Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

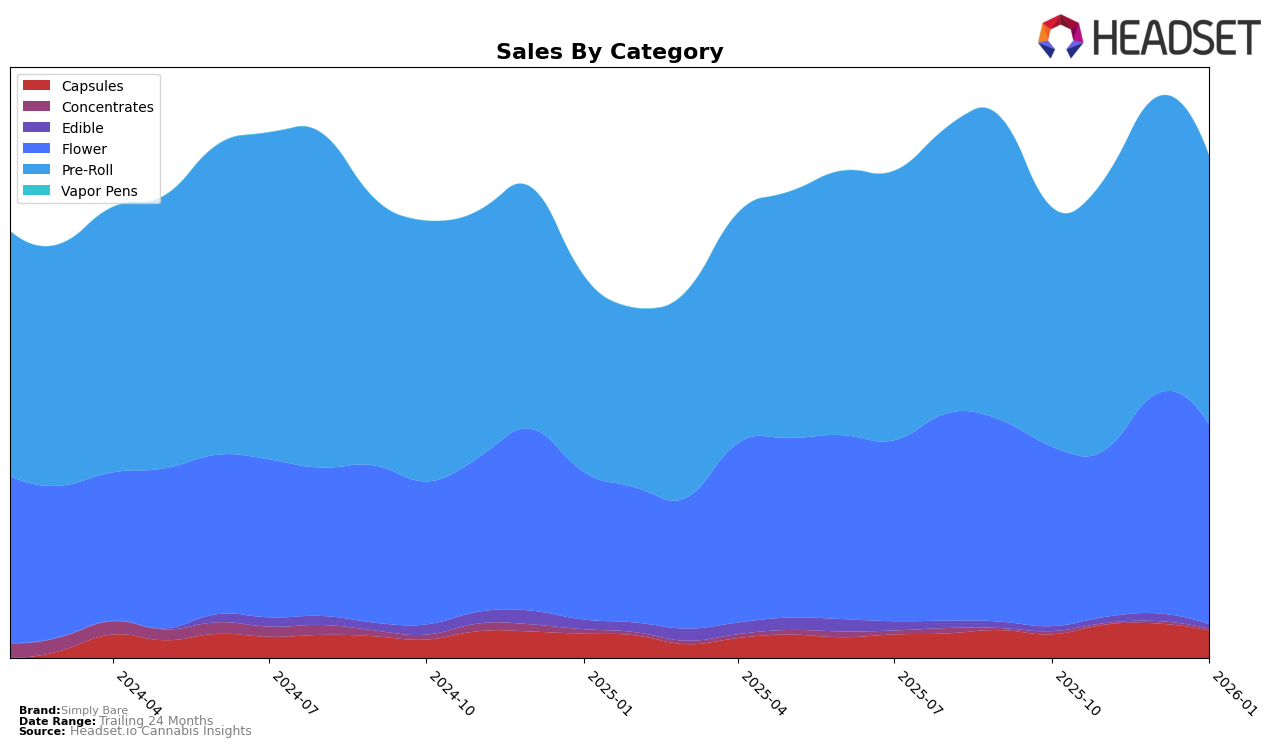

Simply Bare has shown fluctuating performance across different categories and provinces in recent months. In Alberta, the brand's presence in the capsules category was inconsistent, with rankings missing for two months, which indicates that Simply Bare was not in the top 30 during those periods. However, when ranked, it held a respectable position, achieving a rank of 5.0 in December 2025. In the flower category, Simply Bare experienced an improvement in its ranking from 22.0 in November 2025 to 14.0 in December 2025, before slightly declining to 16.0 in January 2026. This suggests a competitive landscape where the brand managed to gain some ground, though maintaining consistency remains a challenge.

In British Columbia, Simply Bare's performance in capsules was notable in November 2025, achieving a rank of 4.0. However, the absence of rankings in other months suggests it struggled to maintain a top 30 position. The flower category saw a gradual improvement with a rise from 46.0 in November 2025 to 35.0 by January 2026, indicating positive momentum. Meanwhile, in Ontario, Simply Bare maintained a consistent rank of 8.0 in the capsules category across all months, showcasing stability. However, its flower category ranking fluctuated slightly, peaking at 37.0 in December 2025 before dropping back to 40.0 in January 2026, reflecting the competitive pressures in this market.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, Simply Bare has demonstrated a steady presence, albeit with some fluctuations in rank. From October 2025 to January 2026, Simply Bare's rank improved from 32nd to 29th, indicating a slight upward trend in market positioning. Despite this improvement, Simply Bare faces stiff competition from brands like Dab Bods, which consistently ranked higher, maintaining a position around 28th. Meanwhile, The Original Fraser Valley Weed Co. consistently outperformed Simply Bare, holding a rank in the mid-20s. Simply Bare's sales figures showed a peak in December 2025, but a notable decline in January 2026, which may suggest seasonal influences or increased competition impacting sales. Brands like Rizzlers also experienced rank volatility, dropping from 25th in November to 31st in January, which could indicate market dynamics that Simply Bare might capitalize on to enhance its competitive edge.

Notable Products

In January 2026, the top-performing product from Simply Bare was the Fruit Loopz Pre-Roll 5-Pack (1.5g), maintaining its number one rank for four consecutive months with sales figures reaching 10,398. The BC Organic Fruit Loopz Pre-Roll (0.5g) held steady at the second position, showing consistent popularity since November 2025. The BC Organic - Fire OG Rosin Infused Pre-Roll (0.5g) improved its ranking from fifth in November to third in January, indicating a notable increase in demand. Harlequin Pre-Roll 5-Pack (1.5g) advanced from fifth place in December to fourth in January, suggesting a resurgence in consumer interest. Lastly, the Craft Flight Pre-Roll 3-Pack (1.5g) maintained its fifth position, demonstrating stable sales performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.