Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

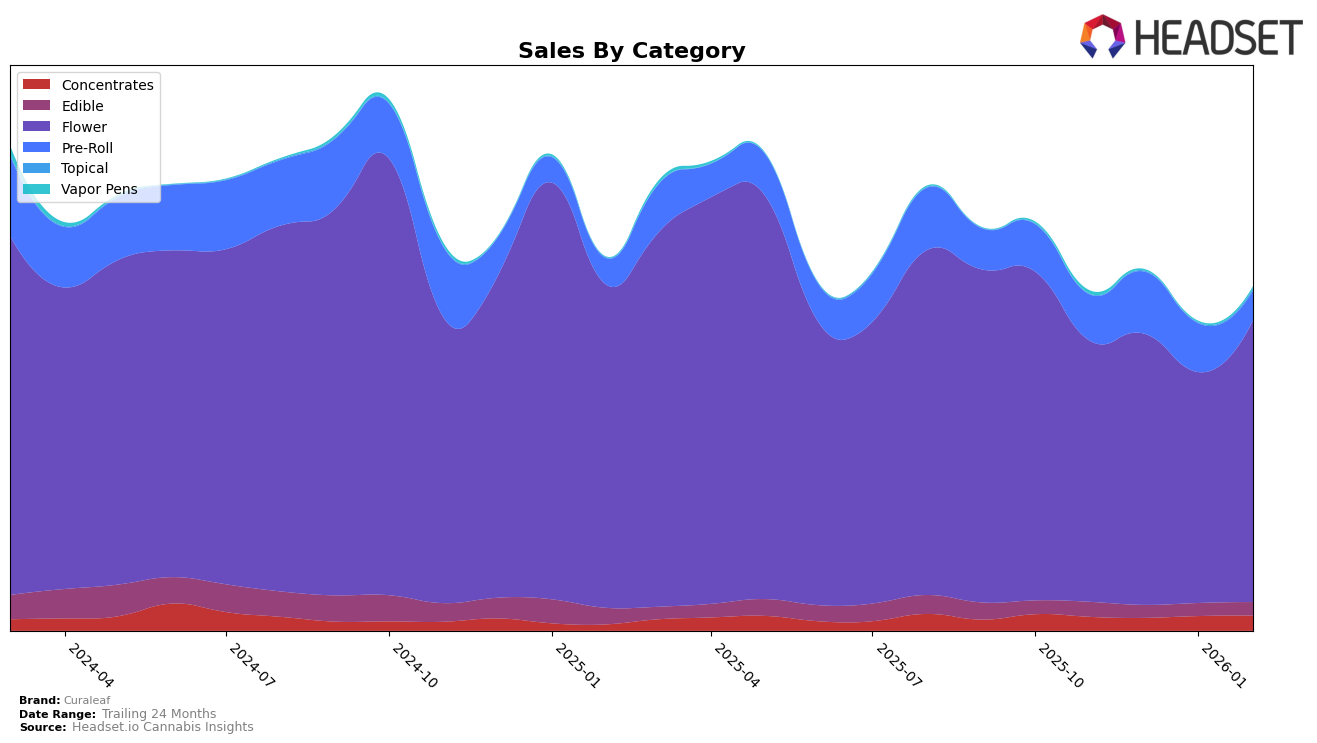

Curaleaf's performance across various states and categories has shown both strengths and areas for improvement. In Arizona, Curaleaf's presence in the Flower category has been particularly noteworthy, with a steady climb from the 10th position in November 2025 to an impressive 6th position by February 2026. This upward trend is supported by a significant increase in sales during this period. Meanwhile, in the Concentrates category in Arizona, Curaleaf maintained a consistent ranking, hovering between 11th and 13th positions. This stability in Concentrates, coupled with the notable rise in the Flower category, underscores Curaleaf's strategic positioning in Arizona's competitive market.

In Connecticut, Curaleaf's performance in the Flower category saw a decline, dropping from the 2nd position in November 2025 to the 6th position by February 2026. This shift indicates potential challenges in maintaining market share amidst changing consumer preferences or heightened competition. Their Edible category rankings in Connecticut remained relatively stable, oscillating between 10th and 13th positions. Interestingly, Curaleaf did not secure a spot in the top 30 for the Flower category in Illinois and Maryland, suggesting opportunities for growth or a need for strategic adjustments in these markets. The varying performance across states highlights the diverse challenges and opportunities Curaleaf faces in different regional markets.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Curaleaf has shown a notable upward trend in rankings, moving from 10th place in November 2025 to 6th place by February 2026. This improvement in rank is accompanied by a significant increase in sales, indicating a strong market performance. However, Curaleaf faces stiff competition from brands like Grassroots, which made a remarkable leap from 15th to 4th place over the same period, showcasing an even more aggressive growth trajectory. Meanwhile, Dr. Greenthumb's maintained a steady presence in the top 10, although it saw a slight dip in February. Brown Bag consistently ranked higher than Curaleaf but experienced a drop from 4th to 5th place, which might suggest a potential opportunity for Curaleaf to capitalize on. Additionally, Fenix fluctuated in the rankings, peaking at 5th place in January before settling at 7th in February, indicating a volatile but competitive presence. Overall, Curaleaf's upward trajectory in both rank and sales highlights its growing influence in the Arizona Flower market, though it must continue to innovate and adapt to maintain its competitive edge against these dynamic rivals.

Notable Products

In February 2026, the top-performing product for Curaleaf was Bulbz (14g) in the Flower category, securing the number one rank with sales of 3866 units. Galactic Garlic (14g) maintained a strong presence, ranking second, though it dropped from its previous top position in December 2025 and January 2026. B.A.M. (14g) showed a notable improvement, climbing to the third position from fifth in January 2026. Atomic Breath (3.5g) entered the rankings at fourth place, while Atomic Breath (14g) experienced a decline, falling to fifth place from its earlier second position in January 2026. Overall, the Flower category dominated the top ranks, indicating a continued preference for this product type among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.