Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

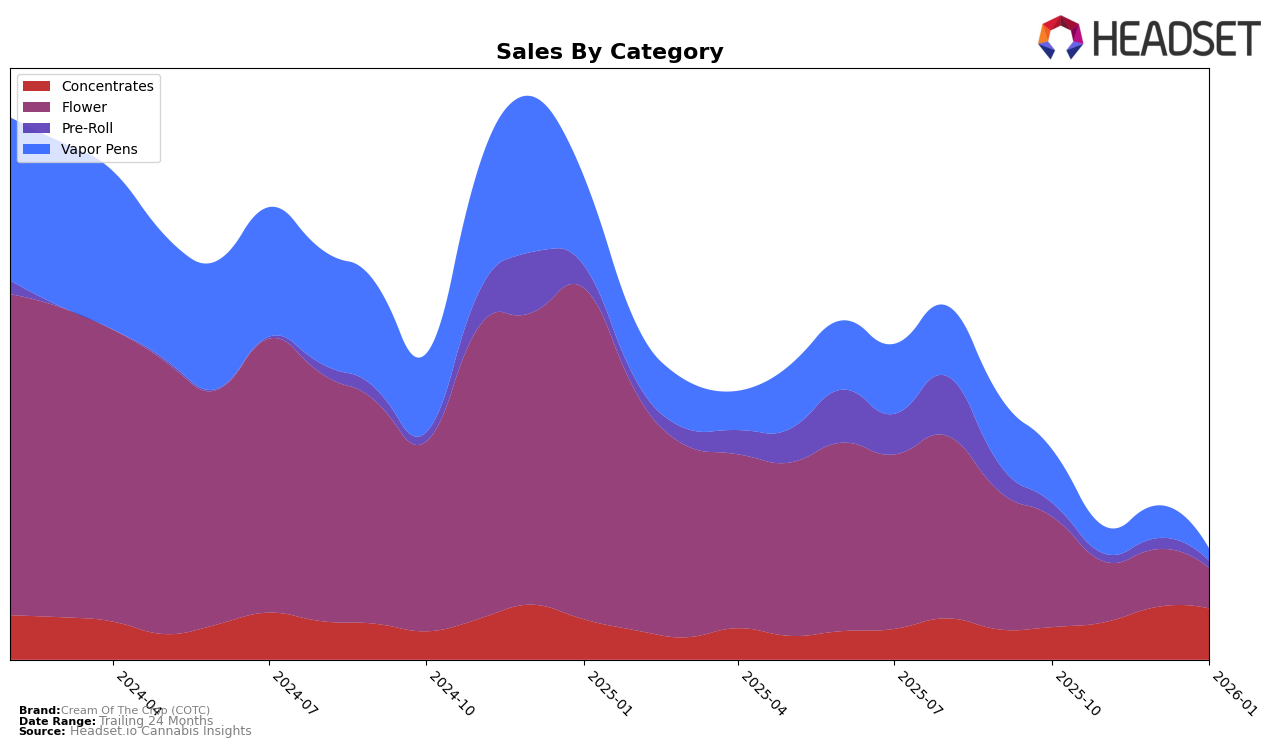

Cream Of The Crop (COTC) has shown a notable upward trajectory in the Concentrates category within California. Over the span from October 2025 to January 2026, COTC improved its ranking from 22nd to 18th, with a significant sales increase from approximately $144,136 to over $206,000. This consistent rise suggests a growing consumer preference for their concentrates, positioning them as a rising competitor in this segment. In contrast, their performance in the Flower category has seen a decline, with rankings slipping from 58th in October to missing the top 30 by January, indicating potential challenges in maintaining market share in this highly competitive category.

In the Vapor Pens category, COTC experienced a downward trend in California, with its ranking dropping from 55th to 96th by January 2026. This decline is accompanied by a decrease in sales from $214,146 in October to $75,874 in January, suggesting a need for strategic adjustments to regain traction. The absence of COTC in the top 30 for Flower by January highlights a critical area for potential improvement, as it reflects a significant loss in visibility and consumer engagement within this category. These insights underscore the importance of strategic focus on sustaining growth in Concentrates while addressing the challenges faced in other categories.

Competitive Landscape

In the competitive landscape of California's concentrates category, Cream Of The Crop (COTC) has shown a steady performance, maintaining its rank at 18th place from December 2025 to January 2026. This stability is noteworthy, especially when compared to competitors like Casual Cannabis, which improved its rank from 22nd to 20th in the same period, and West Coast Trading Co., which experienced a decline from 15th to 17th. COTC's sales saw a slight decrease from December to January, contrasting with Master Makers, which climbed to 16th place with a notable increase in sales. Meanwhile, Have Hash saw a drop in rank to 19th, despite a sales performance close to COTC. This data suggests that while COTC maintains a competitive position, there is dynamic movement among its peers, indicating potential opportunities for strategic adjustments to enhance its market share.

Notable Products

In January 2026, the top-performing product for Cream Of The Crop (COTC) was High Note (3.5g) in the Flower category, securing the number one spot with sales of 754 units. Following closely were Permanent Cherry Diamonds (1g) and Cali Coma Live Resin Crushed Diamonds (1g), both in the Concentrates category, ranking second and third respectively. Monk Fruit Diamonds (1g) also in Concentrates, held the fourth position. Notably, Gelato Breath Badder (1g) dropped from third place in December 2025 to fifth in January 2026, indicating a shift in consumer preference. This change in rankings suggests a strong demand for flower products over concentrates this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.