Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

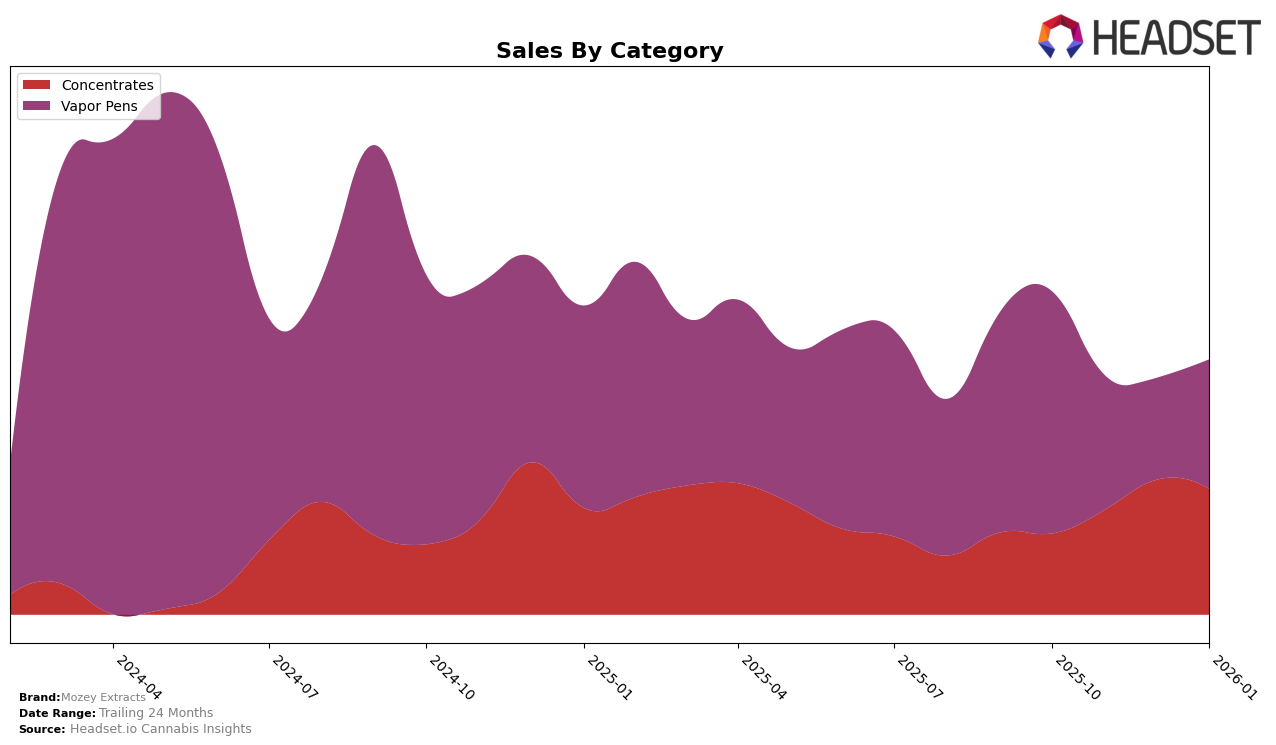

Mozey Extracts has demonstrated notable performance in the concentrates category, particularly in Illinois. Over the past few months, the brand has climbed from the 10th position in October 2025 to the 5th position by January 2026. This upward trend is indicative of their growing market share and consumer preference in the state. In contrast, their performance in the vapor pens category in Illinois has shown a declining trend, with rankings dropping from 41st to 49th place over the same period. This suggests potential challenges in maintaining competitiveness in this category within the state.

In Michigan, Mozey Extracts has seen fluctuating success across different categories. The concentrates category has been inconsistent, with the brand not securing a top 30 position in November and December 2025, before reappearing at 92nd in January 2026. However, in vapor pens, the brand's ranking has varied significantly, peaking at 25th in October 2025, dropping to 46th in December, and then rising again to 32nd in January 2026. Meanwhile, in Ohio, Mozey Extracts has maintained a relatively stable presence in the concentrates category, with rankings consistently hovering around the top 10, reflecting a strong foothold in this market.

Competitive Landscape

In the Illinois concentrates market, Mozey Extracts has demonstrated a notable upward trajectory in its rankings over the past few months. Starting from the 10th position in October 2025, Mozey Extracts climbed to 5th place by January 2026, reflecting a strategic improvement in market presence and consumer preference. This ascent is particularly significant when compared to competitors like Nature's Grace and Wellness, which consistently maintained a top 4 position, and IC Collective, which improved from 8th to 4th place. Meanwhile, Superflux experienced a decline from 3rd to 7th place, suggesting potential market share opportunities for Mozey Extracts. Additionally, Lula's saw fluctuating ranks, dropping from 3rd to 6th, which may have contributed to Mozey Extracts' ability to gain ground. Overall, Mozey Extracts' sales growth aligns with its improved ranking, indicating a positive trend that could further enhance its competitive stance in the Illinois concentrates market.

Notable Products

In January 2026, Razzle Dazzle Berry Distillate Cartridge (1g) emerged as the top-performing product for Mozey Extracts, climbing from the third position in December 2025 to the first, with notable sales of 4573 units. Cherry Pie Distillate Cartridge (1g) maintained strong performance, securing the second spot after being the top product in December, with sales reaching 4357 units. Bomb Berry Pop Distillate Cartridge (1g) experienced a slight drop, moving from second place in December to third in January. Peach Perfect Distillate Cartridge (1g) maintained its rank at third, tied with Bomb Berry Pop, showing consistent performance. Jungle Punch Distillate Cartridge (1g) made its debut in the rankings at fourth place, indicating a positive market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.