Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

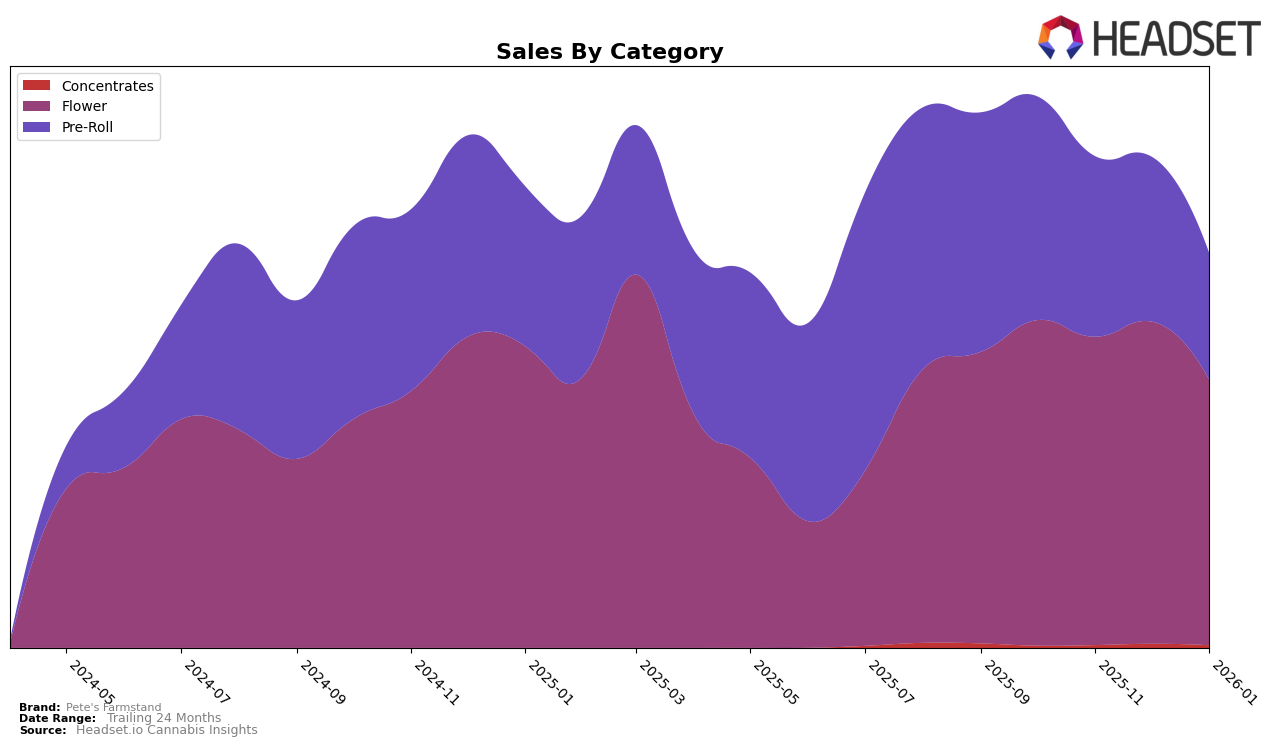

In the state of New Jersey, Pete's Farmstand has shown consistent performance in the Flower category, maintaining a position within the top 10 brands. Over the four-month period from October 2025 to January 2026, the brand fluctuated slightly, moving from 9th to 7th place and back to 8th, indicating a stable presence in the market. Despite a decrease in sales from October to January, Pete's Farmstand managed to retain its competitive ranking, suggesting a strong brand loyalty or market presence in this category. This stability in ranking amidst varying sales figures could be indicative of strategic marketing or product consistency that resonates with consumers.

In contrast, Pete's Farmstand's performance in the Pre-Roll category in New Jersey has been slightly more volatile, with a notable drop in sales from October to January. Despite this decline, the brand maintained a steady 5th place ranking from November onwards, after starting at 3rd in October. This consistency in ranking, even as sales decrease, might suggest that while their market share is being challenged by competitors, Pete's Farmstand remains a preferred choice for a segment of the consumer base. The ability to sustain a top 5 position despite declining sales could indicate room for growth if market conditions improve or if the brand adapts its strategy to reignite sales momentum.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Pete's Farmstand has shown resilience and consistency in its market position, maintaining a steady rank between 7th and 9th place from October 2025 to January 2026. Despite facing fierce competition from top brands like Garden Greens, which consistently held the top spot until a slight decline to 6th in January 2026, Pete's Farmstand has managed to outperform brands like Kind Tree Cannabis and The Lid. Notably, Zips has been a close competitor, often ranking just above Pete's Farmstand, indicating a competitive rivalry. The sales trends suggest that while Pete's Farmstand experienced a dip in January 2026, it has generally maintained a stable sales trajectory, positioning itself as a reliable choice for consumers amidst fluctuating performances from its competitors.

Notable Products

In January 2026, Pete's Farmstand's top-performing product was Pete's Medley Pre-Roll 1g, maintaining its consistent first-place ranking from previous months, despite a slight dip to 9327 in sales. The newly introduced Fuji OG Pre-Roll 1g secured the second position, followed by Flapjackz Pre-Roll 1g in third. Bridgegate Pre-Roll 1g and Silly Rabbit Pre-Roll 1g rounded out the top five, placing fourth and fifth respectively. Notably, these products did not appear in the top ranks in the preceding months, indicating a successful launch or increased popularity in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.