Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

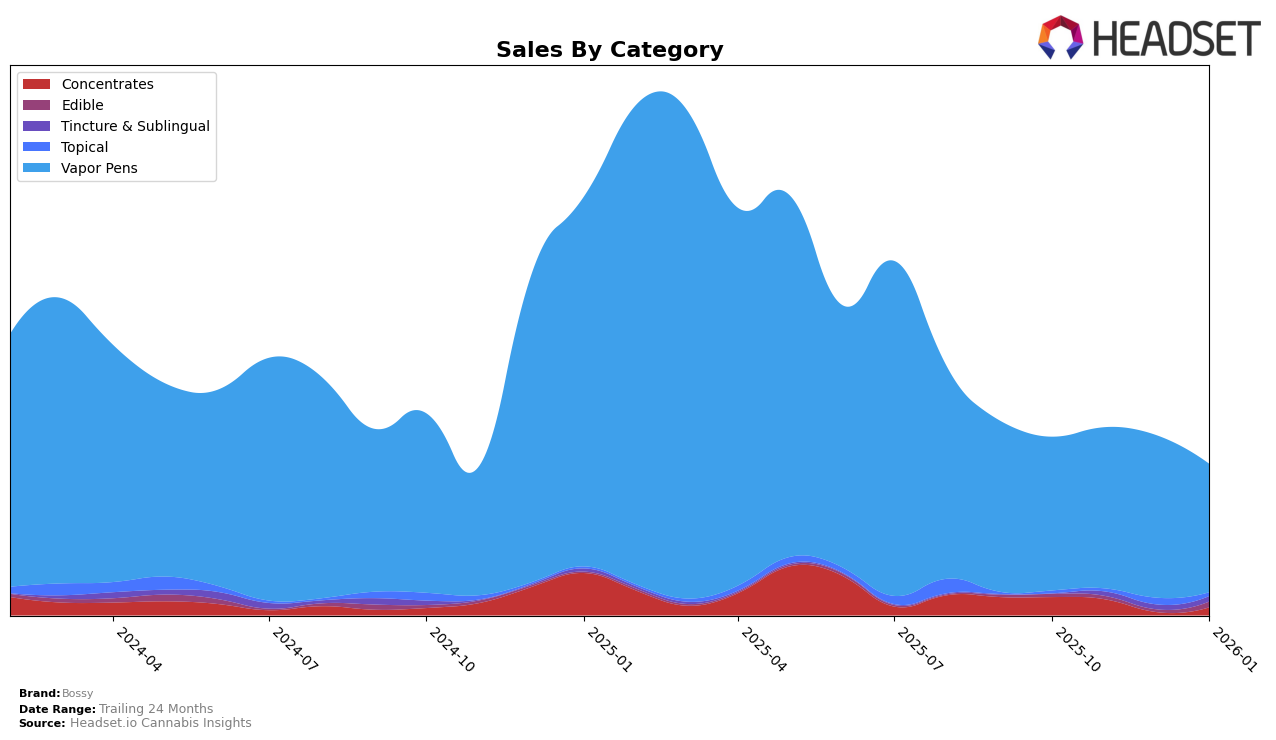

Bossy's performance in the Vapor Pens category within Michigan shows a fluctuating trend over the observed months. The brand did not make it into the top 30 rankings from October 2025 through January 2026, peaking at 40th place in December 2025. This indicates that while there was some improvement in their ranking from October to December, they eventually fell back to 50th in January 2026. The sales figures reflect this volatility, with a notable decrease from December 2025 to January 2026, suggesting potential challenges in maintaining consistent consumer interest or competitive pressure from other brands in the market.

Despite these challenges in Michigan, Bossy's gradual climb from 50th to 40th place by December hints at a potential for growth, albeit not sustained for January 2026. This inconsistency in ranking and sales could be indicative of seasonal trends, marketing efforts, or shifts in consumer preferences. For those interested in the dynamics of the cannabis market, Bossy's performance in the Vapor Pens category provides an intriguing case study of how brands can experience both upward and downward movements within a short timeframe. Further analysis could reveal deeper insights into the factors influencing these changes.

Competitive Landscape

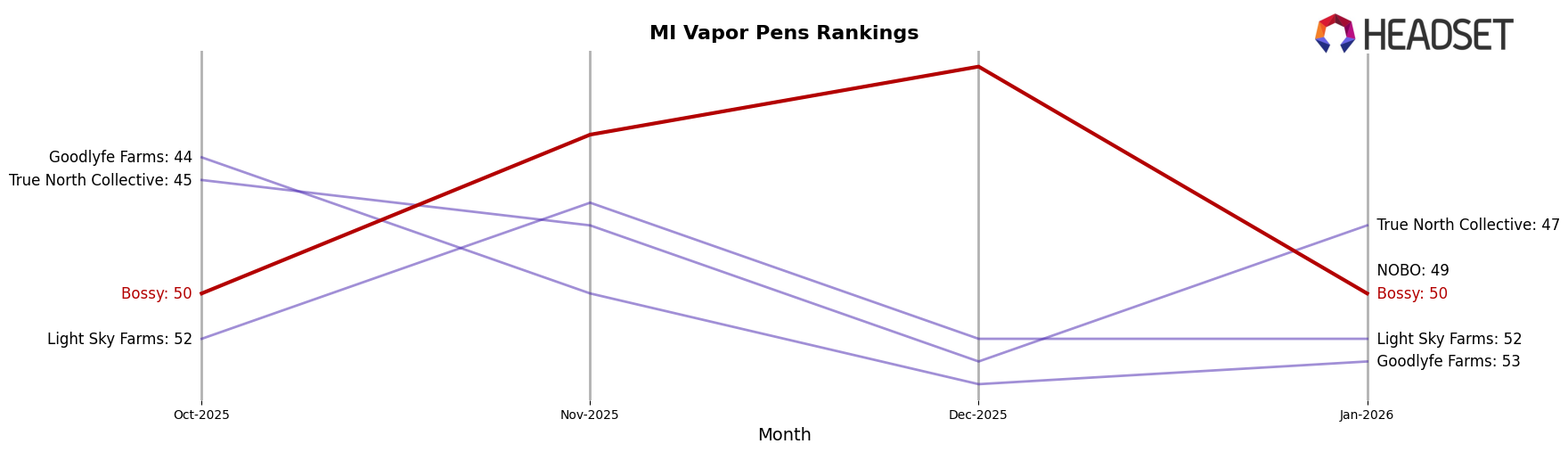

In the competitive landscape of vapor pens in Michigan, Bossy has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially ranked 50th in October 2025, Bossy climbed to 43rd in November and further to 40th in December, indicating a positive trajectory in the market. However, by January 2026, Bossy slipped back to 50th place, suggesting potential challenges in maintaining its upward momentum. In contrast, True North Collective and Light Sky Farms have shown relatively stable rankings, with True North Collective consistently staying in the mid-40s and Light Sky Farms fluctuating slightly but maintaining a position in the low 50s. NOBO re-entered the top 50 in January 2026 after being absent from the rankings in previous months, while Goodlyfe Farms saw a decline from 44th in October to 53rd by January. Bossy's sales peaked in December 2025, contrasting with a decline in January, which could be attributed to increased competition or market saturation. These dynamics highlight the volatility and competitive nature of the Michigan vapor pen market, emphasizing the need for strategic positioning and innovation to sustain growth.

Notable Products

In January 2026, Bossy's top-performing product was Premium Granddaddy Purple Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank despite a decrease in sales to 5698 units. Blueberry Diesel Distillate Cartridge (1g) held steady at the second position, showing consistent performance across the months. Premium Candyland Distillate Cartridge (1g) climbed back to third place after slipping to fifth in December 2025. Premium Strawberry Kush Distillate Cartridge (1g) moved down one spot to fourth, while Peaches & Cream Distillate Cartridge (1g) remained in fifth place. The rankings indicate a slight reshuffling among the top products, with Premium Granddaddy Purple consistently leading the sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.