Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

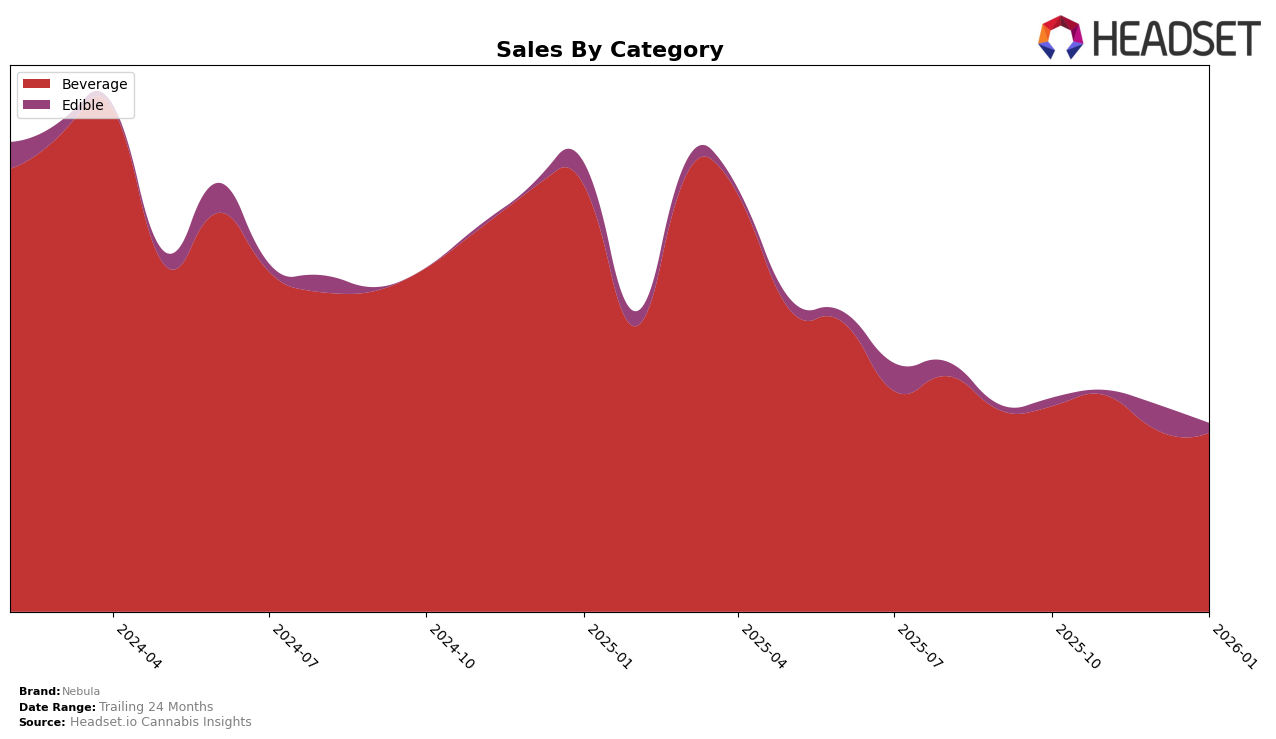

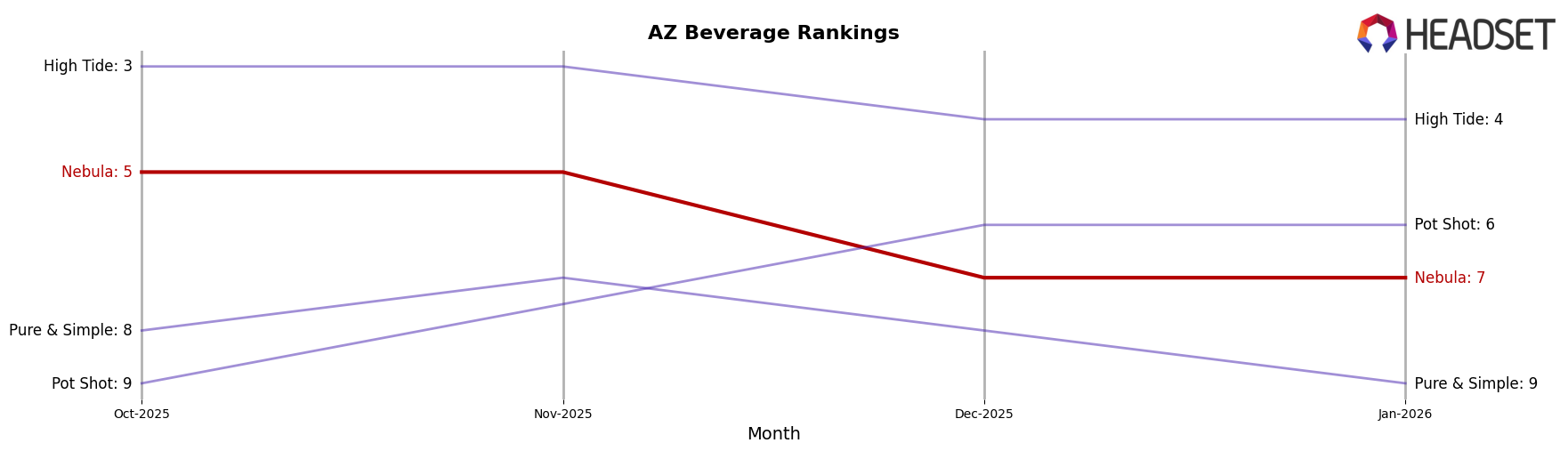

In the state of Arizona, Nebula has shown consistent performance in the Beverage category. Holding steady at the 5th position in both October and November of 2025, they experienced a slight drop to the 7th position in December 2025 and maintained this rank into January 2026. This indicates a potential challenge in maintaining their earlier momentum, possibly due to increased competition or seasonal shifts in consumer preferences. Despite the drop in ranking, Nebula's sales figures reveal a slight decline from November to January, which could suggest a need for strategic adjustments to regain their top-five standing.

Interestingly, Nebula's presence in other states and categories is absent from the top 30 rankings, suggesting either a focus on the Arizona Beverage market or difficulties in penetrating other markets and categories effectively. This absence could be interpreted as a strategic decision to consolidate their efforts where they have established a foothold or as a potential area for growth and expansion in the future. The lack of data for other regions and categories leaves room for speculation on Nebula's broader market strategy and potential untapped opportunities.

Competitive Landscape

In the Arizona beverage category, Nebula has experienced some fluctuations in its competitive positioning over recent months. Despite maintaining a steady rank of 5th in October and November 2025, Nebula slipped to 7th place in December 2025 and maintained this position in January 2026. This shift can be attributed to the rise of Pot Shot, which jumped from being unranked in November to securing the 6th position in December and January. Meanwhile, High Tide consistently held a strong position, ranking 3rd in both October and November before dropping slightly to 4th in December and January. Pure & Simple showed a stable performance with minor fluctuations, ranking between 7th and 9th. These dynamics suggest that while Nebula remains a key player, the competitive landscape is becoming increasingly challenging, highlighting the need for strategic adjustments to regain and sustain higher rankings and sales momentum.

Notable Products

In January 2026, the top-performing product from Nebula was Nectar - Pure Unflavored Syrup (100mg, 1oz) in the Beverage category, maintaining its first-place ranking with a notable sales figure of 546 units. Wild Strawberry Nectar Syrup (100mg) consistently held the second rank across the months, with sales rising to 489 units. Blue Razz Nectar Syrup (100mg) showed significant improvement, climbing from fifth place in November to third place in January. Tigers Blood Nectar Syrup (100mg) reappeared in the rankings, securing the fourth position with 351 units sold. Lemon Lime Syrup (100mg) dropped from third in December to fifth in January, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.