Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

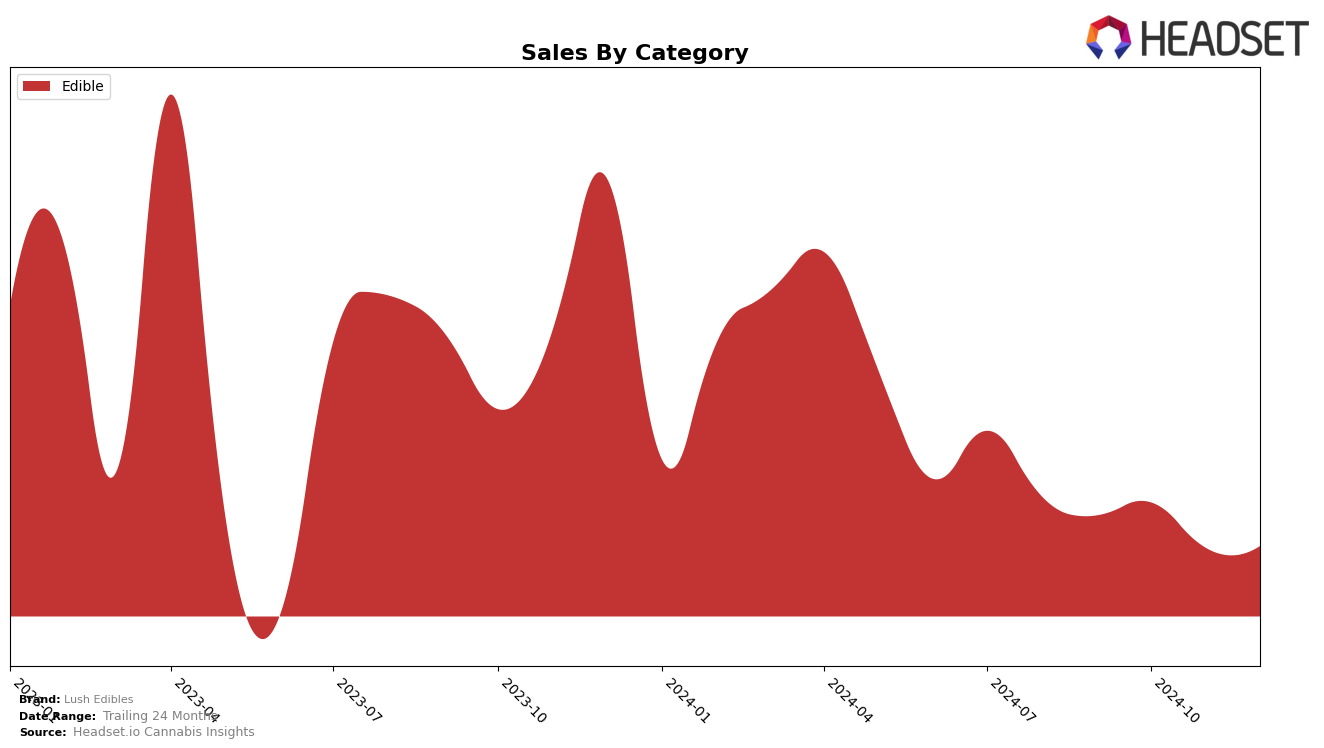

Lush Edibles has shown a consistent presence in the Arizona market within the Edible category. Despite a slight dip in November 2024, where the brand fell out of the top 30 rankings, Lush Edibles managed to recover by December. The brand maintained its 28th position in both September and October, indicating a stable demand during these months. The fluctuation in rankings, particularly the drop in November, suggests a competitive market environment or possible shifts in consumer preferences. However, the ability to re-enter the top 30 by December reflects resilience and potential strategic adjustments by the brand.

While Lush Edibles' performance in Arizona provides insights into its market dynamics, the absence of rankings in other states or provinces highlights potential areas for expansion or challenges in reaching broader markets. The brand's sales figures in Arizona reveal a peak in October before a decline in November, which could be attributed to seasonal factors or market saturation. Maintaining a presence in the top rankings consistently can be crucial for brand visibility and consumer retention. Observing trends across different states or provinces could offer deeper understanding and opportunities for growth.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Lush Edibles has shown resilience and adaptability, maintaining a relatively stable position in the rankings from September to December 2024. Despite a slight dip from 28th to 31st place in November, Lush Edibles rebounded to 30th in December, indicating a positive trajectory. In comparison, iLava consistently ranked lower, maintaining a steady 27th position throughout the period, while Curaleaf experienced more volatility, dropping from 30th to 36th by December. Chew & Chill (C & C) demonstrated notable fluctuations, ending December at 29th, just ahead of Lush Edibles. Meanwhile, Pucks showed a downward trend, slipping from 31st to 34th. These dynamics suggest that while Lush Edibles faces stiff competition, its ability to recover and maintain a competitive edge amidst fluctuating market conditions is a testament to its brand strength and market strategy.

Notable Products

In December 2024, the top-performing product for Lush Edibles was Mango OG Gummies 10-Pack (100mg), which achieved the first rank with sales of $878. Strawberry Cough Gummies 10-Pack (100mg) maintained its strong position at the second rank, despite a drop in sales from previous months. Wildberry Gummies 10-Pack (100mg) climbed to the third position, showing a positive trend from its fifth-place ranking in November. Tropicanna Punch Gummies 10-Pack (100mg) held steady in the fourth rank, while Watermelon Haze Gummies 10-Pack (100mg) dropped to fifth from its top position in November. Overall, the rankings indicate a dynamic shift in consumer preferences towards Mango OG Gummies in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.