Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

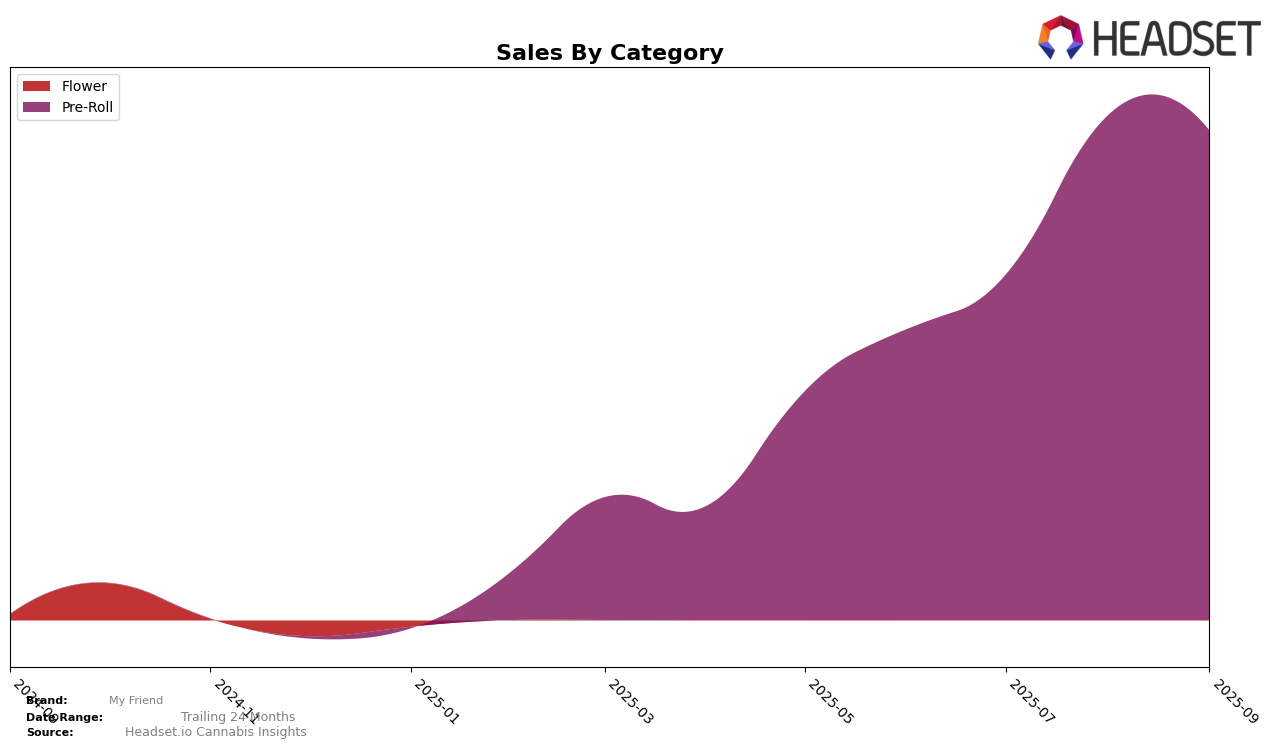

In the state of Michigan, My Friend has shown notable progress in the Pre-Roll category over the past few months. Starting from a rank of 46 in June 2025, the brand improved its standing to reach the 23rd position by September 2025. This upward trajectory suggests a growing acceptance and popularity of My Friend's offerings among consumers in Michigan. Despite not being in the top 30 at the beginning of the period, My Friend's consistent climb into the ranks indicates effective strategies and product appeal that have resonated well with the market.

While the specific sales figures for My Friend in Michigan illustrate a significant increase, with a peak in sales during August 2025, it's important to note that the brand's journey into the top 30 is a testament to its evolving market presence. This movement reflects positively on My Friend's ability to adapt and capture market share in a competitive landscape. However, the absence of rankings in other states or categories suggests that there is still room for growth and expansion beyond Michigan. This could be a focal point for future strategies as the brand seeks to replicate its success in other regions and product categories.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, My Friend has exhibited a notable upward trajectory in its ranking over the past few months. Starting from a rank of 46 in June 2025, My Friend climbed to 23 by September 2025, indicating a significant improvement in its market position. This upward movement is particularly impressive when compared to competitors like Element and LOCO, both of which have shown fluctuating ranks, with Element not even making it into the top 20 during this period. Meanwhile, High Minded maintained a relatively stable presence, but My Friend's consistent rise suggests a growing consumer preference. Additionally, My Friend's sales have seen a substantial increase, especially from July to August, which aligns with its improved ranking, suggesting effective market penetration and consumer acceptance. This trend positions My Friend as a strong contender in the Michigan Pre-Roll market, potentially poised for further growth if the current trajectory continues.

Notable Products

In September 2025, the top-performing product for My Friend was the Shikuwasa Pre-Roll (1g) in the Pre-Roll category, maintaining its position at rank 1 with sales of 22,869. Grape Kandy Pre-Roll (1g) climbed to rank 2, showing a significant improvement in sales from the previous month. Cap Junkie Pre-Roll (1g) experienced a drop to rank 3 after holding the top position in August. Gush Mints Pre-Roll (1g) entered the rankings for the first time at position 4, while GMO Pre-Roll (1g) secured the fifth spot. These shifts indicate dynamic changes in consumer preferences within My Friend's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.