Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

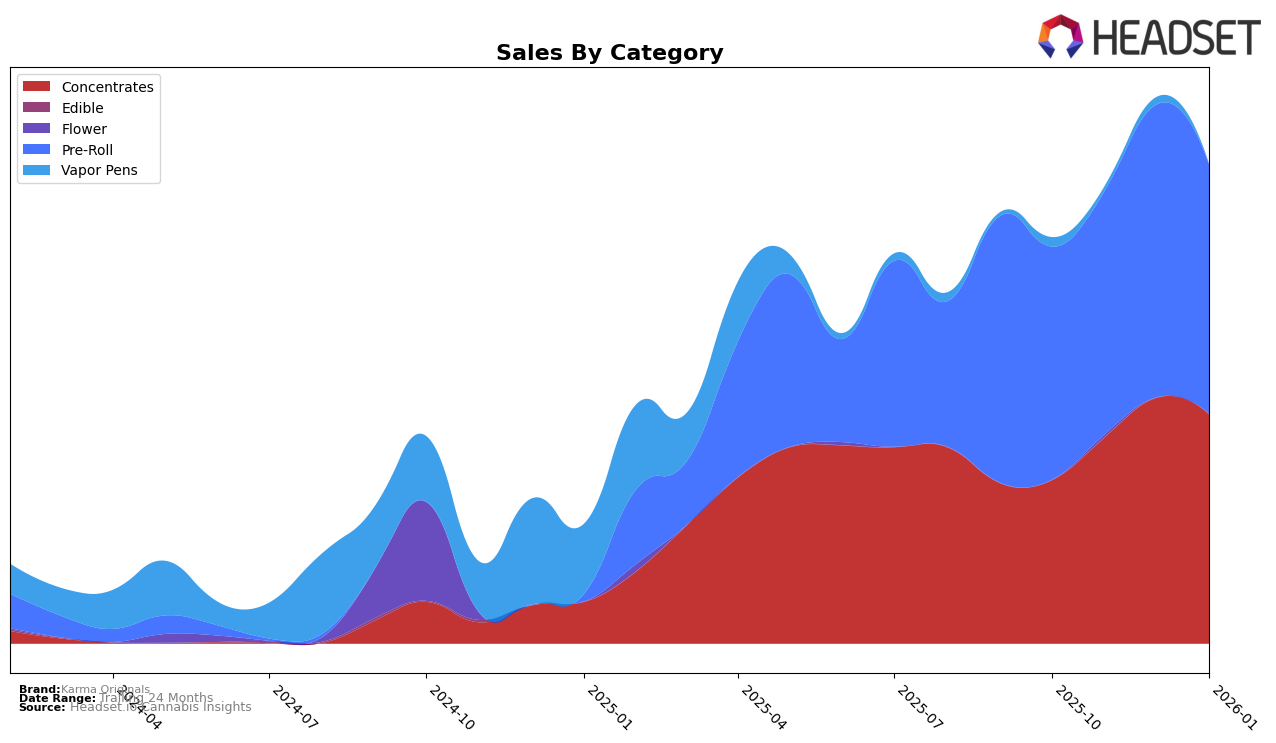

Karma Originals has shown a promising upward trajectory in the Nevada concentrates market, as evidenced by their consistent climb in rankings from October 2025 to January 2026. Starting at the 15th position in October, the brand improved its standing to 11th in November and further to 8th by December, maintaining this position into January. This upward movement is indicative of a strong performance in a competitive category, supported by a notable increase in sales from $54,102 in October to $81,440 in December. Such consistent improvement suggests a growing consumer base and enhanced market penetration within Nevada.

In contrast, the performance of Karma Originals in the Nevada pre-roll category presents a more fluctuating trend. The brand made significant strides from October to December 2025, moving from the 22nd position to the 13th, reflecting a positive reception of their pre-roll products. However, this momentum was not sustained into January 2026, as the brand slipped back to the 20th position. Despite this setback, the sales figures reveal a robust demand, with a peak in December at $96,649. This volatility in rankings suggests that while the brand has a strong foothold in the pre-roll market, there may be challenges related to competition or product differentiation that could be explored further.

Competitive Landscape

In the competitive landscape of the Nevada Pre-Roll category, Karma Originals has demonstrated notable fluctuations in its ranking over the past few months. In October 2025, Karma Originals was ranked 22nd, but it climbed to an impressive 13th place by December 2025, showcasing a positive trend in consumer preference and market penetration. However, by January 2026, the brand experienced a slight dip to the 20th position. This fluctuation is indicative of a highly competitive market where brands like Summa Cannabis and Prime Cannabis are also vying for consumer attention, with Summa Cannabis notably improving its rank from 25th in October 2025 to 17th by January 2026. Despite the competition, Karma Originals' sales trajectory has shown resilience, with sales peaking in December 2025, which suggests a strong consumer base that could be leveraged for future growth. Brands such as Smoke Signals and THC Design also present formidable competition, with varying sales figures and rank positions that highlight the dynamic nature of the market.

Notable Products

In January 2026, Karma Originals' top-performing product was the Indica RSO Syringe (1g) in the Concentrates category, maintaining its number one rank from the previous two months with sales of 1193 units. The Sativa RSO Syringe (1g), also in the Concentrates category, held its position at number two, indicating consistent demand. The CBG/CBN/THC 1:1:4 RSO Syringe (1g) remained steady at the third rank, showing no change in its ranking since October 2025. New entrants in January, Pineapple Express Honey Infused Pre-Roll (1.2g) and Lennon Infused Pre-Roll (1.2g), debuted at fourth and fifth ranks, respectively, in the Pre-Roll category. These insights suggest a strong preference for Concentrates among consumers, with Pre-Rolls gaining traction in the latest month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.