Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

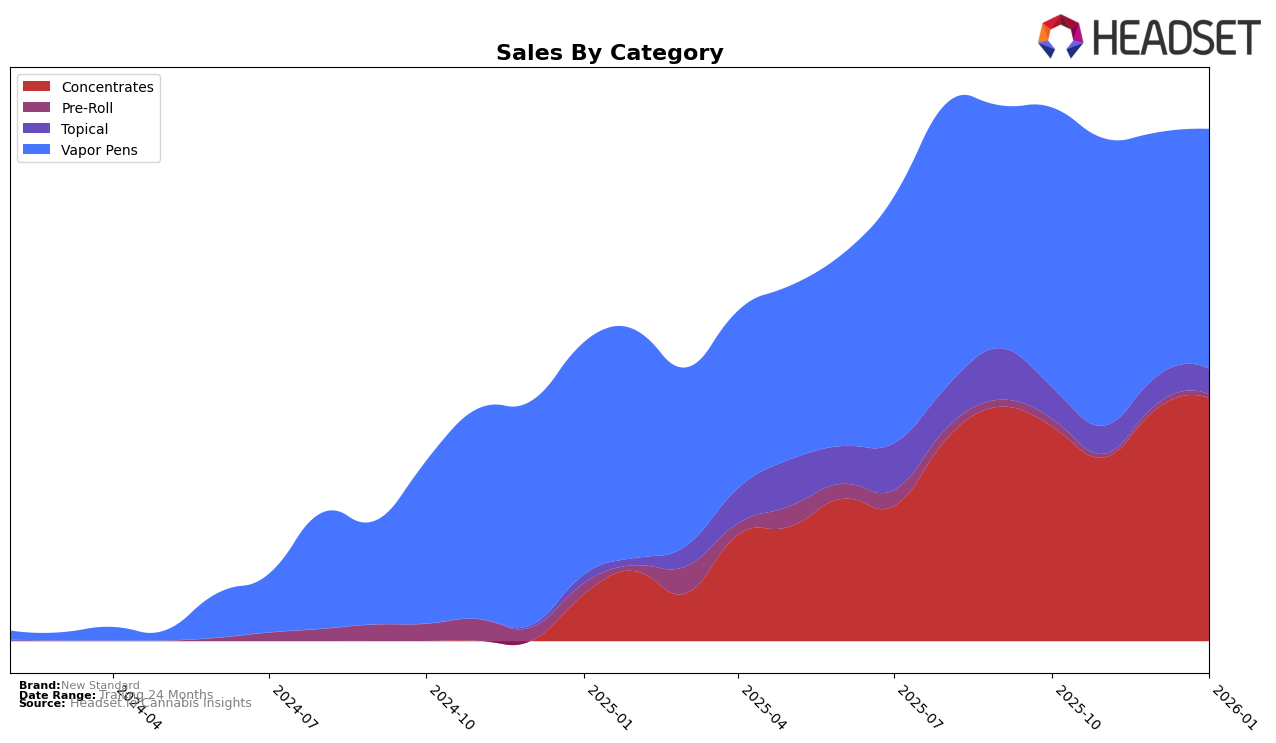

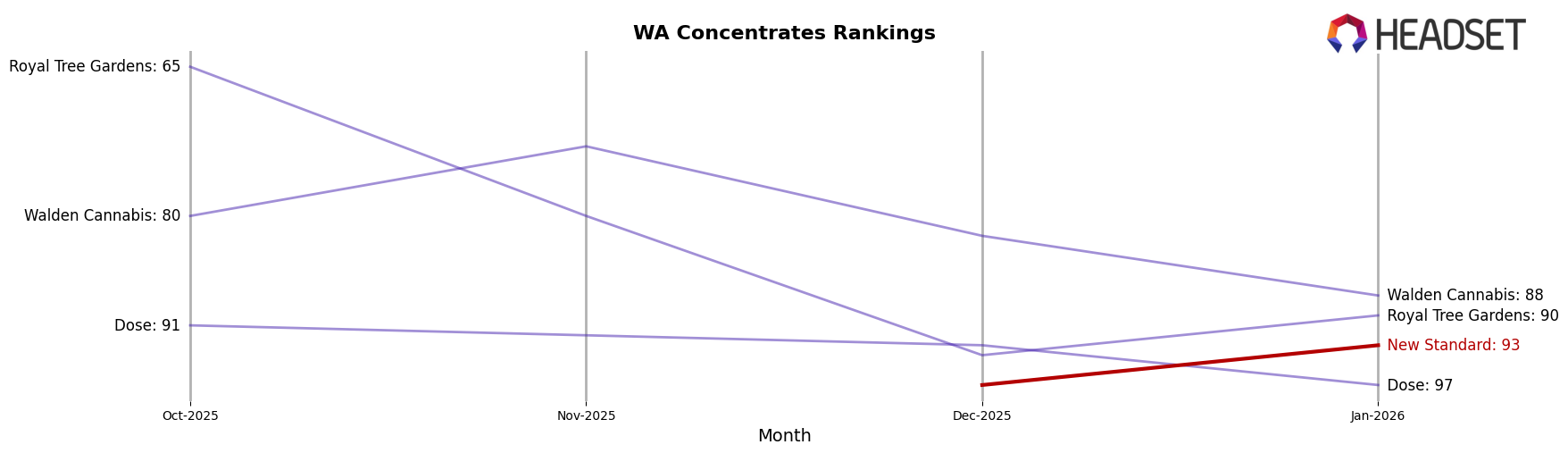

New Standard's performance in the Washington market has shown some notable trends in the Concentrates category over recent months. While the brand did not make it into the top 30 rankings for October, November, or December 2025, they managed to climb to the 93rd position by January 2026. This upward movement suggests a positive trajectory, although they still remain outside of the top tier in this category. The increase in sales from $16,193 in December 2025 to $16,951 in January 2026 highlights a steady growth, which could indicate an increasing consumer interest or effective marketing strategies that are starting to pay off.

Despite not securing a top 30 position, New Standard's gradual rise in rank within the Concentrates category in Washington reflects potential for further growth. The absence of a ranking in the earlier months could be seen as a challenge, but their recent progress shows resilience and an ability to capture market share. It will be interesting to see if this trend continues and whether New Standard can break into the top 30 in the coming months. Observing how they adapt their strategies to further penetrate the market will be crucial for their sustained success.

Competitive Landscape

In the Washington concentrates market, New Standard has shown a promising upward trajectory in recent months. Although it was not in the top 20 brands for October through December 2025, it made a notable entry at rank 97 in January 2026, climbing to rank 93 by February. This positive trend suggests a growing consumer interest and potential for increased market share. In comparison, Royal Tree Gardens experienced a decline, moving from rank 65 in October to 90 in January, while Walden Cannabis showed some fluctuation, ending at rank 88 in January. Dose and American Hash Makers also faced challenges, with Dose not ranking in November and American Hash Makers only appearing briefly in December. This competitive landscape indicates that New Standard is gaining momentum, potentially capitalizing on the struggles of its competitors to enhance its market position.

Notable Products

In January 2026, Face Off OG Live Resin (1g) maintained its position as the top-performing product for New Standard, with sales reaching 234 units. Blue Dream Live Resin (1g) climbed two spots from December, securing the second position. Orange Diesel Rosin (1g) debuted in the rankings at third place, while Walter White Rosin (1g) fell from second to fourth. GMO Rosin (1g) entered the top five for the first time, taking the fifth spot. This reshuffling highlights a dynamic shift in consumer preferences, with new entries and changes in rankings from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.