Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

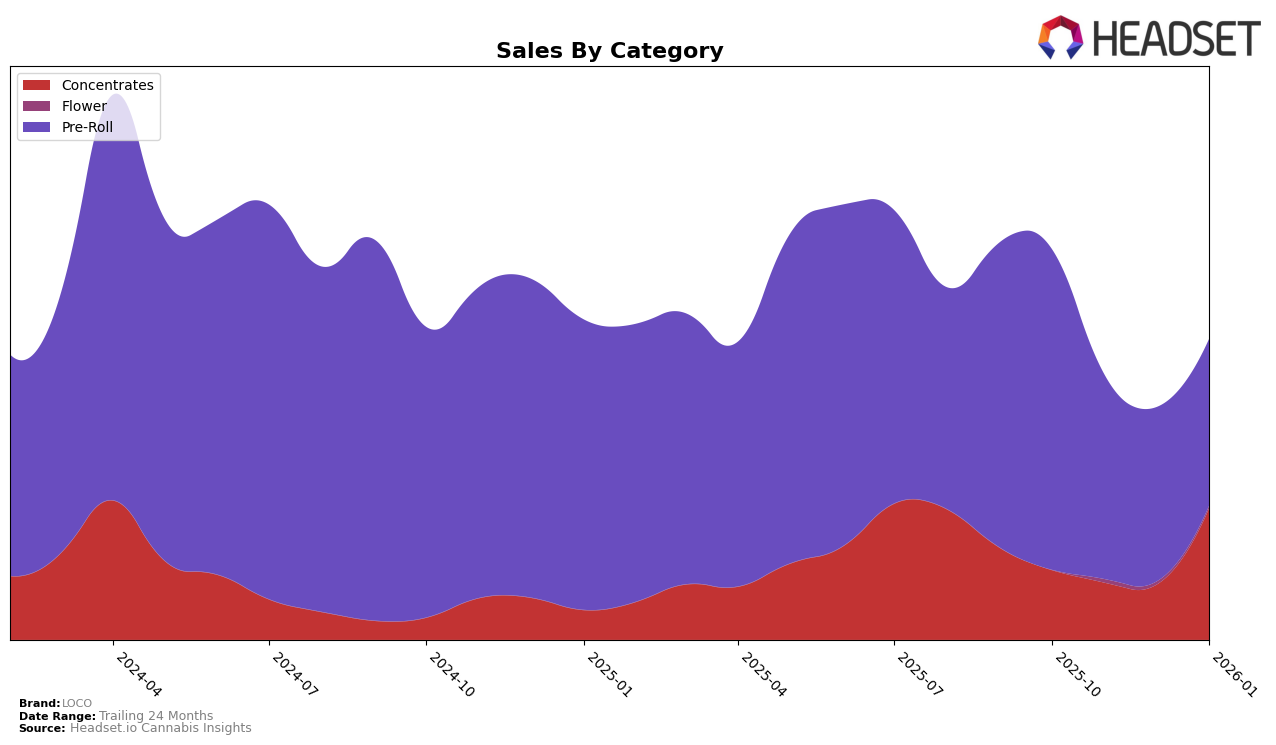

In the state of Michigan, LOCO has shown varied performance across different product categories. Notably, in the Concentrates category, LOCO made a significant comeback in January 2026, achieving the 25th rank after not being in the top 30 in the preceding months. This upward movement is quite significant given their previous rankings of 40th, 53rd, and 57th in October, November, and December 2025, respectively. The sales figures for January 2026 in this category underscore a strong recovery, indicating a potential strategic shift or market response that favored LOCO. This indicates that LOCO is gaining traction in Michigan's Concentrates market, although the journey through the last quarter of 2025 was challenging.

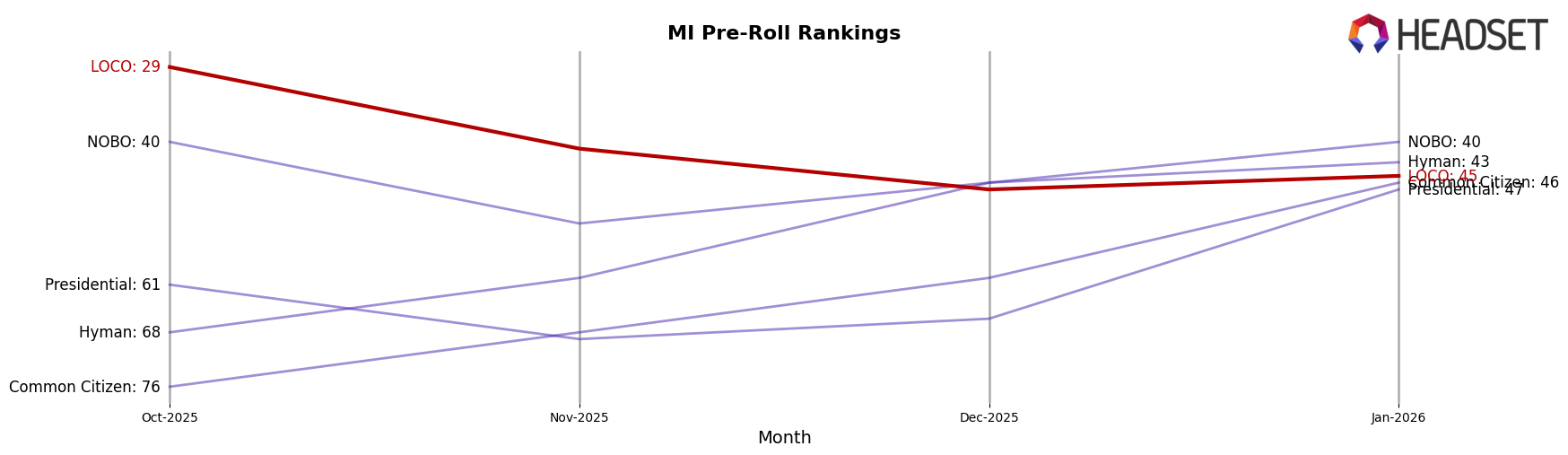

In contrast, LOCO's performance in the Pre-Roll category in Michigan has been more stable, though it shows a downward trend in rankings over the months. Starting from a 29th position in October 2025, LOCO slipped to 45th by January 2026. This decline in the rankings might suggest increased competition or a shift in consumer preferences in the Pre-Roll segment. Despite this, the sales figures remained substantial, indicating a consistent demand base. However, the consistent presence in the top 50 suggests that while LOCO may be facing challenges, it still holds a significant foothold in Michigan's Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, LOCO experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 29th in October 2025, LOCO saw a decline in rank to 41st by November, followed by a further drop to 47th in December, before slightly recovering to 45th in January 2026. This downward trend contrasts with the performance of competitors like Hyman, which improved its rank from 68th in October to 43rd by January, and Common Citizen, which showed a significant jump from 76th in October to 46th in January, despite missing data for November. Meanwhile, NOBO maintained a relatively stable position, re-entering the top 40 by January after a brief absence in December. These shifts suggest that while LOCO's sales have been decreasing, competitors have been gaining traction, indicating a need for strategic adjustments to regain market share.

Notable Products

In January 2026, Grape Ape Infused Pre-Roll (1g) maintained its top position as the leading product for LOCO, with sales reaching 4690 units. Watermelon Splash Infused Pre-Roll (1g) climbed to the second position, showing a significant improvement from its fifth-place debut in December 2025. Fruit Punch Infused Pre-Roll (1g) held steady in third place, despite a decrease in sales from the previous month. Sour Tangie Live Resin Infused Pre-Roll (1g) re-entered the rankings at fourth place, showing resilience after not ranking in December. Forbidden Fruit Infused Pre-Roll (1g) made its first appearance in the rankings, coming in fifth, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.