Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

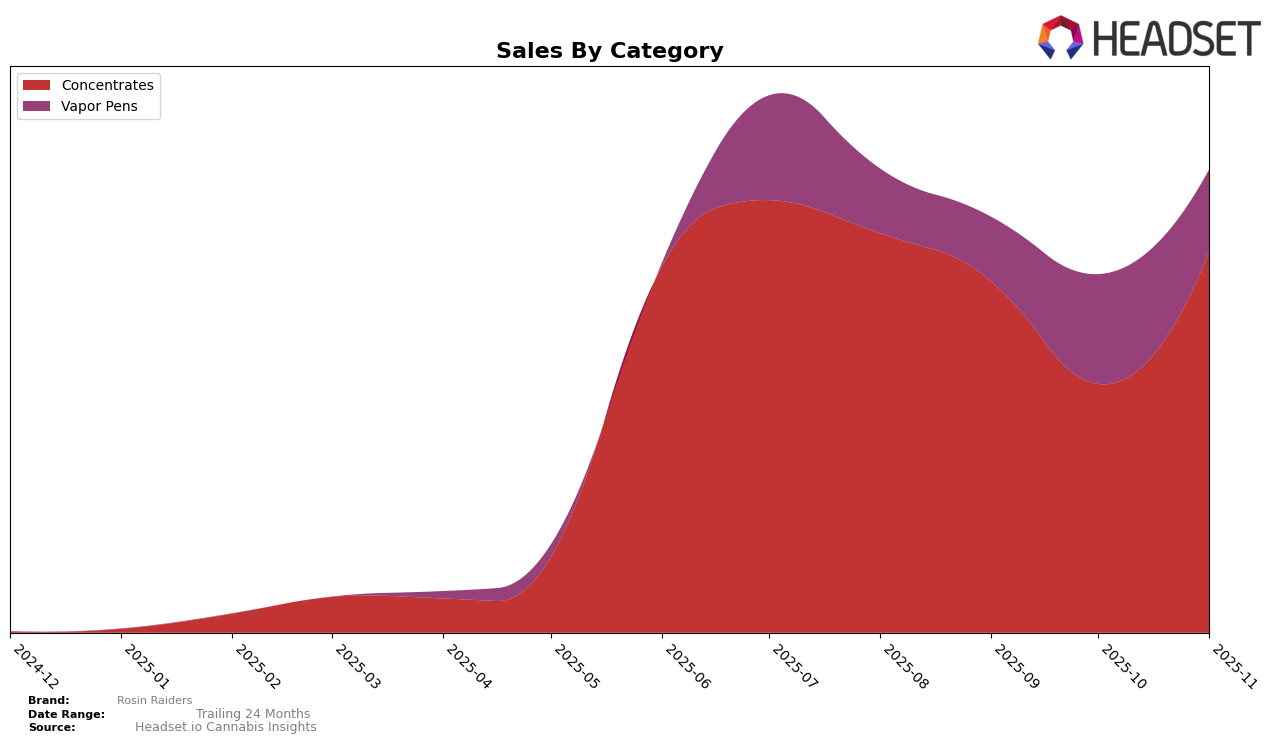

Rosin Raiders has demonstrated fluctuating performance in the California concentrates market over the past few months. Notably, the brand's ranking dropped from 20th in August 2025 to 35th in October 2025, before rebounding to 18th in November 2025. This movement indicates a significant recovery in their market position after a dip in sales performance. The November sales figures reflect a notable increase compared to October, suggesting that Rosin Raiders has managed to recapture some of its lost ground in the competitive California concentrates category.

In Oregon, Rosin Raiders' performance in the concentrates category has remained relatively stable, with rankings hovering around the mid-30s. Although they have not broken into the top 30, the consistent ranking suggests a steady presence in the market. Conversely, their position in the vapor pens category shows a gradual improvement, moving from 61st in August to 49th in October, before slightly declining in November. While their vapor pen sales have experienced some fluctuations, the upward trend observed in October indicates potential for growth in this category.

Competitive Landscape

In the competitive landscape of the California concentrates market, Rosin Raiders has experienced significant fluctuations in its ranking and sales performance over recent months. Notably, Rosin Raiders saw a sharp decline in October 2025, dropping to 35th place, which indicates a temporary exit from the top 20 brands, before rebounding to 18th place in November 2025. This volatility contrasts with competitors like Greenline Organics, which maintained a more stable presence, ranking between 16th and 19th place, and Clsics, which showed a positive trajectory, moving from 24th to 17th place over the same period. Despite Rosin Raiders' dip in October, their November sales recovery suggests resilience and potential for regaining market share. Meanwhile, Cream Of The Crop (COTC) and Master Makers also demonstrated competitive pressures, with both brands hovering around the 20th rank, indicating a tightly contested market space. These dynamics highlight the importance for Rosin Raiders to capitalize on its November momentum to secure a more consistent top-tier position in the coming months.

Notable Products

In November 2025, Sour Banana Sherbet Cold Cure Rosin (2g) emerged as the top-performing product for Rosin Raiders, leading the Concentrates category with an impressive sales figure of 1071. Pomelo Punch Cold Cure Live Rosin (2g) followed closely in second place, indicating a strong market presence. Pie Hoe Cold Cure Live Rosin (2g) secured the third position, maintaining its popularity among consumers. Notably, Mango Slurry Rosin Cartridge (1g) saw a decline from its top position in Vapor Pens in October to fifth place in November, reflecting a shift in consumer preference. Pink Marshmellow Live Rosin (2g) rounded out the top four, highlighting a consistent performance within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.