Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

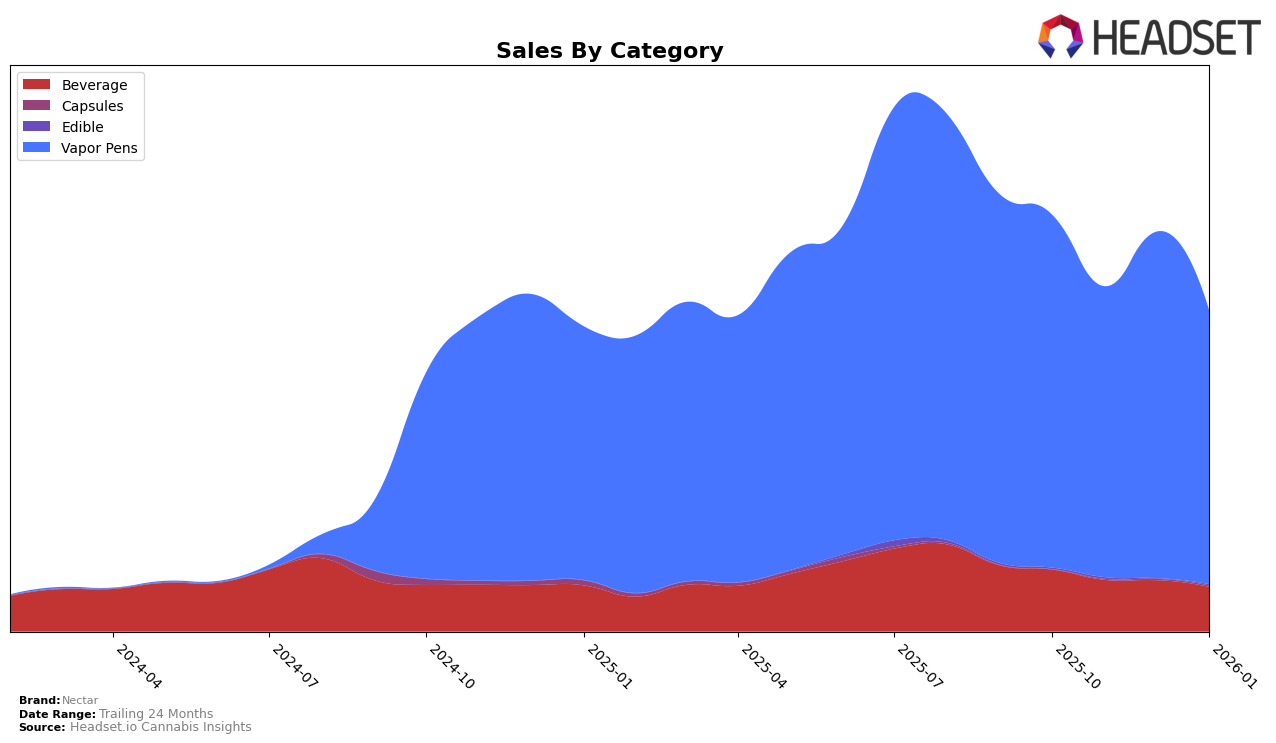

Nectar's performance in the Massachusetts market demonstrates a notable shift in the Beverage category, where the brand experienced a gradual decline from the 7th rank in October 2025 to the 12th rank by January 2026. This downward trend is accompanied by a decrease in sales, which could indicate increasing competition or changing consumer preferences within the state. In the Vapor Pens category, Nectar managed to maintain a position within the top 30, although it slipped out of the top 30 in November, only to regain it by December and January. This fluctuation suggests a volatile market presence that might require strategic adjustments to maintain or improve its standing.

In Ohio, Nectar's presence in the Vapor Pens category has been more challenging, as evidenced by its ranking slipping from 51st in October 2025 to 67th by January 2026. Notably, Nectar did not make it into the top 30 rankings in this category at any point, indicating a significant struggle to capture market share in the state. This drop in rankings is mirrored by a decline in sales, suggesting that Nectar may need to reassess its approach in Ohio to enhance its competitiveness. Such insights into state-specific performance can be crucial for understanding regional dynamics and tailoring marketing strategies accordingly.

Competitive Landscape

In the Massachusetts vapor pens market, Nectar has experienced fluctuating rankings from October 2025 to January 2026, indicating a volatile competitive landscape. Initially ranked 28th in October, Nectar dropped to 32nd in November, then climbed to 30th by December and maintained this position in January. This suggests a recovery in sales performance, aligning with a sales increase from November to December. Competitors like Treeworks and Papa's Herb have shown more stable rankings, with Treeworks consistently hovering around the 27th to 28th positions and Papa's Herb maintaining a presence just outside the top 20. Meanwhile, Regenerative has shown significant upward momentum, climbing from 66th in October to 32nd in January, potentially posing a future threat to Nectar's market share. These dynamics highlight the importance for Nectar to capitalize on its recent sales recovery and strategize against emerging competitors to improve its standing in this competitive category.

Notable Products

In January 2026, the top-performing product from Nectar was Nitetime - CBD/THC 1:1 Lemon Chamomile Seltzer, which ascended to the number one spot with sales reaching 1196 units. The Maui Wowie Distillate Disposable, a vapor pen, maintained a strong position, ranking second after previously holding the top spot in December 2025. DayTime - Orange Pineapple Seltzer consistently held the third rank over the past few months, though its sales slightly declined to 857 units. Strawberry Fields Seltzer dropped to fourth place from its previous third position in December 2025, while Watermelon Gelato Seltzer entered the rankings at fifth place. These rankings highlight a notable shift in consumer preference towards the Nitetime beverage in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.