Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

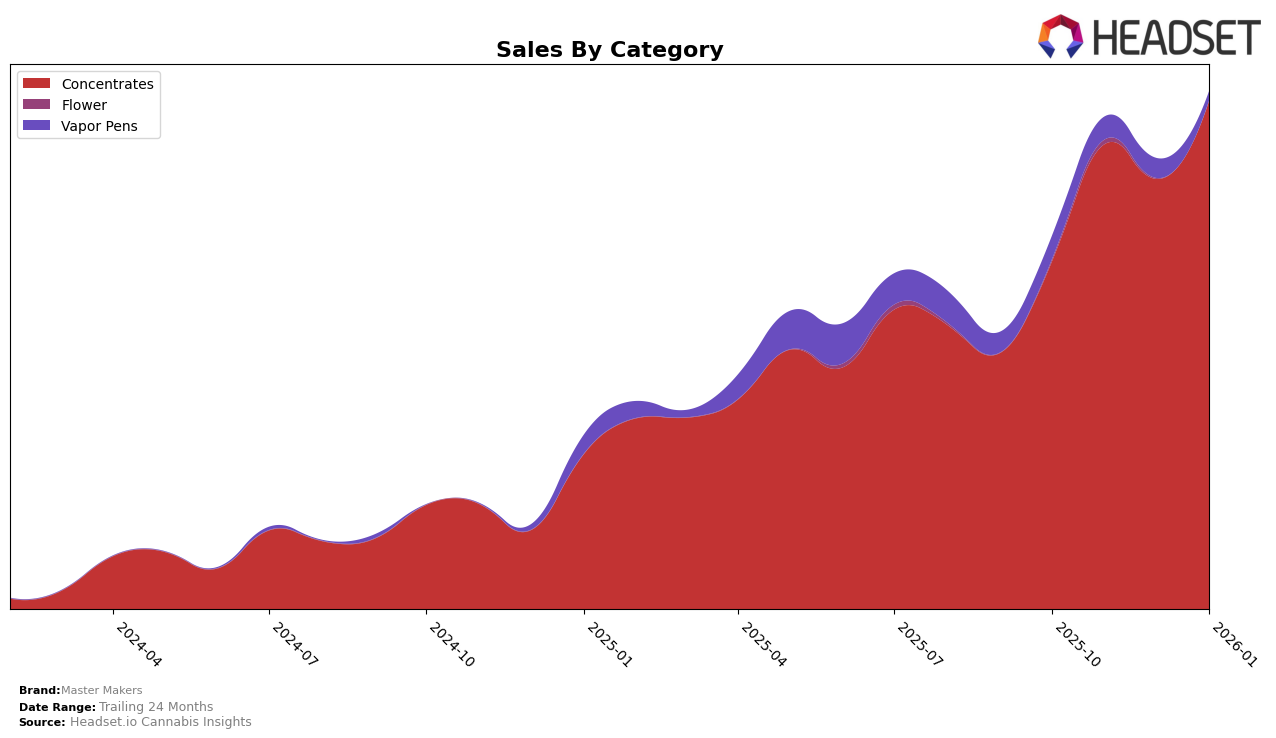

Master Makers has demonstrated a notable presence in the Concentrates category within California. Over the course of four months, the brand has shown a steady improvement in its ranking, starting from 21st place in October 2025 and climbing to 16th place by January 2026. This upward trend is indicative of their growing influence in the market, with a significant increase in sales during this period. For instance, their sales in November 2025 saw a substantial boost compared to October, which contributed to their improved ranking. Such consistent performance suggests that Master Makers is effectively capturing consumer interest and expanding its market share in California's competitive concentrates sector.

However, outside of California, Master Makers' presence is less pronounced, as they did not secure a spot in the top 30 brands in other states or provinces for the Concentrates category during the same period. This absence highlights a potential area for growth and expansion for the brand. The lack of ranking in other regions could be seen as a challenge, but it also presents an opportunity for Master Makers to strategize and penetrate new markets. By focusing on enhancing their brand visibility and tailoring their offerings to meet diverse consumer preferences, Master Makers could replicate their California success in other markets, driving further growth and establishing a broader footprint across the industry.

Competitive Landscape

In the competitive California concentrates market, Master Makers has shown a dynamic shift in its rankings and sales trajectory over recent months. Initially absent from the top 20 in October 2025, Master Makers surged to 16th place in November, demonstrating a significant upward momentum. This improvement was marked by a notable increase in sales, surpassing Greenline and Have Hash in November. However, by December, Master Makers experienced a slight dip to 19th place, before recovering to 16th in January 2026, indicating resilience and potential for growth. In comparison, West Coast Trading Co. and Loud + Clear maintained relatively stable positions, suggesting that while Master Makers is gaining traction, it faces stiff competition from these established brands. This fluctuating performance highlights the brand's potential to climb higher in the ranks, provided it continues to capitalize on its recent sales growth and strategic market positioning.

Notable Products

In January 2026, Egyptian Gold Cold Cure Full Spectrum Live Rosin (1g) maintained its position as the top-performing product for Master Makers, with sales reaching 668 units. Whitethorn Rose Cold Cure Live Rosin (1g) climbed to the second position from the third in December 2025, reflecting strong growth with 515 units sold. Purple Donny Cold Cure Full Spectrum Live Rosin (1g) entered the rankings at third place, showing a promising start. Grilled Peaches Full Spectrum Cold Cure Live Rosin (1g) improved its rank from fifth in December to fourth in January, indicating a positive sales trend. Garlic Juice Cold Cure Live Rosin Badder (1g), previously unranked, secured the fifth position, demonstrating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.