Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

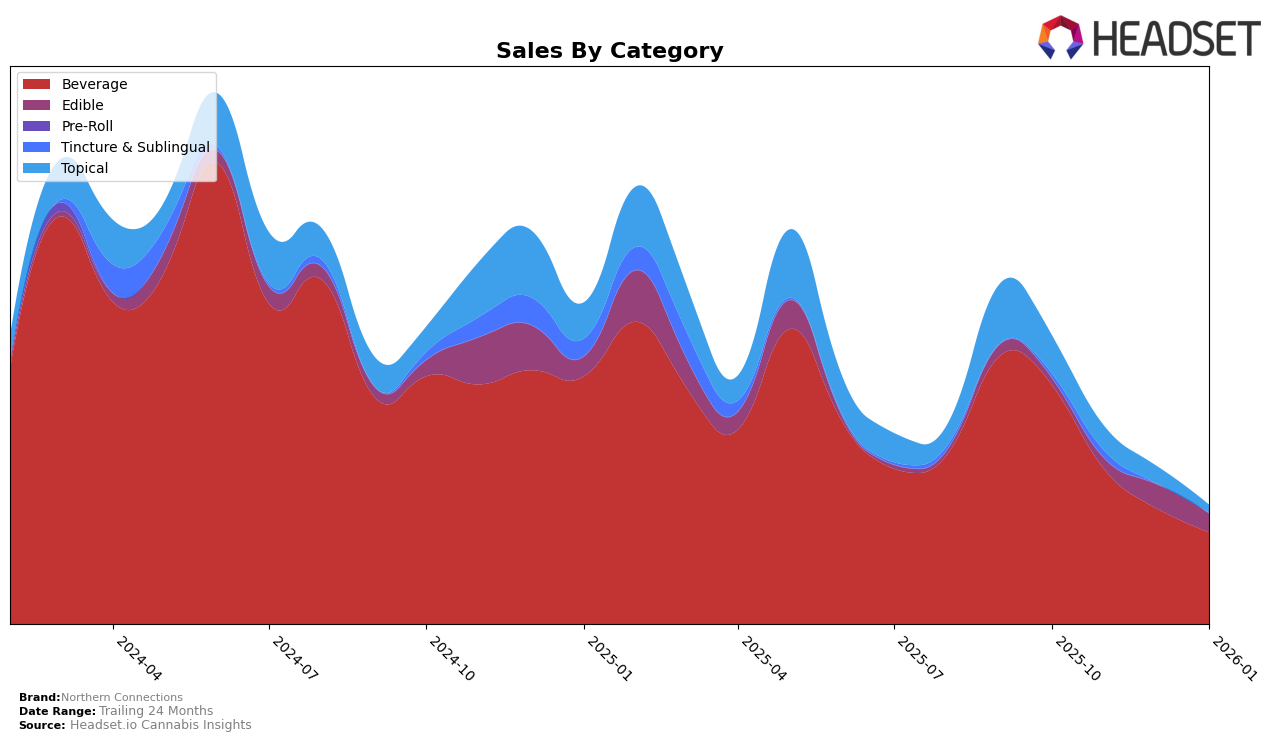

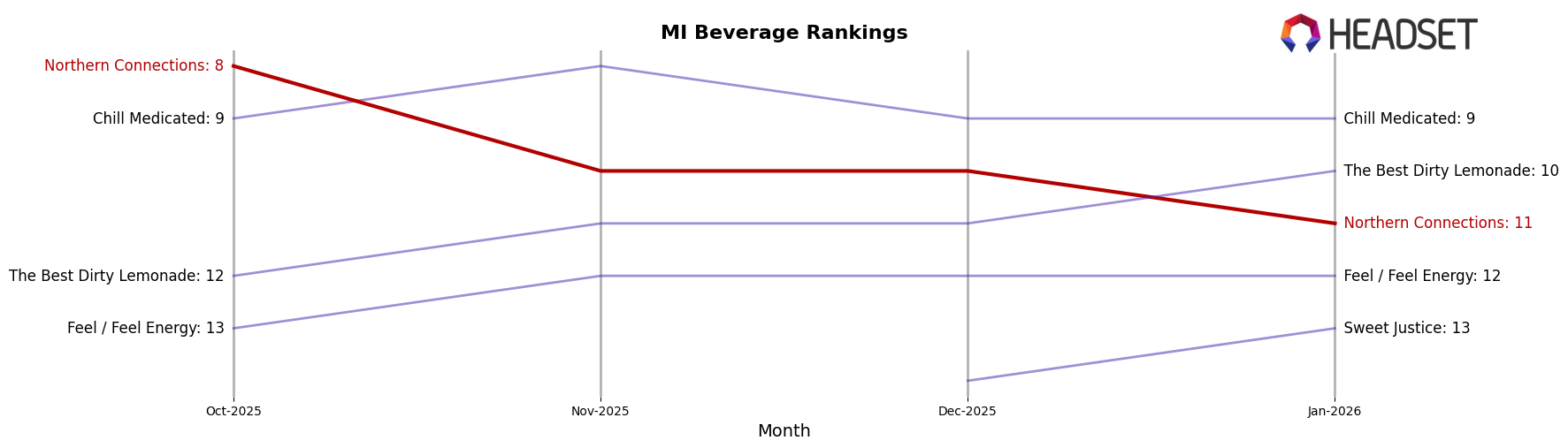

In the state of Michigan, Northern Connections has demonstrated a notable presence in the Beverage category, although there is a clear downward trend in their rankings over the recent months. Starting from a rank of 8 in October 2025, the brand slipped to 11 by January 2026. This decline is mirrored by a decrease in sales, with a notable drop from $71,414 in October to $27,298 in January. Such a trajectory suggests potential challenges in maintaining consumer interest or possibly increased competition within the category, which warrants further analysis for those interested in the dynamics of cannabis beverages in Michigan.

Conversely, Northern Connections' performance in the Topical category in Michigan is less clear due to limited available data. The brand was ranked 5th in October 2025, but subsequent months did not see the brand in the top 30. This absence could indicate a significant decline in market presence or sales performance, which might be concerning for stakeholders. Understanding the factors behind this drop, such as shifts in consumer preferences or strategic changes by the brand, would be crucial for a comprehensive evaluation of Northern Connections' market strategy in the Topical category.

Competitive Landscape

In the competitive landscape of the Michigan beverage category, Northern Connections has experienced a notable decline in both rank and sales over the observed months. Starting from October 2025, Northern Connections was ranked 8th, but by January 2026, it had slipped to 11th place. This downward trend in rank is mirrored by a consistent decrease in sales, which have dropped significantly from October 2025 to January 2026. In contrast, Chill Medicated maintained a steady position within the top 10, consistently ranking 9th, while The Best Dirty Lemonade improved its position, climbing from 12th to 10th. Meanwhile, Sweet Justice re-entered the top 20 in December 2025 at 14th and improved to 13th by January 2026, indicating a positive sales trajectory. The competitive pressure from these brands highlights the challenges Northern Connections faces in maintaining its market position and underscores the importance of strategic adjustments to regain momentum in the Michigan beverage market.

Notable Products

In January 2026, the top-performing product from Northern Connections was the Mixed Berry Liquid Loud Syrup (200mg) in the Beverage category, climbing to the number one rank with sales reaching 460 units. The Bake your Own Double Chocolate Chip Muffin Mix (200mg) secured the second position, marking its first appearance in the rankings. Salted Caramel High Cocoa (50mg) dropped from first place in December 2025 to third place in January 2026, indicating a notable decrease in sales. The Northern Connections X Ice Kream Hash Co- Peach Mango Liquid Loud Syrup (200mg) slipped from second to fourth position, showing a decline in its performance compared to previous months. Additionally, the Ice Kream Hash Co. x Northern Connections - Blue Razz Liquid Loud Rosin Infused Syrup (200mg) entered the list in January, securing fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.