Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

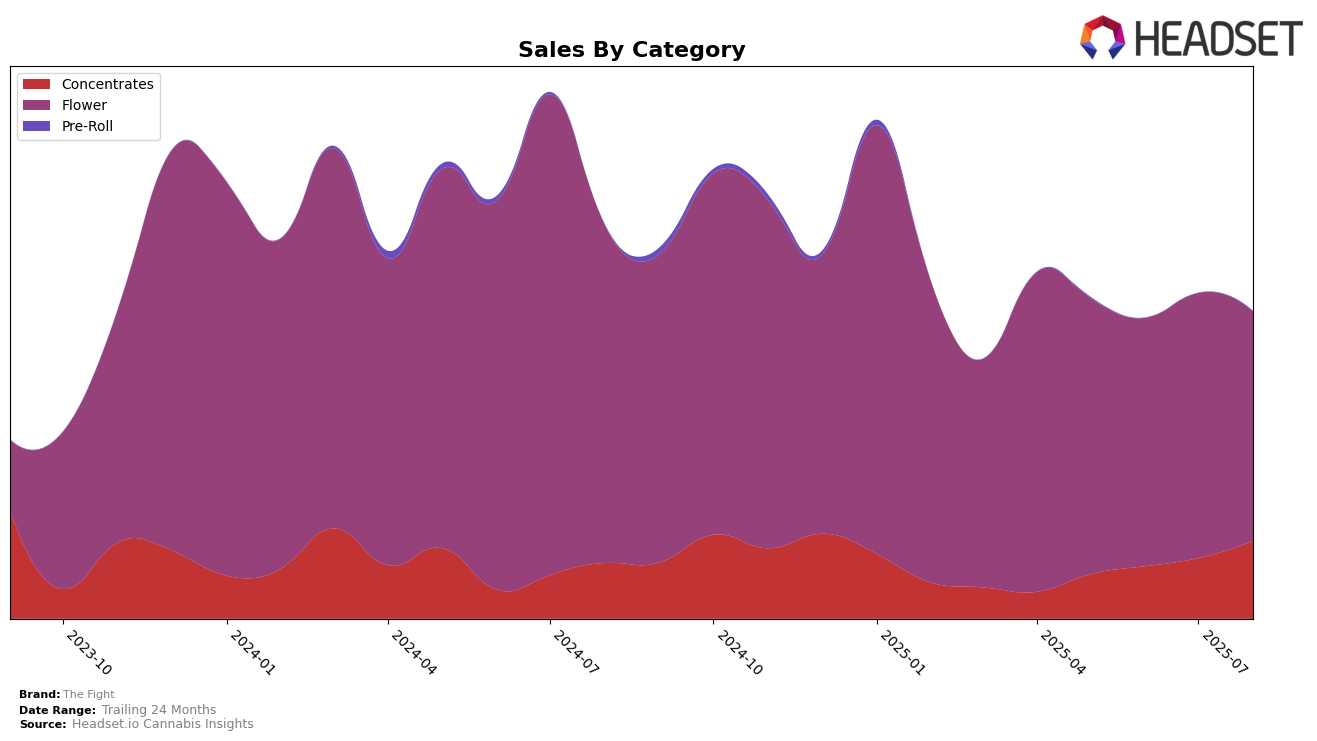

The Fight has shown a notable upward trajectory in the Concentrates category within California. Starting from a rank of 45 in May 2025, the brand climbed to secure the 30th position by August 2025. This steady rise is accompanied by a significant increase in sales, suggesting a growing consumer preference for The Fight's concentrate offerings. The brand's ability to break into the top 30 signifies a strong performance in a competitive market, indicating that their product quality and marketing strategies might be resonating well with consumers in this category.

Conversely, The Fight's performance in the Flower category in California presents a more challenging scenario. The brand's rank fluctuated, beginning at 61 in May 2025 and dropping to 72 by August 2025. This decline in ranking, coupled with a decrease in sales during the same period, highlights potential issues in maintaining market share or consumer interest in their flower products. The absence of a top 30 position in this category underscores the competitive pressures The Fight faces and suggests areas for potential improvement or strategic realignment to regain traction in the Flower market.

Competitive Landscape

In the competitive landscape of the California flower category, The Fight has experienced notable fluctuations in its ranking and sales performance from May to August 2025. Initially ranked 61st in May, The Fight saw a decline to 68th in June, a slight recovery to 63rd in July, and a further drop to 72nd in August. This downward trend in rank is mirrored by a decrease in sales, with a significant drop from May to August. In contrast, MADE demonstrated a strong upward trajectory, climbing from 80th in May to 65th in August, with sales peaking in July. Meanwhile, Lights Out maintained a relatively stable position, fluctuating slightly but remaining ahead of The Fight in August. Autumn Brands also showed resilience, improving its rank from 72nd in May to 73rd in August, despite a dip in sales. These movements suggest that The Fight faces increasing competition from both established and emerging brands, emphasizing the need for strategic adjustments to regain market share and improve its standing in the California flower market.

Notable Products

In August 2025, the top-performing product for The Fight was Gorilla Glue #4 Crumble (1g) in the Concentrates category, securing the number one rank with sales of 1663 units. California Octane Sugar (1g), also in the Concentrates category, followed closely in the second position. Extreme - LA Confidential (14g) from the Flower category took the third spot. Notably, Royal Skywalker Sugar (1g) experienced a drop in its ranking from first place in July to fourth in August, despite achieving sales of 885 units. Blue Dream Badder (1g) entered the top five for the first time, indicating a positive shift in its market performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.