Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

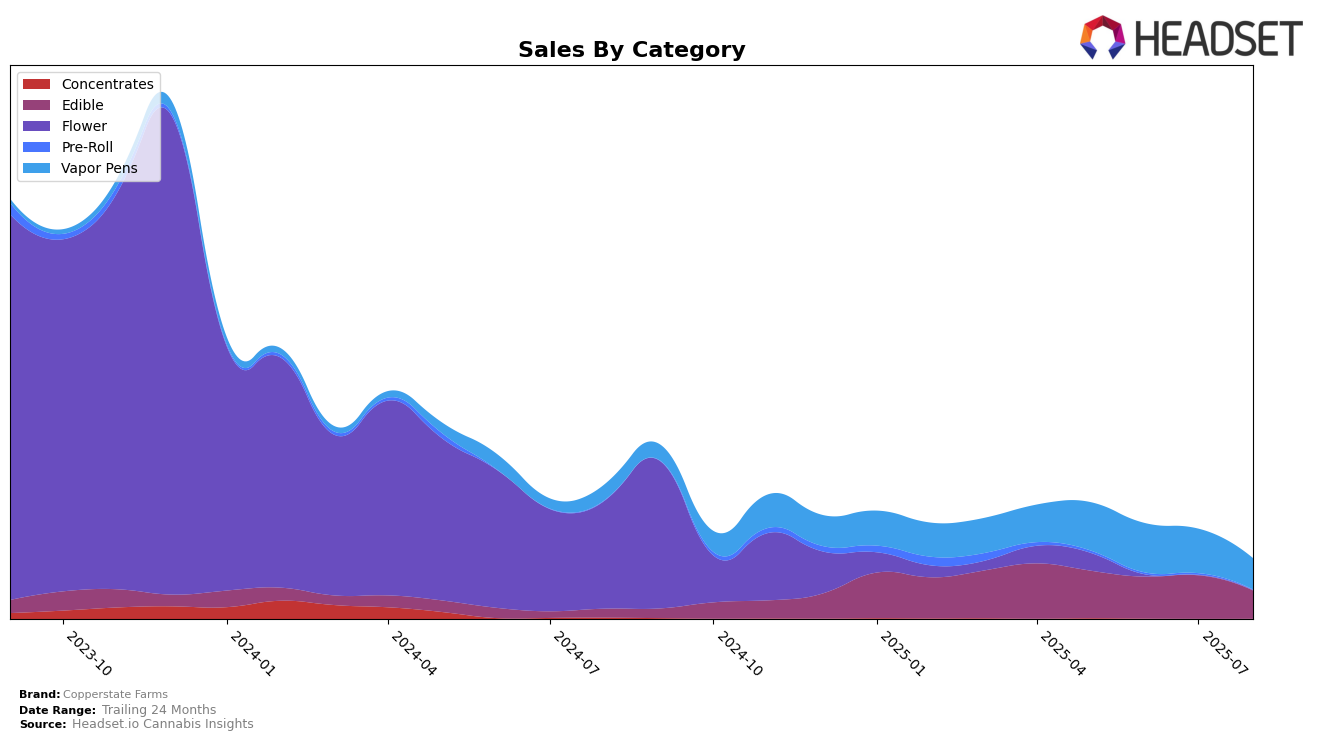

Copperstate Farms has shown varied performance across different product categories in Arizona. In the Edible category, the brand maintained a steady presence within the top 30, albeit with a slight decline, moving from 24th place in May 2025 to 30th in August 2025. This downward trend might indicate increased competition or a shift in consumer preferences. On the other hand, their Vapor Pens category has demonstrated stability, consistently holding the 44th rank from June to August 2025. The Flower category, however, did not make it into the top 30 rankings for the months following May, suggesting challenges in maintaining market presence in that segment.

The sales trends for Copperstate Farms reveal significant insights into their market performance. While there was a noticeable decrease in sales for Edibles from May to August 2025, the Vapor Pens category experienced a less dramatic decline. This could suggest a stronger consumer loyalty or preference for their Vapor Pens over Edibles. The absence of ranking in the Flower category post-May indicates a potential area for strategic improvement or reevaluation of their product offerings. These movements highlight the dynamic nature of the cannabis market in Arizona, where brand positioning can shift rapidly across different categories.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Copperstate Farms has shown a consistent performance by maintaining its rank at 44th position from June to August 2025, after a slight improvement from 47th in May. This stability in rank suggests a steady market presence, even as competitors like Achieve and Mr. Honey Extracts experienced more fluctuation, with Achieve dropping from 38th in May to 43rd in August, and Mr. Honey Extracts falling from 24th to 42nd over the same period. Despite these shifts, Copperstate Farms' sales figures indicate a downward trend, particularly in August, where sales were notably lower compared to earlier months. This suggests that while Copperstate Farms has managed to maintain its rank, there may be underlying challenges in boosting sales, especially as competitors like Nuvata and FENO have shown improvements in their rankings, potentially capturing more market share.

Notable Products

In August 2025, the top-performing product from Copperstate Farms was Watermelon Live Rosin Gummies 10-Pack (100mg) in the Edible category, which rose to the number one rank despite a decrease in sales to 895.0. Blue Raspberry Live Rosin Gummies 10-Pack (100mg) and Pink Lemonade Live Rosin Gummies 10-Pack (100mg) both secured the second position, showcasing a consistent improvement in their rankings from previous months. The CBN:THC:CBD 4:1:1 Dark Cherry Live Rosin Gummies, previously the top-ranked product, fell to third place, indicating a notable shift in consumer preferences. A new entry, Lemon HD x Superboof Live Rosin Cartridge (0.5g) in the Vapor Pens category, debuted at fourth position, marking its first appearance in the rankings. This month saw significant changes in product rankings, reflecting dynamic market trends and consumer choices within Copperstate Farms' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.