Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

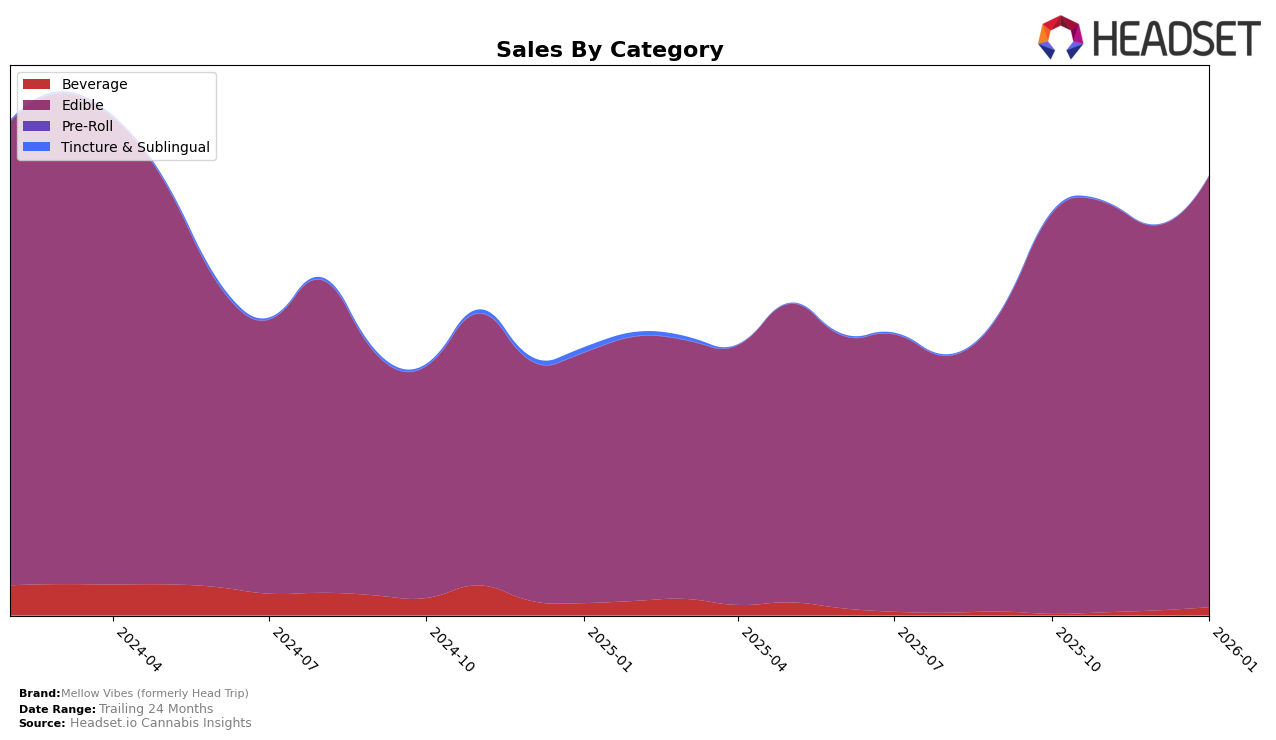

Mellow Vibes (formerly Head Trip) has demonstrated varied performance across different states and categories, with notable activity in the Edible category. In Arizona, the brand maintained a consistent ranking at 18th place from October through December 2025, before slipping slightly to 21st in January 2026. This minor drop coincides with a slight decrease in sales from December to January, suggesting potential seasonal fluctuations or increased competition. Despite this, the brand's overall performance in Arizona indicates a relatively stable presence within the top 30, which is a positive indicator of its market resilience.

In contrast, Oregon showcases a more dynamic movement for Mellow Vibes within the same Edible category. Starting at 18th position in October 2025, the brand improved its standing to 17th by November, only to experience a dip to 19th in December, before bouncing back to 17th in January 2026. This fluctuation in rankings is accompanied by a notable increase in sales from December to January, suggesting a successful recovery or strategic adjustment that allowed Mellow Vibes to regain its footing. The ability to rebound and improve its ranking in Oregon highlights the brand's adaptability and potential for growth in competitive markets.

Competitive Landscape

In the competitive landscape of the edible category in Arizona, Mellow Vibes (formerly Head Trip) has maintained a steady presence, consistently ranking 18th from October to December 2025, before slipping to 21st in January 2026. This slight decline in rank coincides with a decrease in sales from December to January, suggesting potential challenges in maintaining market share. Meanwhile, competitors like Sublime and Grow Sciences have shown upward mobility, with Sublime climbing from 21st to 20th and Grow Sciences improving from 20th to 19th in January 2026. These shifts highlight a competitive pressure that may have contributed to Mellow Vibes' drop in rank. Additionally, Pucks and BITS have remained stable in their rankings, indicating a consistent performance that Mellow Vibes might need to address to regain its footing in the market.

Notable Products

In January 2026, Mellow Vibes (formerly Head Trip) saw Raspberry Lemonade Solventless Gummy (100mg) maintain its top position as the leading product, with sales reaching 3890 units. Hybrid Mango Guava Gummy (100mg) consistently held the second spot, following its strong performance in previous months. Sweet Green Apple Live Terp Resin Jelly (100mg) remained steady at third place, showing a gradual increase in sales since November 2025. Green Apple Jellies 5-Pack (100mg) occupied fourth place, slightly down from its second place in November 2025. The CBN/THC 1:1 Dream Berry Scored Jelly (100mg CBN, 100mg THC) re-entered the top five, highlighting a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.