Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

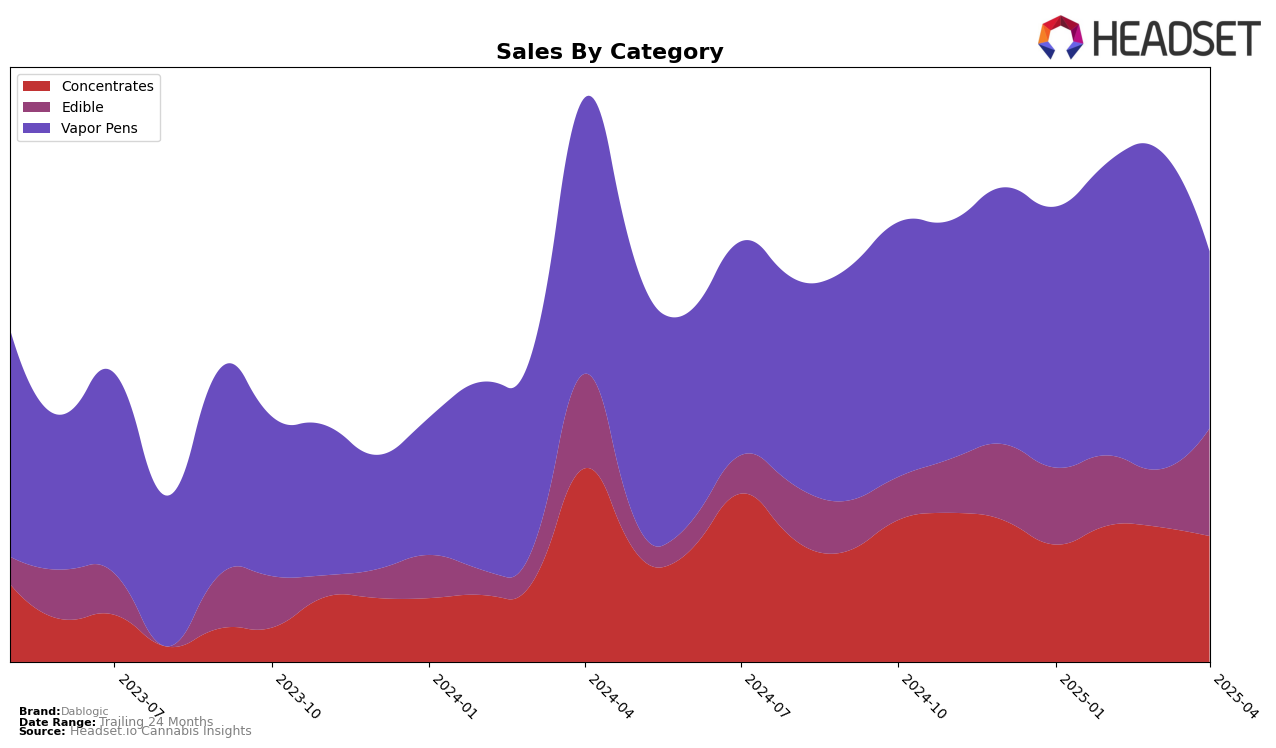

Dablogic has shown a notable upward trend in the Concentrates category in Colorado, rising from 15th place in January 2025 to 9th by April 2025. This consistent climb in rankings suggests a growing consumer preference and possibly enhanced distribution strategies or product offerings. However, the sales figures for April show a slight dip compared to March, indicating that while their market position is improving, there might be external factors affecting sales volume. This performance in Concentrates is a positive indicator of the brand's strengthening presence in this category within the state.

In contrast, Dablogic's performance in the Vapor Pens category in Colorado has been somewhat volatile. The brand started the year in 22nd place, improved to 19th by March, but then dropped to 27th in April. This fluctuation might indicate challenges in maintaining consistent consumer interest or competition pressures. Interestingly, despite the drop in ranking, the sales figures for Vapor Pens peaked in March, suggesting a temporary surge in demand. Meanwhile, in the Edibles category, Dablogic experienced a recovery in April, moving up from 18th to 14th place, accompanied by a significant increase in sales, which could hint at successful marketing or product innovation efforts.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Dablogic has experienced notable fluctuations in its market position from January to April 2025. Initially holding the 22nd rank in January, Dablogic improved to 19th in March, indicating a positive trajectory in sales performance. However, by April, Dablogic's rank slipped to 27th, suggesting increased competition and potential challenges in maintaining its upward momentum. In contrast, 710 Labs showed a decline from 16th in February to 26th in April, while Jetty Extracts demonstrated a steady climb, reaching 25th in April. Next1 Labs LLC and Wavelength Extracts also showed varied performance, with Wavelength Extracts improving significantly to 29th in April. These dynamics highlight the competitive pressures Dablogic faces, emphasizing the importance of strategic marketing and product differentiation to regain and sustain a higher market position.

Notable Products

In April 2025, Snoozeberry Live Rosin Fruit Chew 10-Pack (100mg) emerged as the top-performing product for Dablogic, securing the first rank with a notable sales figure of 3100 units. Following closely, Blood Orange Rosin Fruit Chew 10-Pack (100mg) claimed the second position, showing a consistent performance by climbing from third place in March. Lemon Meringue Pie Live Rosin Gummies 10-Pack (100mg) took the third rank, maintaining a steady presence in the top three since its debut in March. Sour Cherry Live Rosin Fruit Chew 10-Pack (100mg) experienced a drop to fourth place from its previous third position. Finally, Strawberry Lemonade Live Rosin Fruit Chew 10-Pack (100mg) held its ground at the fifth rank, identical to its March performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.