Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

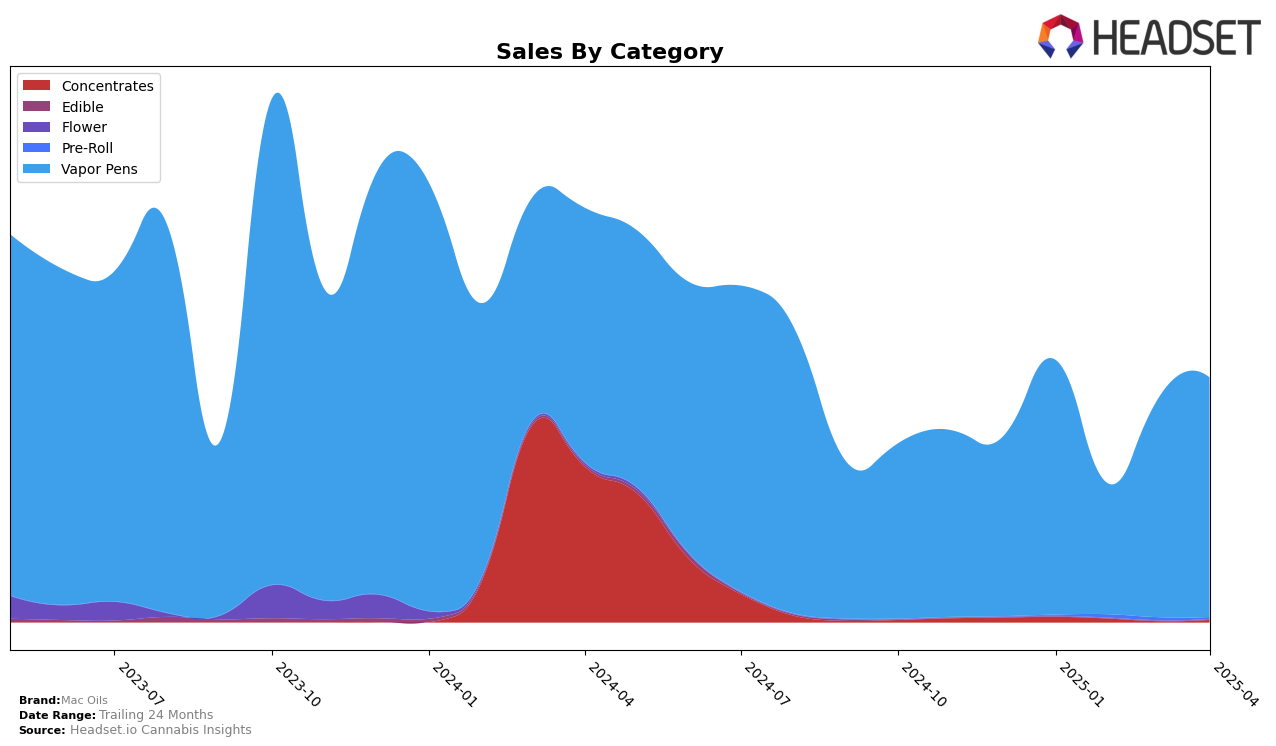

Mac Oils has demonstrated a notable performance trajectory within the vapor pens category in Michigan. Starting the year in January 2025 with a rank of 25, the brand experienced a dip in February, falling out of the top 30, but quickly rebounded by March to secure the 28th spot. By April, Mac Oils had improved its position to 24, indicating a strong recovery and positive growth trend within the state. This fluctuation in rankings suggests a volatile yet promising market presence, and the brand's ability to bounce back highlights its resilience and potential for further growth.

Despite the initial setback in February, Mac Oils' sales figures reflect a robust recovery, with a significant increase from February to April 2025. The sales in April 2025 nearly doubled from February, showcasing the brand's capacity to regain consumer interest and market share. However, the absence of Mac Oils from the top 30 in February serves as a reminder of the competitive nature of the cannabis market in Michigan. This variability underscores the importance of strategic positioning and adaptability for brands looking to maintain and improve their standing in such a dynamic industry.

Competitive Landscape

In the Michigan Vapor Pens category, Mac Oils has experienced notable fluctuations in its market position from January to April 2025. Initially ranked 25th in January, Mac Oils saw a significant drop to 45th in February, before rebounding to 28th in March and further improving to 24th in April. This volatility in ranking is mirrored in its sales performance, which saw a sharp decline in February but recovered in the subsequent months. In contrast, competitors like North Cannabis Co. and ErrlKing Concentrates have shown more stable upward trends, with North Cannabis Co. climbing from 29th to 22nd and ErrlKing Concentrates improving from 41st to 26th over the same period. Meanwhile, Amnesia has maintained a relatively high rank, although it has seen a gradual decline from 14th to 23rd. These dynamics suggest that while Mac Oils is capable of recovering its market position, it faces stiff competition from brands that are either steadily climbing or maintaining their ranks, indicating a need for strategic adjustments to sustain and improve its competitive standing.

Notable Products

In April 2025, Rainbow Runtz Distillate Cartridge (1g) maintained its position as the top-performing product for Mac Oils in the Vapor Pens category, with sales reaching 7,123 units. Mango Lychee Distillate Cartridge (1g) climbed back to the second position after a dip to fifth place in March, reflecting a steady sales increase to 6,034 units. Banangie Distillate Cartridge (1g) held the third position, demonstrating consistent performance over the months. White Razz Distillate Cartridge (1g) debuted in the rankings at fourth place, indicating strong market entry. Apple Mintz Distillate Cartridge (1g) retained its fifth-place ranking from March, showing stable sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.