Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

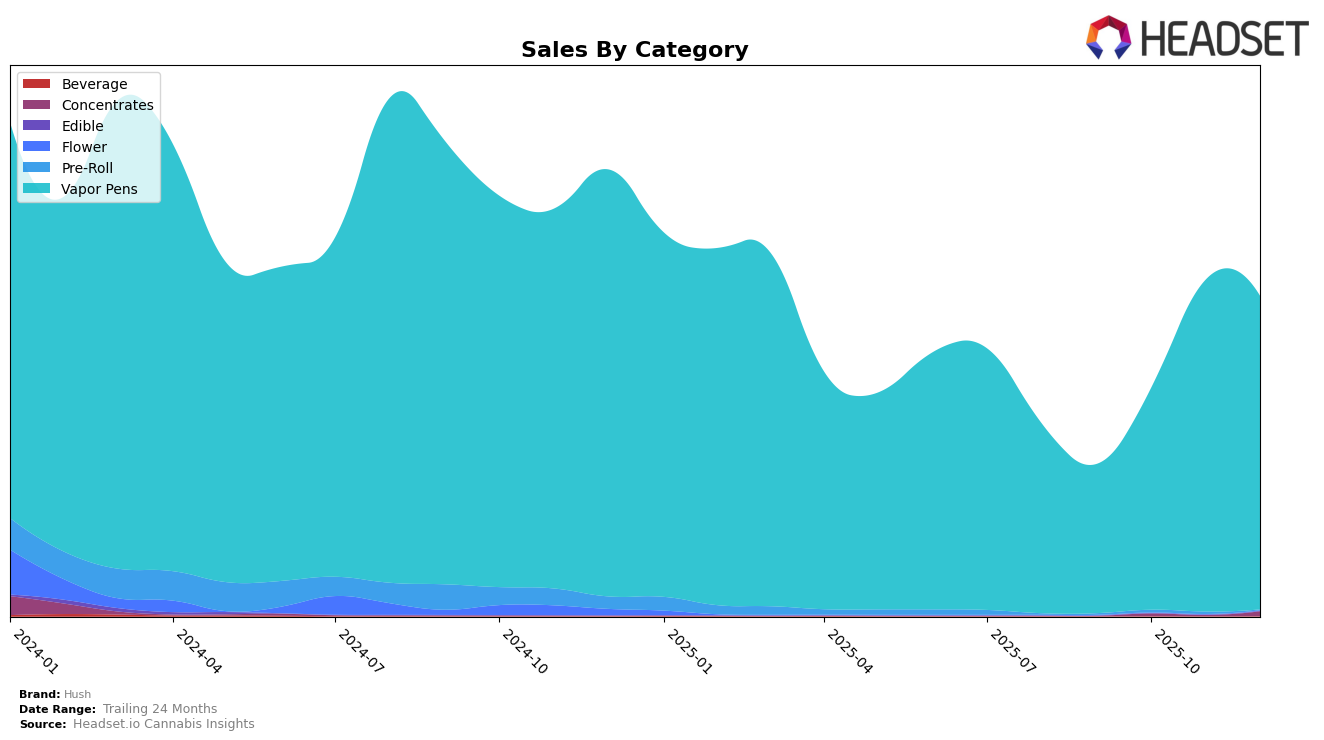

Hush has shown notable performance across various states, particularly in the Vapor Pens category. In California, Hush experienced an upward trajectory from September to November 2025, moving from the 65th to the 52nd rank before a slight dip to 57th in December. This fluctuation suggests a competitive market, yet Hush's ability to climb the ranks indicates a strengthening presence. Meanwhile, in Oregon, Hush made significant strides, breaking into the top 30 by November. The brand's absence from the top 30 in September highlights a major improvement, signaling a positive reception among consumers in the state.

Despite not being in the top 30 in California throughout the analyzed months, the brand's sales figures reveal a robust performance, with a peak in November. This suggests that while Hush may not be a top contender in terms of rankings, its sales volume is substantial, indicating a loyal customer base or effective sales strategies. In Oregon, Hush's entrance into the top 30 by November and maintaining a similar position in December suggests a growing acceptance and popularity, which could be indicative of successful market penetration strategies. These shifts in rankings and sales performance across states provide a glimpse into Hush's market dynamics, hinting at strategic movements that could be pivotal for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, Hush has shown a notable upward trend in its rankings from September to December 2025, moving from 65th to 57th place. This improvement is indicative of a positive shift in consumer preference or strategic marketing efforts. However, Hush still trails behind competitors such as DomPen, which consistently ranks higher and ended December at 50th place, and Care By Design, which improved its rank to 52nd by December. Despite Hush's sales peaking in November, they experienced a slight decline in December, contrasting with Care By Design's significant sales boost during the same period. Meanwhile, Eureka and Greenline have shown fluctuating ranks, with Eureka dropping to 61st and Greenline slightly improving to 59th by December. These dynamics suggest that while Hush is making strides, it faces stiff competition from brands that are either stabilizing or improving their market positions, highlighting the need for strategic initiatives to further enhance its market share.

Notable Products

In December 2025, the top-performing product for Hush was the Purple Punch Distillate Cartridge (1g) in the Vapor Pens category, achieving the highest rank with sales of 4080 units. Following closely, the Strawberry Cheesecake Distillate Cartridge (1g) secured the second spot, and the Clementine Flavored Distillate Cartridge (1g) came in third. Notably, the Peach Distillate Cartridge (1g) experienced a drop to fourth place from its second-place ranking in November, reflecting a decrease in sales momentum. The Grape Ape Distillate Cartridge (1g) re-entered the top five, securing fifth place after being unranked in the previous two months. Overall, these rankings highlight a competitive landscape within the Vapor Pens category, with shifts indicating dynamic consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.