Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

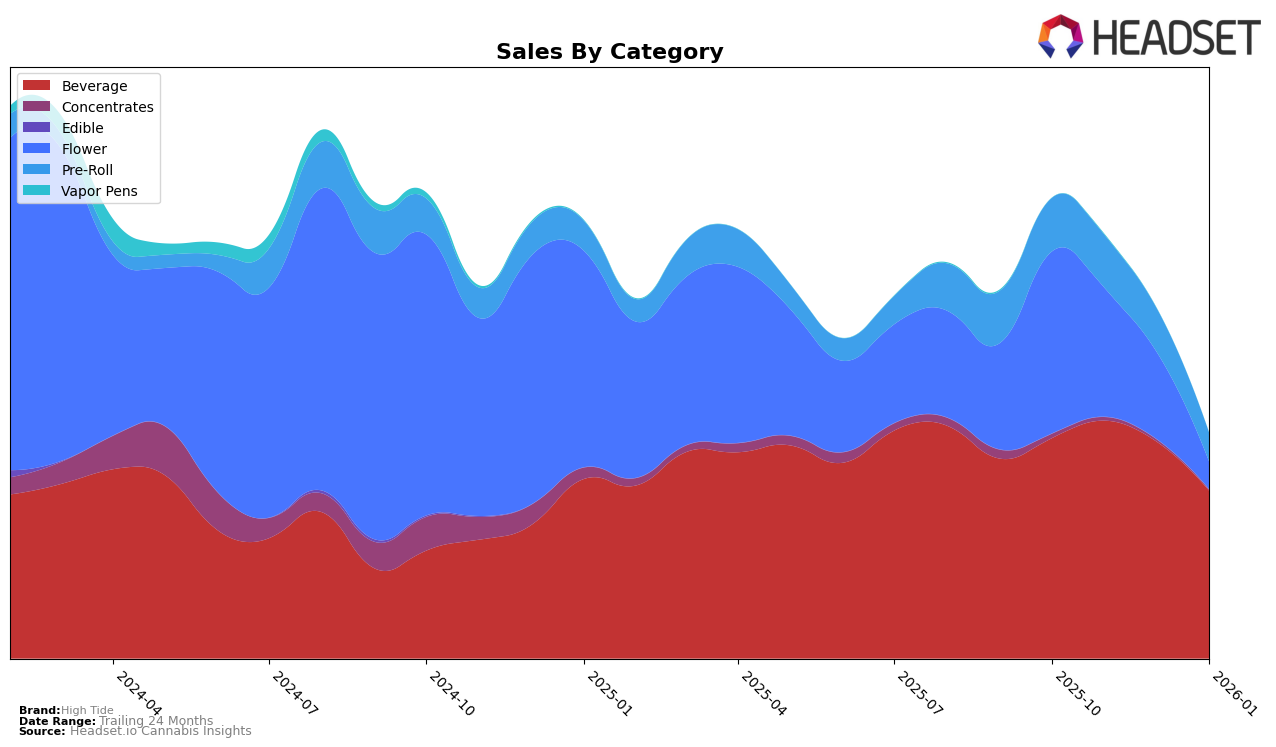

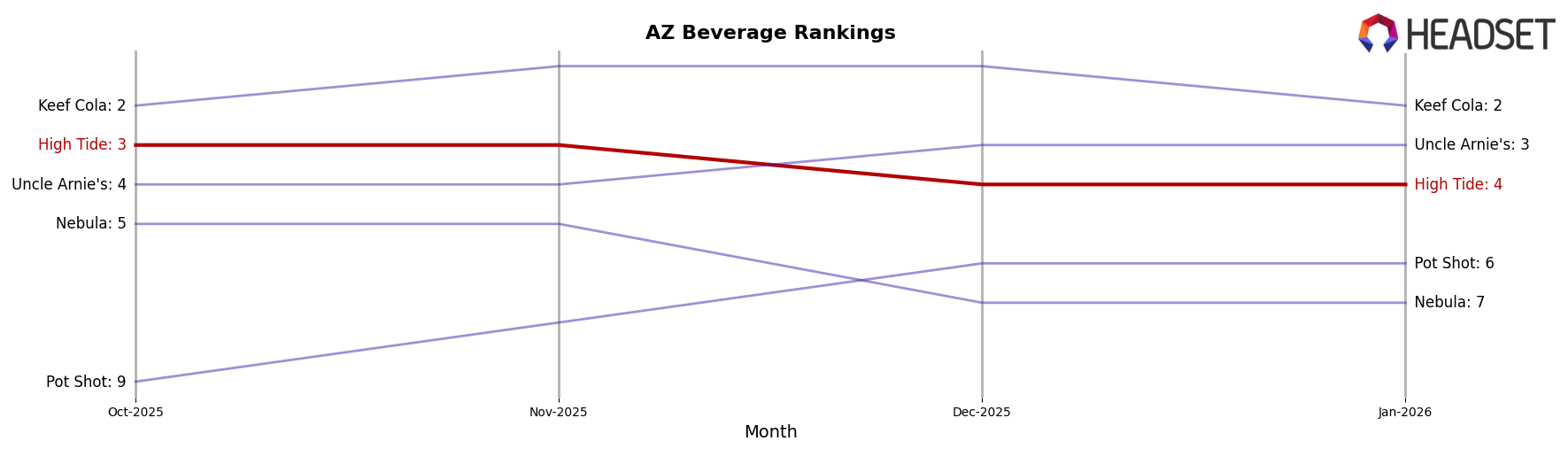

High Tide has shown a consistent presence in the beverage category within Arizona, maintaining a steady rank of 3rd place in both October and November 2025. However, they experienced a slight dip to 4th place in December 2025 and remained there in January 2026. Despite this minor decline in ranking, their sales figures suggest a notable increase in November 2025, followed by a decrease in the subsequent months. This trend indicates that while High Tide has a strong foothold in the Arizona beverage market, maintaining momentum will be crucial for sustaining their competitive position.

In contrast, High Tide's performance in the flower category in Washington is less prominent, as they did not make it into the top 30 brands after October 2025. Their initial rank of 95th in October suggests that there is significant room for improvement in this category and market. The absence of subsequent rankings highlights a potential challenge for High Tide to penetrate the Washington flower market more effectively. This disparity between their performance in different states and categories underscores the importance of strategic focus and adaptation to local market dynamics.

Competitive Landscape

In the competitive landscape of the Arizona cannabis beverage market, High Tide has maintained a steady presence, although it faces stiff competition from leading brands. Over the four-month period from October 2025 to January 2026, High Tide consistently ranked third or fourth, indicating a stable yet challenging position. Notably, Keef Cola dominated the market, holding the top rank in three out of four months, with sales significantly higher than High Tide's. Meanwhile, Uncle Arnie's showed a strong upward trend, surpassing High Tide in December and January, which suggests a potential threat to High Tide's market share. Additionally, Nebula and Pot Shot remained lower in rankings, with Pot Shot not even making the top 20 in November, highlighting the competitive pressure from both established and emerging brands. For High Tide, this competitive analysis underscores the importance of strategic marketing and product differentiation to enhance its rank and sales in this dynamic market.

Notable Products

In January 2026, High Tide's Black Cherry Seltzer (10mg) emerged as the top-performing product, maintaining its first-place rank from November 2025 after briefly dropping to second in December. Raspberry Lemon THC Seltzer (10mg THC) climbed to the second position, up from third place in the previous two months, with a notable sales figure of 3286 units. The CBD/CBC/THC 1:1:1 Black Cherry Seltzer (10mg CBD, 10mg CBC, 10mg THC) advanced to third place, consistently improving its rank from fifth in October. The CBD/CBC/THC 1:1:1 Raspberry Lemon Seltzer (10mg CBD, 10mg CBC, 10mg THC) also saw a rise, moving up to fourth place. Conversely, the Peach Mango Seltzer Beverage (10mg THC, 12oz) experienced a decline, dropping to fifth place after leading in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.