Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

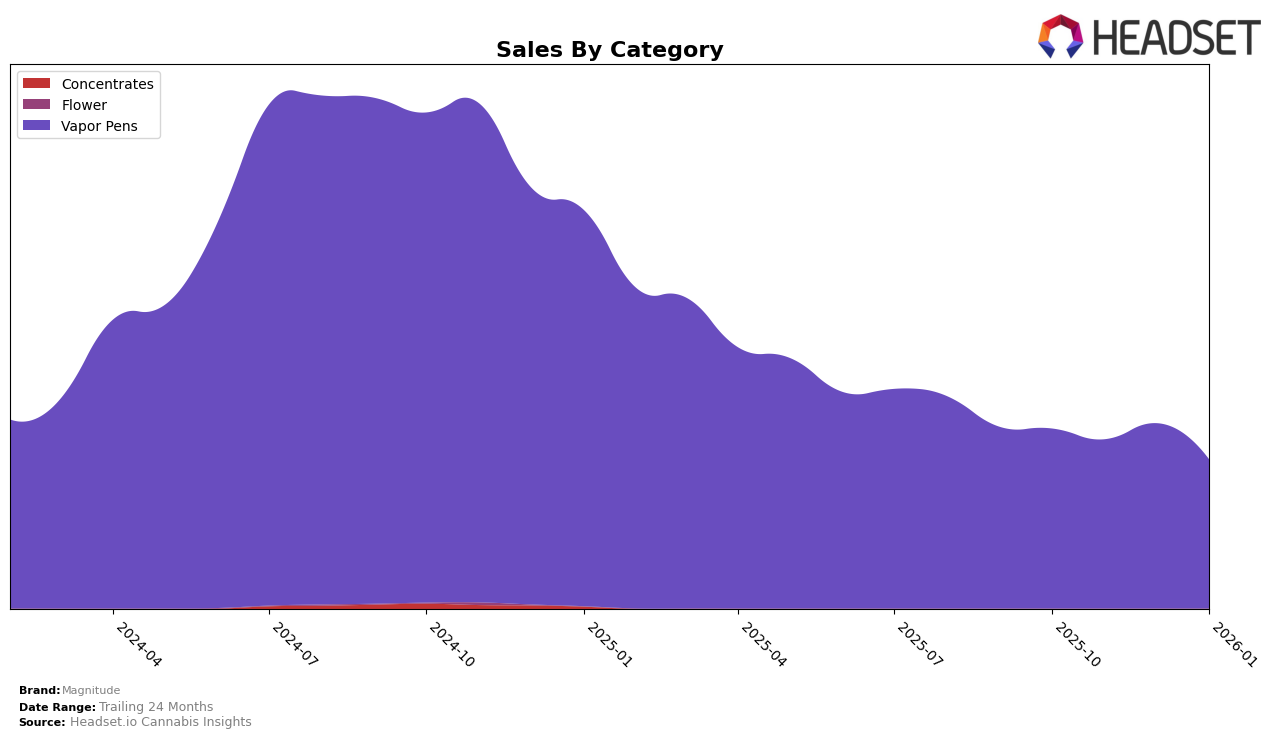

Magnitude's performance in the Vapor Pens category has shown varied results across different states, indicating a dynamic market presence. In Illinois, the brand has shown a steady upward trajectory, improving its rank from 73rd in October 2025 to 58th by January 2026. This positive movement is accompanied by a notable increase in sales, suggesting a growing consumer base. Conversely, in Ohio, Magnitude remained consistently at the 69th position for three consecutive months before dropping out of the top 30, which may point to challenges in market penetration or competition. Meanwhile, New York presents a more stable scenario where Magnitude maintains its presence within the top 30, although with a slight decline in rank from 23rd to 30th over the observed period.

In Maryland, Magnitude's performance in the Vapor Pens category is notable, as the brand entered the top 50 in November 2025 and has maintained a position within the top 50 since. The brand's rank improved to 42nd in December, followed by a slight dip to 44th in January 2026, indicating some fluctuations but overall a promising presence. This is contrasted by the absence of Magnitude from the top 30 rankings in Ohio come January 2026, marking a potential area of concern or a strategic pivot. These insights into state-specific performances highlight the brand's varying market strategies and consumer reception across different regions, offering a glimpse into the broader competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Magnitude has experienced a slight decline in its market position, moving from 23rd in October 2025 to 30th by January 2026. This downward trend in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining its competitive edge. Notably, Eureka, which started at 22nd in October 2025, has also seen a decline, dropping to 29th by January 2026, indicating a broader market shift or increased competition. Meanwhile, Littles has shown an upward trajectory, improving its rank from 31st to 28th over the same period, accompanied by a rise in sales, which could be a factor contributing to Magnitude's challenges. Additionally, Bonanza Cannabis Company and Dragonfly Cannabis have both improved their standings, with Dragonfly showing significant growth from 43rd to 33rd, highlighting the dynamic nature of the market and the need for Magnitude to strategize effectively to regain its competitive positioning.

Notable Products

In January 2026, the top-performing product from Magnitude was the Mimosa Distillate Cartridge (1g) in the Vapor Pens category, climbing to the first position with sales of 1731 units. The London Pound Cake Distillate Cartridge (1g) also showed significant improvement, moving up to the second spot from a previous absence in December rankings. Sour Diesel Distillate Cartridge (1g) fell to third place after securing the top rank in November 2025. Ghost Memory OG BDT Distillate Cartridge (1g) dropped to the fourth position after leading in December 2025. Notably, the Platinum Jack Distillate Cartridge (1g) entered the rankings for the first time, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.