Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

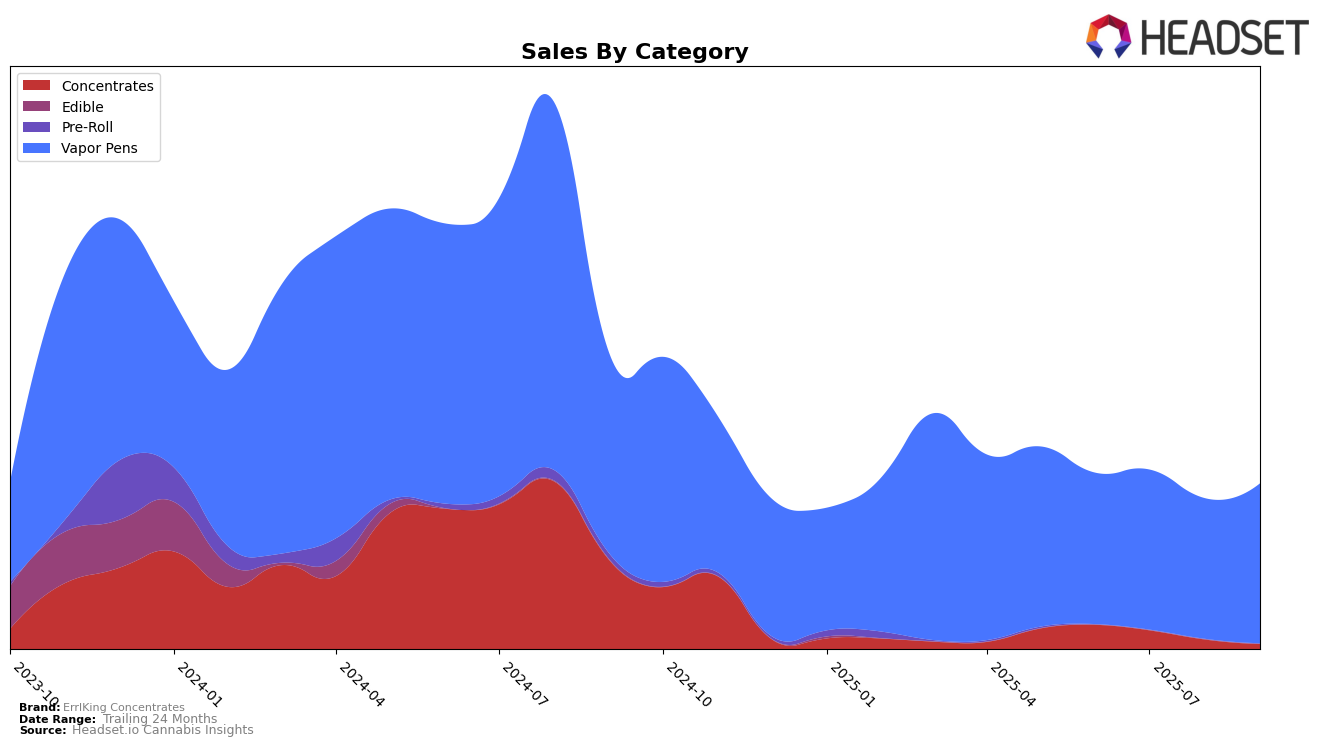

ErrlKing Concentrates has shown varied performance across different categories and states. In the Michigan market, the brand has not managed to secure a spot in the top 30 for the Concentrates category from June to September 2025, indicating a potential area for growth or a need for strategic adjustments. Interestingly, while the brand's sales in the Concentrates category decreased from June to July, it did not appear in the ranking for August and September, which could suggest increasing competition or a shift in consumer preferences. This absence from the top 30 highlights the challenges faced by ErrlKing Concentrates in maintaining a strong foothold in this particular category within Michigan.

Conversely, ErrlKing Concentrates has demonstrated resilience and a positive trajectory in the Vapor Pens category within Michigan. From June to September 2025, the brand's ranking fluctuated but showed an upward trend, starting at 30th in June, dipping slightly in July and August, and then improving to 28th by September. This movement indicates a strengthening position in the Vapor Pens market, suggesting that ErrlKing Concentrates is successfully capturing consumer interest in this category. Despite a slight dip in sales during August, the brand managed to recover by September, underscoring their ability to adapt and respond to market dynamics effectively in Michigan.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, ErrlKing Concentrates has experienced notable fluctuations in its market position over the past few months. While it ranked 30th in June 2025, it saw a decline to 34th in July and further to 40th in August, before rebounding to 28th in September. This indicates a volatile market presence, potentially influenced by the competitive dynamics of brands like Levitate, which maintained a stronger position despite a downward trend from 14th in June to 27th in September. Meanwhile, Voodoo Cannabis showed resilience, ranking consistently higher than ErrlKing Concentrates, peaking at 22nd in August. Stickee also demonstrated a competitive edge, climbing from 47th in June to 28th in July, maintaining a stable position close to ErrlKing in subsequent months. These dynamics suggest that ErrlKing Concentrates faces stiff competition, necessitating strategic adjustments to improve its rank and sales performance in the Michigan vapor pen market.

Notable Products

In September 2025, ErrlKing Concentrates saw King's Choice - Blackberry Kush Distillate Cartridge (1g) rise to the top position in the Vapor Pens category, achieving the number 1 rank with sales of 6100 units. The King's Choice - Strawberry Cough Distillate Cartridge (1g) maintained a consistent performance, holding steady at rank 2 across several months. Meanwhile, King's Choice - Lemon Cherry Gelato Distillate Cartridge (1g) also showed stability, ranking 3rd in September after maintaining similar positions in previous months. Notably, the Kings Choice - Gummy Shark Distillate Cartridge (1g), which had been leading the category, dropped from the 1st position to 4th place. Lastly, King's Choice - Watermelon Zkittles Distillate Cartridge (1g) entered the rankings for the first time in September, debuting at 5th place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.