Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

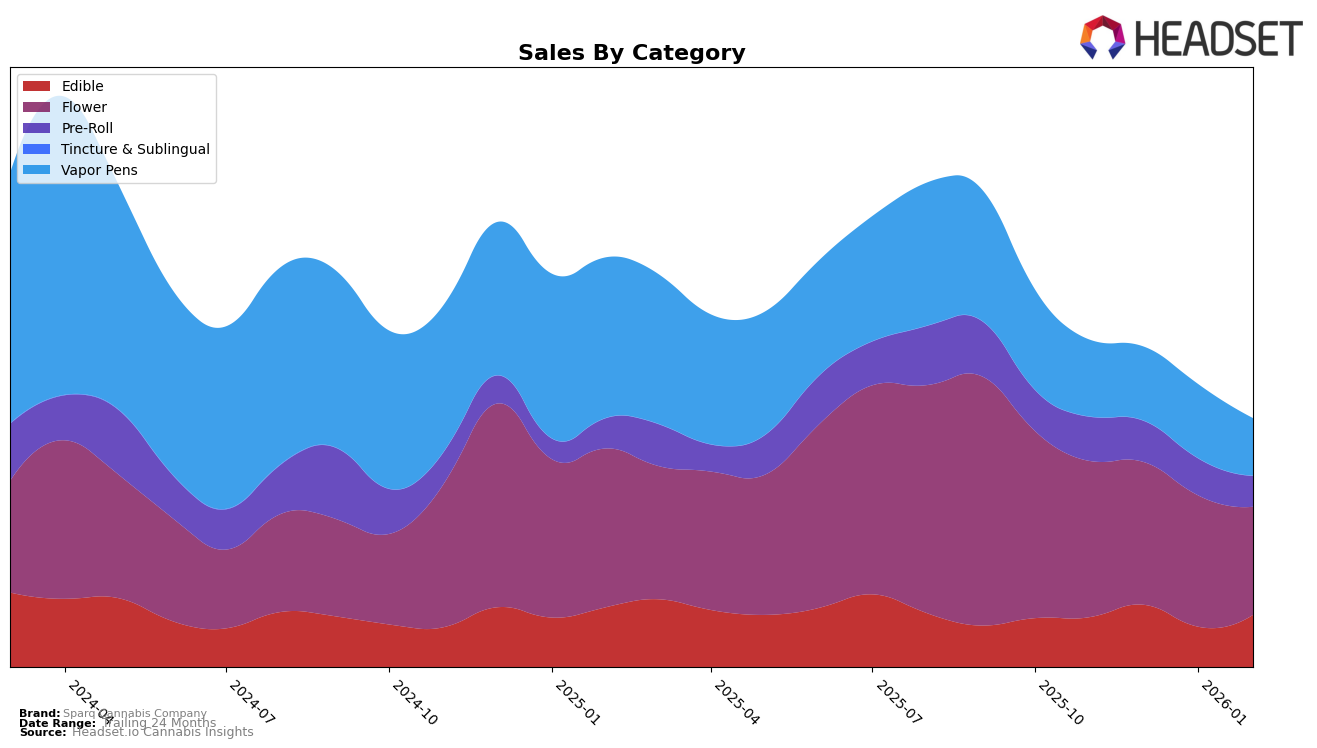

Sparq Cannabis Company has demonstrated a varied performance across different product categories in Massachusetts. In the Edible category, the brand maintained a relatively stable presence within the top 30, moving from rank 23 in November 2025 to rank 24 by February 2026. This stability suggests a consistent demand for their edibles, even though there was a notable dip in sales in January. In contrast, the Flower category showed a downward trend, with Sparq Cannabis Company not making it into the top 30 by February 2026, indicating potential challenges in maintaining market share in this highly competitive segment. The Pre-Roll category also saw a decline, with the brand falling from rank 72 in November to 83 by February, reflecting a more significant struggle to capture consumer interest.

The Vapor Pens category tells a slightly different story, with Sparq Cannabis Company holding steady at rank 39 in both November and December 2025, before a slight decline to rank 40 in January 2026 and returning to rank 39 in February. This consistency suggests that their vapor pens have a loyal customer base, even as sales slightly decreased over the period. Overall, while Sparq Cannabis Company has maintained its presence in certain categories, the brand's performance highlights the dynamic nature of the cannabis market in Massachusetts, where maintaining and improving rankings requires continuous adaptation and innovation.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Sparq Cannabis Company has experienced a gradual decline in its ranking from November 2025 to February 2026, moving from 37th to 47th place. This downward trend is indicative of the increasing competition and market dynamics in the region. Notably, brands like Cheech & Chong's and HighMark Provisions (HMP) have shown fluctuating yet relatively stronger positions, with Cheech & Chong's maintaining a steady 44th rank in January and February 2026, and HighMark Provisions (HMP) experiencing a dip to 43rd in February after a peak at 27th in January. Additionally, Local Roots has also been a significant competitor, ranking slightly above Sparq Cannabis Company in February 2026 at 51st. These shifts highlight the need for Sparq Cannabis Company to innovate and strategize effectively to regain its competitive edge and improve its sales trajectory in this vibrant market.

Notable Products

In February 2026, Blue Watermelon Fast Acting Gummies 20-Pack (100mg) emerged as the top-performing product for Sparq Cannabis Company, claiming the number one rank with sales of $1,261. Appleberry Fast Acting Gummies 20-Pack (100mg) secured the second position, showing a notable entry in the rankings. Blue Raspberry Fast Acting Gummies 20-Pack (100mg) achieved the third rank, improving from its previous unranked status. Red Velvet Pre-Roll (1g) debuted in the rankings at fourth place, while Sour Cherry Fast Acting Gummies 20-Pack (100mg) followed closely in fifth place. The shift in rankings from the previous months highlights a strong performance by the Edible category, particularly with the introduction and rise of new gummy flavors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.