Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

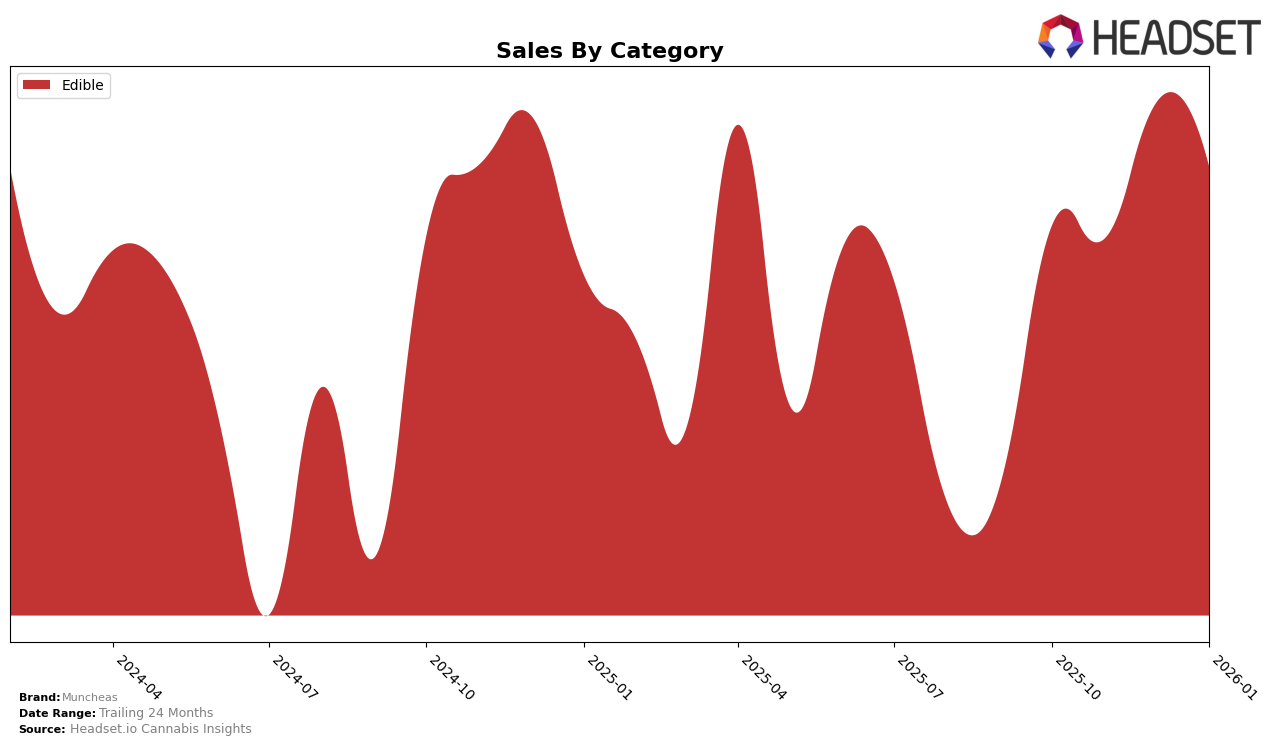

Muncheas has shown a consistent presence in the Massachusetts edibles market, maintaining its position among the top 30 brands. Over the past few months, the brand has seen a slight decline in its ranking, moving from 20th place in October 2025 to 22nd by January 2026. Despite this subtle drop in position, Muncheas experienced a notable increase in sales from November to December, with sales peaking at 149,199 USD in December before slightly decreasing in January. This pattern suggests that while the brand's ranking has fluctuated, it has managed to capture consumer interest effectively during the holiday season, which is often a peak time for edible purchases.

In contrast, the absence of Muncheas from the top 30 brands in other states or provinces indicates potential areas for growth and expansion. The brand's consistent performance in Massachusetts could serve as a model for entering new markets or strengthening its presence in existing ones. The challenge for Muncheas will be to replicate its Massachusetts strategy in other regions, adapting to local tastes and regulatory environments. By understanding consumer preferences and market dynamics in different states, Muncheas could potentially enhance its brand ranking and sales figures across a broader geographical landscape.

Competitive Landscape

In the Massachusetts edible cannabis market, Muncheas has demonstrated a consistent presence, although it faces stiff competition from several notable brands. Over the four-month period from October 2025 to January 2026, Muncheas maintained a steady rank, moving from 20th to 22nd, indicating a slight decline in its competitive position. Despite this, its sales figures show a positive trend, peaking in December 2025. In contrast, Sapura consistently outperformed Muncheas, holding ranks between 18th and 20th, with sales figures that remained robust throughout the period. Meanwhile, Lost Farm showed a stronger performance with ranks improving from 19th to 18th, and sales peaking in November 2025, significantly higher than Muncheas. Happy Valley and Effin' Edibles trailed behind Muncheas in both rank and sales, highlighting Muncheas' competitive edge over these brands. The data suggests that while Muncheas is holding its ground, there is room for strategic improvements to climb the ranks and increase its market share in the Massachusetts edible category.

Notable Products

In January 2026, Muncheas' Blue Raspberry Fruit Gems Gummies 20-Pack (100mg) maintained its top ranking in the Edible category with notable sales of 1806 units, showing consistent performance from November 2025. Pink Lemonade Fruit Gems Gummies 20-Pack climbed to the second position, up from its previous fourth place in October 2025, with sales reaching 1581 units. Tropical Fruit Gems Gummies 20-Pack held steady in third place, mirroring its rank from November 2025. Cran-Grape Fruit Gems Gummies 20-Pack improved its standing from fifth in December 2025 to fourth in January 2026. Meanwhile, Tangerine Energize Gummies 20-Pack saw a decline, dropping from first place in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.