Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

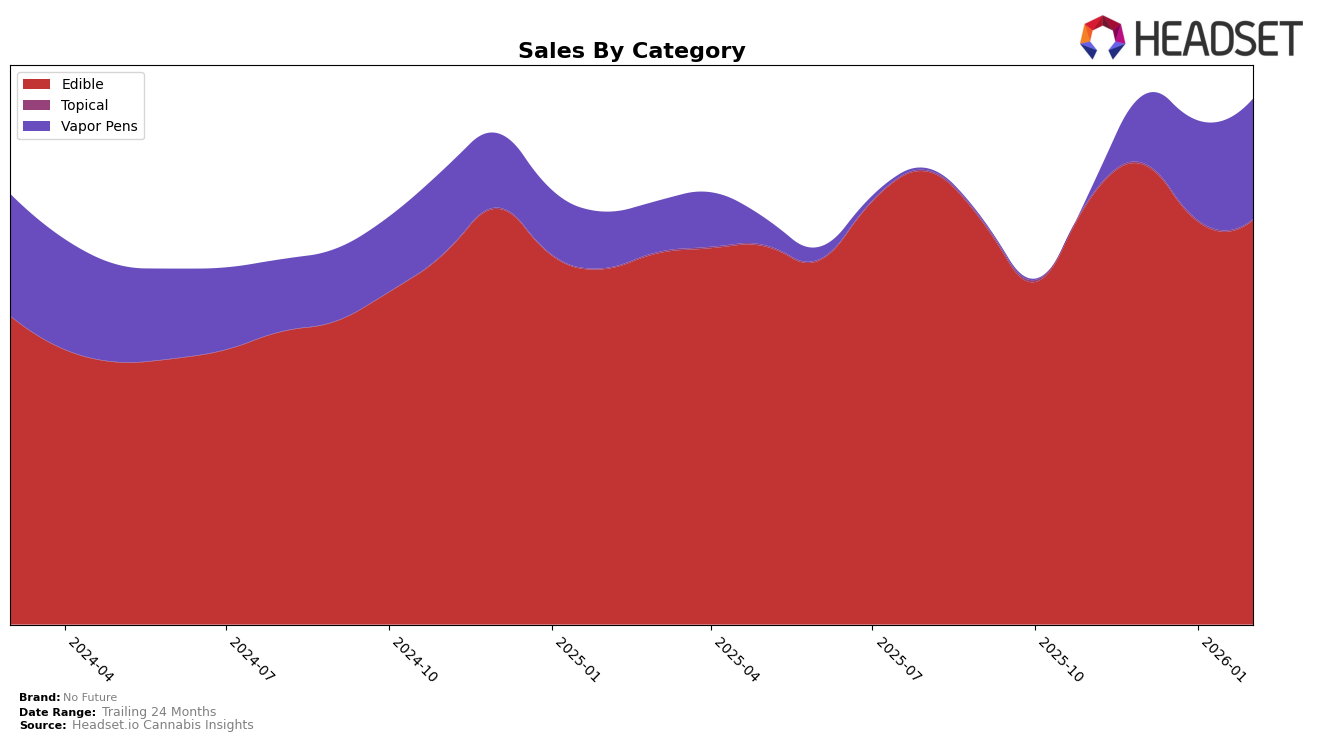

No Future has demonstrated a consistent performance in the Edibles category across several Canadian provinces. In Alberta, the brand maintained a steady rank of 6th place from November 2025 through January 2026, before climbing to 5th place in February 2026. This upward movement indicates a strengthening position in the market. Meanwhile, in British Columbia, No Future has shown resilience by maintaining a top 4 position, including a return to 3rd place in February 2026, suggesting a strong consumer base. In Ontario, while the brand held onto the 7th spot from December 2025 to February 2026, the sales figures experienced a noticeable decline, which could be a point of concern for maintaining market share.

In the Vapor Pens category, No Future's presence has been less consistent. In Alberta, the brand did not make it into the top 30 until January 2026, when it entered at 57th place and improved to 35th by February 2026, indicating potential growth in this segment. In British Columbia, the brand has shown a positive trajectory, moving from 28th in December 2025 to 19th by February 2026. However, in Ontario, No Future's ranking remained static at 49th for two consecutive months before improving slightly to 41st in February 2026. The absence from the top 30 in some months highlights areas where the brand could focus on bolstering its market presence.

Competitive Landscape

In the competitive landscape of the edible cannabis category in British Columbia, No Future has experienced notable fluctuations in its market position over recent months. From November 2025 to February 2026, No Future's rank oscillated between third and fourth place, indicating a dynamic competitive environment. The brand's sales trajectory shows a promising upward trend, especially in February 2026, where it regained the third position, suggesting a successful strategic adjustment or product offering that resonated with consumers. In contrast, Gron / Grön and Spinach consistently dominated the top two spots, with Spinach briefly overtaking Gron / Grön in January 2026. Meanwhile, 1964 Supply Co and Shred maintained stable positions, with Shred showing a slight decline in sales. This competitive analysis highlights the importance for No Future to continue innovating and adapting to maintain and improve its standing in this vibrant market.

Notable Products

In February 2026, No Future's top-performing product was The Blue One Sativa Bonbon Gummy (10mg), maintaining its first-place rank for four consecutive months with sales of 30,437 units. The Purple One Sativa Bonbon Gummy (10mg) also held its second-place position consistently over the same period. The Orange One Indica Gummy (10mg) rose to third place in January 2026 and retained this ranking in February, showing a steady performance. The Red One Indica Gummy (10mg) remained at fourth place, both in January and February, while the new entry 10x the Madness - The Sour Blue One Sativa Gummies 10-Pack (100mg) debuted in February at fifth place. Notably, all products showed a decline in sales figures compared to previous months, indicating a potential seasonal dip or market trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.