Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

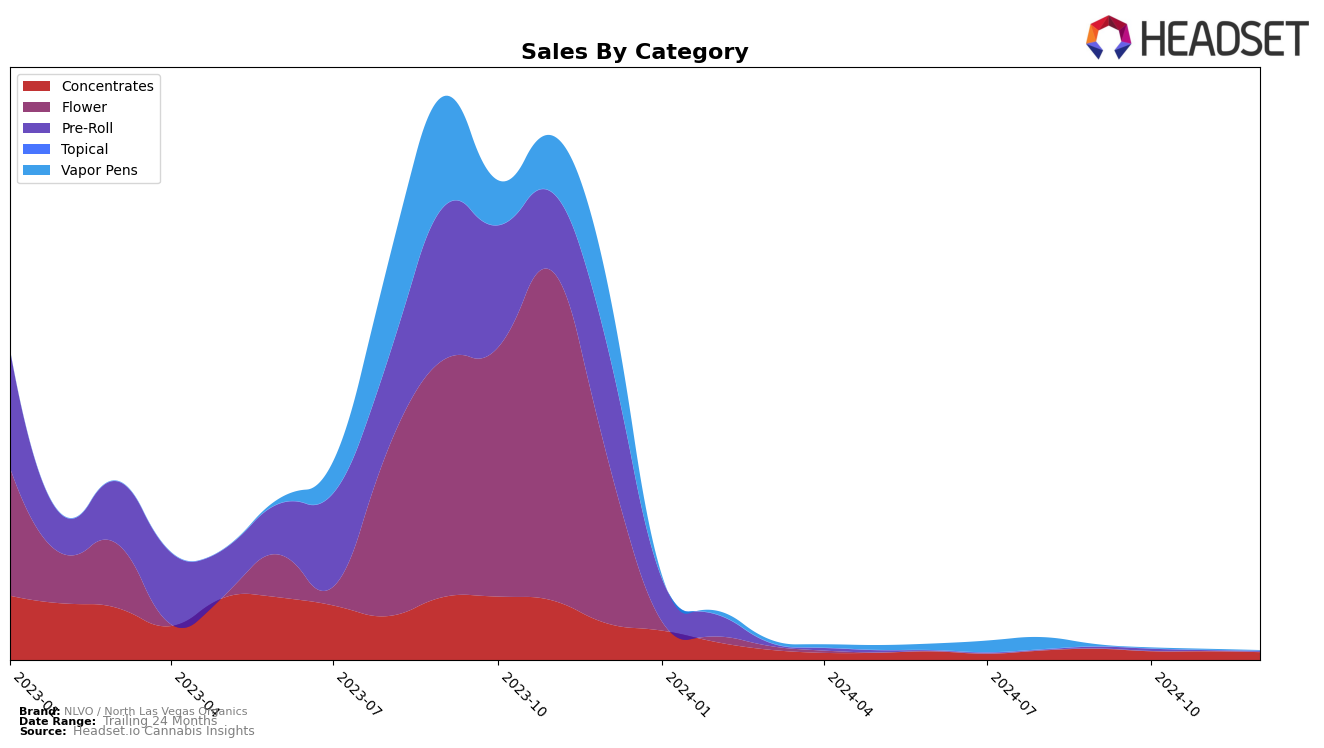

NLVO / North Las Vegas Organics has experienced fluctuating performance in the Concentrates category in Nevada over the last few months of 2024. Starting with a rank of 22 in September, the brand saw a dip to 29 in October, before bouncing back slightly to 24 in November, and then slipping again to 27 in December. This movement suggests a competitive landscape where NLVO is maintaining a presence but facing challenges to climb higher in the rankings. The decline in sales from September to December also indicates that while they remain within the top 30, sustaining or improving their position may require strategic adjustments.

Interestingly, the data does not show NLVO / North Las Vegas Organics breaking into the top 30 in any other states or categories, highlighting a focused but potentially limited market reach. The absence of rankings outside Nevada could be viewed as a missed opportunity for expansion or a strategic choice to concentrate resources within a single market. The brand's ability to maintain its ranking in Nevada, despite sales fluctuations, points to a resilient market presence, but the lack of broader recognition might suggest room for growth and diversification in other states or product lines.

Competitive Landscape

In the competitive landscape of the Nevada concentrates market, NLVO / North Las Vegas Organics has experienced fluctuating rankings from September to December 2024, indicating a dynamic competitive environment. Despite a drop from 22nd in September to 29th in October, NLVO regained some ground by December, ranking 27th. This movement suggests a resilience in maintaining market presence amidst strong competitors. For instance, Roots consistently performed well, peaking at 19th in October before settling at 25th in December, while Virtue Las Vegas made a notable climb from 32nd in October to 19th in November, although they did not maintain a top 20 position in December. Meanwhile, Gunslinger showed a strong finish in December at 26th, just ahead of NLVO. These shifts highlight the competitive pressures NLVO faces, emphasizing the need for strategic positioning to enhance sales and ranking stability in the concentrates category.

Notable Products

In December 2024, Chemical Cookies Live Rosin (1g) maintained its top position in the Concentrates category for NLVO / North Las Vegas Organics, achieving sales of 431 units. Froyo Live Resin Badder (1g) held steady at the second rank in the same category, demonstrating consistent demand across the last two months. Sin City Runtz Infused Pre-Roll (1g) climbed to the third position in Pre-Rolls, showing a notable increase from its fifth position in November. White Miso Pre-Roll (1g) entered the rankings at fourth place, indicating a strong debut in the Pre-Roll category. Garlic & Bananas Live Badder (1g) also made its first appearance in the rankings, securing the fifth spot in Concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.