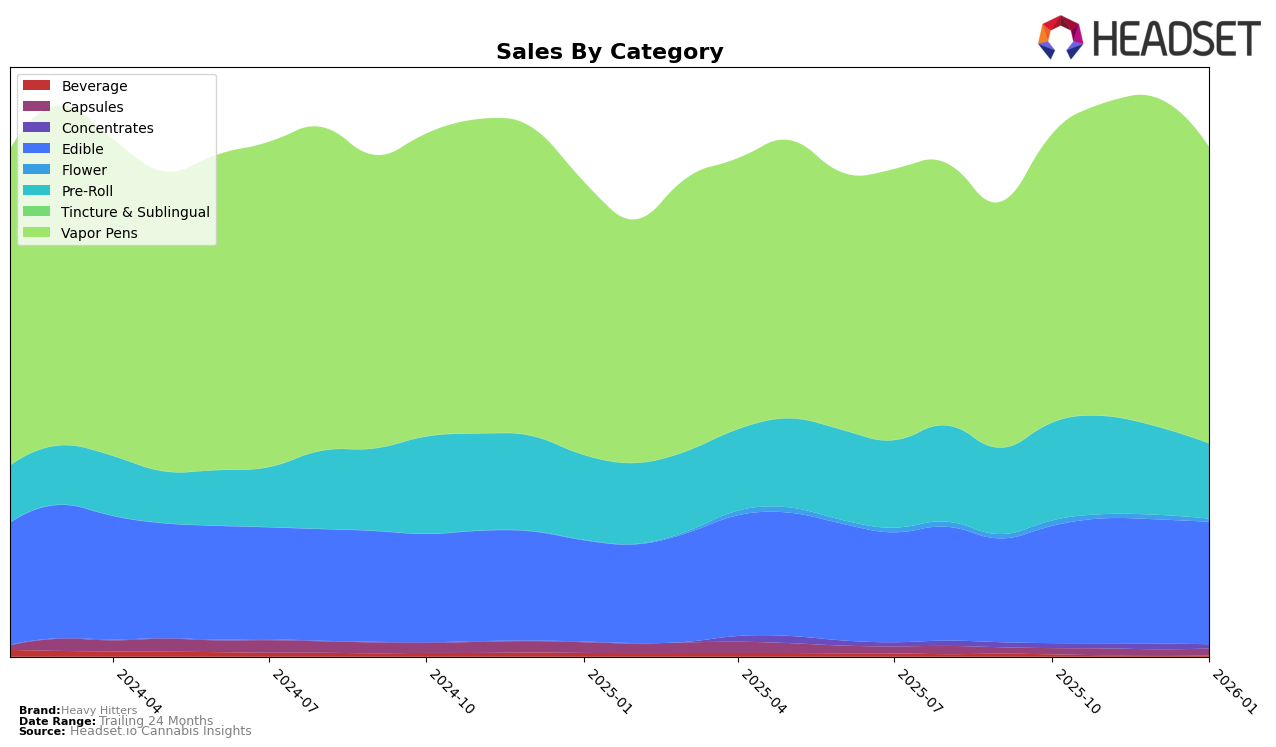

Heavy Hitters has maintained a consistent presence in the California market, particularly within the Edible and Vapor Pens categories. In the Edible category, the brand consistently held the 6th position from October 2025 through January 2026, showcasing stability in a competitive market. Similarly, their Vapor Pens also maintained a steady 6th rank during the same period, signifying strong consumer loyalty or effective brand positioning in this category. However, their performance in the Pre-Roll category saw a slight decline, dropping from 10th to 12th place by January 2026. This indicates a potential area of concern or a shift in consumer preference that may require strategic reassessment.

In contrast, Heavy Hitters' presence in the New Jersey market for Vapor Pens has only recently emerged, with the brand entering the top 30 in December 2025 at the 26th position and slightly dropping to 27th by January 2026. This indicates a nascent but growing footprint in the state. Meanwhile, in New York, the brand's performance in both Edible and Vapor Pens categories shows varied trends. The Edible category saw a stable ranking between 15th and 16th, while Vapor Pens exhibited more fluctuation, moving from 13th to 17th before rising again to 12th by January 2026. This volatility suggests potential opportunities for growth or the need for strategic adjustments to capitalize on market dynamics.

Competitive Landscape

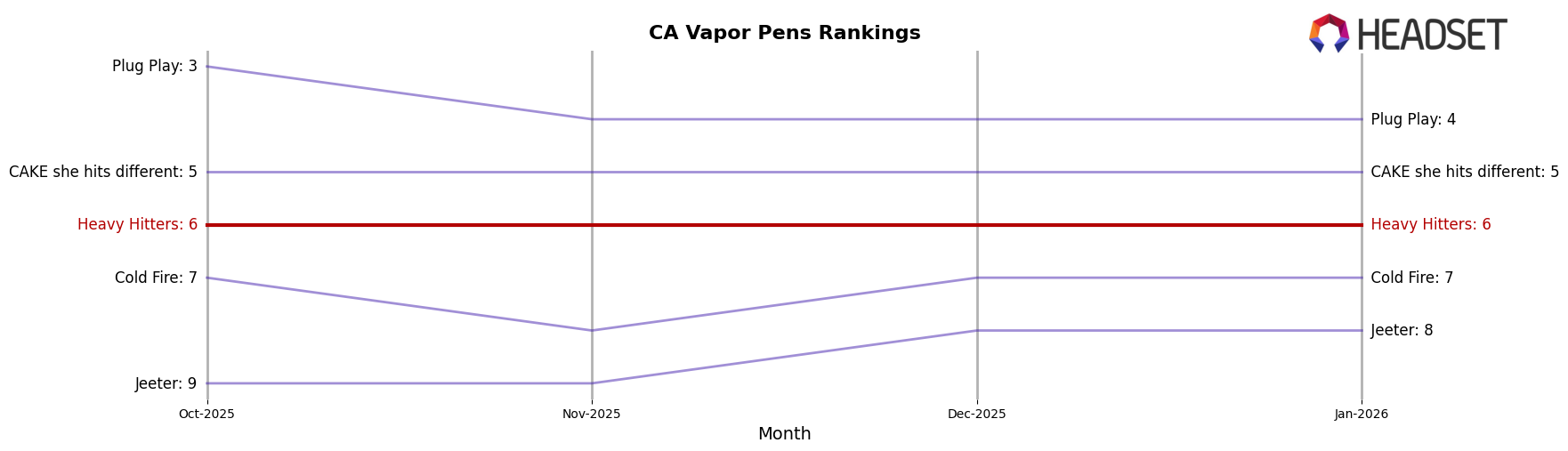

In the competitive landscape of vapor pens in California, Heavy Hitters consistently maintained its 6th place rank from October 2025 to January 2026. Despite stable rankings, sales saw a slight decline in January 2026 compared to previous months. This stability in rank suggests a strong brand presence, but the sales dip could indicate a need for strategic adjustments to capture more market share. Notably, Plug Play consistently outperformed Heavy Hitters, holding the 3rd and 4th positions with significantly higher sales figures. Meanwhile, CAKE she hits different maintained its 5th position, just ahead of Heavy Hitters, with a noticeable sales increase in December 2025. Additionally, Cold Fire and Jeeter trailed behind, with Jeeter improving its rank slightly in December 2025. These dynamics highlight the competitive pressure Heavy Hitters faces and the potential need for innovation or marketing efforts to boost its sales trajectory in the California vapor pen market.

Notable Products

In January 2026, the top-performing product from Heavy Hitters was Lights Out - THC/CBN 1:1 Midnight Cherry Gummies 5-Pack, maintaining its top rank consistently from October 2025 through January 2026 with sales of 20,009 units. Light On - THC/THC-V 2:1 Green Crack Gummies 5-Pack also held steady in second place throughout the same period. Holy Grape x God's Gift Ulta Gummies 5-Pack improved its position from fifth in December 2025 to third in January 2026, showing a positive trend. Pineapple Express Distillate Cartridge slipped from third in December 2025 to fourth in January 2026. Sour Watermelon Fast Acting Diamond Infused Gummies entered the rankings in January 2026 at fifth place, indicating a promising new entry in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.