Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

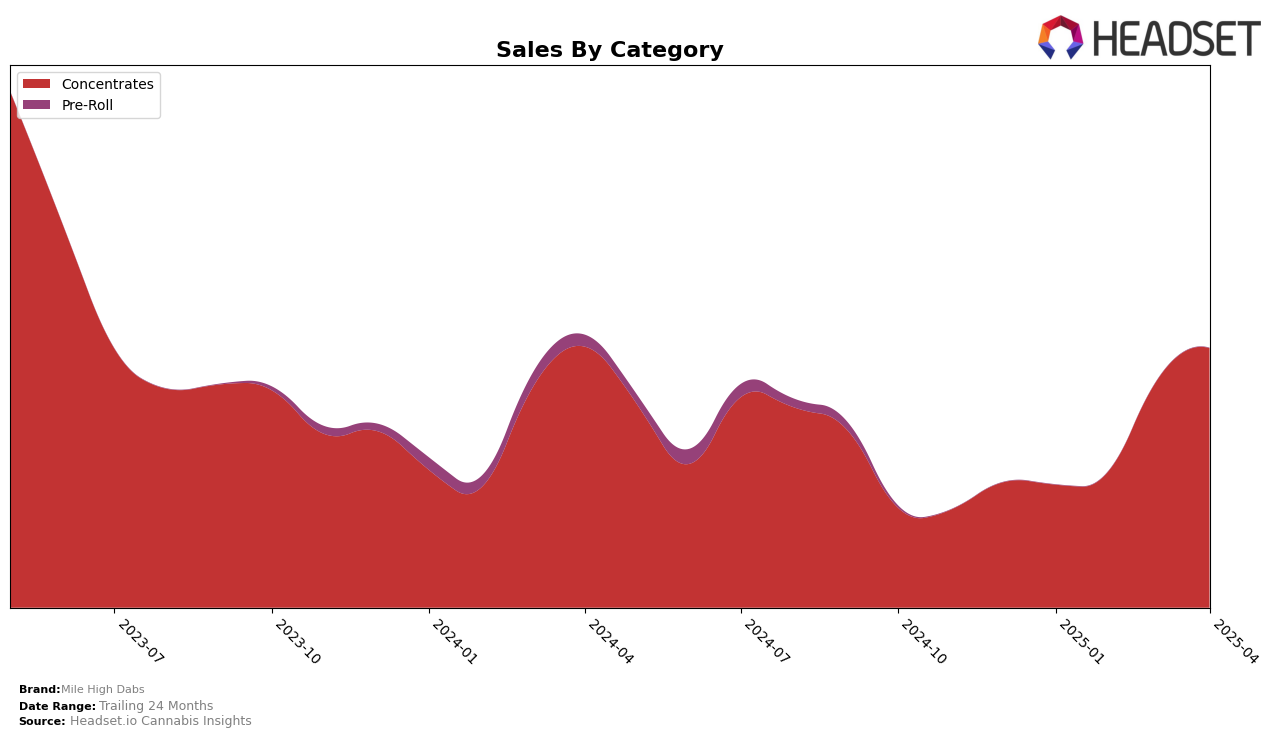

Mile High Dabs has shown a notable upward trajectory in the Colorado market, particularly within the concentrates category. Starting the year at the 30th position in January, the brand made significant strides, climbing to the 10th spot by April. This impressive rise reflects a consistent increase in sales, with a substantial jump from February to March. Such a movement suggests a growing consumer preference and possibly effective marketing strategies or product offerings that have resonated well with the local audience. However, the brand's absence from the top 30 in other states or categories indicates potential areas for growth and expansion.

While Mile High Dabs has made commendable progress in Colorado, its lack of presence in the top 30 rankings in other states or categories highlights a significant opportunity for the brand to diversify its market reach. This absence could be seen as a challenge but also a chance to explore new strategies or product variations to capture other markets. For a brand that has demonstrated strong growth in one region, replicating such success in other states could be a strategic focus moving forward. Observing how Mile High Dabs capitalizes on its current momentum in Colorado could provide insights into its future performance and potential expansion plans.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Mile High Dabs has demonstrated a remarkable upward trajectory in terms of rank and sales from January to April 2025. Starting from a rank of 30 in January, Mile High Dabs climbed to the 10th position by April, showcasing a significant improvement in market presence. This upward movement is particularly notable when compared to competitors like Next1 Labs LLC, which maintained a steady rank around 11, and Nomad Extracts, which experienced fluctuations, peaking at rank 5 in March before dropping to rank 8 in April. Meanwhile, Dablogic showed a gradual improvement, reaching rank 9 by April, and Billo made a notable climb from rank 25 in January to 12 in April. The sales figures for Mile High Dabs also reflect this positive trend, with a consistent increase each month, indicating a growing consumer preference and market penetration. This dynamic shift in ranking and sales positions Mile High Dabs as a rising contender in the Colorado concentrates market, potentially attracting more consumer interest and loyalty.

Notable Products

In April 2025, the top-performing product from Mile High Dabs was Black Cherry Cookies Sugar Wax (1g) in the Concentrates category, which climbed to the number one spot with sales of 2,695 units. Following closely, Black Cherry Cookies Sugar Wax (2g) maintained its position at number two. Mac and Cheese Sugar Wax (1g) experienced a slight drop to third place, despite having been the top performer in March. Mac and Cheese Sugar Wax (2g) also saw a decrease in its ranking, moving from third to fourth place. Oreoz Sugar Wax (1g) remained steady, holding on to the fifth position for two consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.