Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

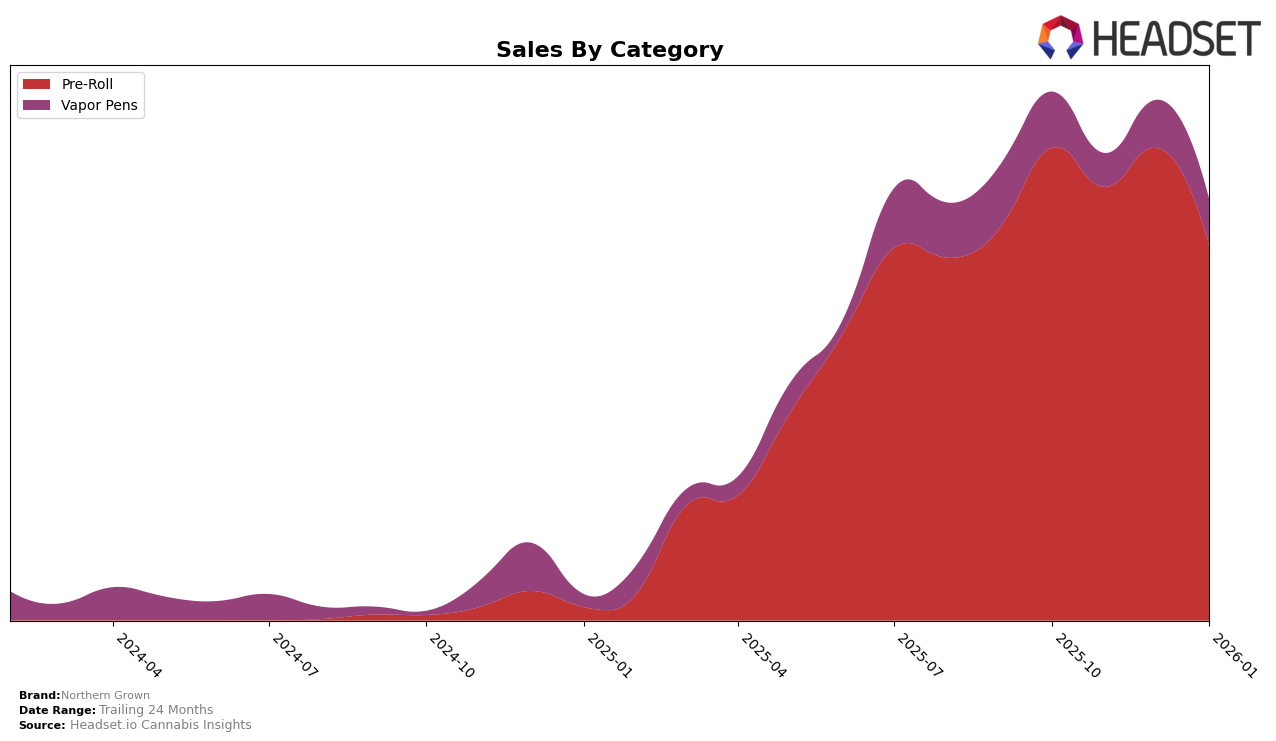

In the Massachusetts market, Northern Grown has shown consistent performance in the Pre-Roll category, maintaining a rank within the top 10 over the past four months. Specifically, they ranked 6th in both October and December 2025, with a slight dip to 8th in November 2025 and January 2026. This indicates a strong foothold in the Pre-Roll category, although the sales figures saw a decline from October to January, which could be an area to watch for potential challenges. In contrast, their presence in the Vapor Pens category is less dominant, as they did not break into the top 30, with rankings hovering around the 60s and 70s. This suggests that while they have a presence in this category, it may not be their primary focus or strength in the Massachusetts market.

The performance gap between the Pre-Roll and Vapor Pens categories in Massachusetts highlights strategic opportunities for Northern Grown. Their strong ranking in Pre-Rolls suggests a solid brand reputation and consumer preference in this segment, which could be leveraged to improve their standing in other categories. The absence from the top 30 in Vapor Pens, however, indicates a potential area for growth or a need for strategic reevaluation. Understanding consumer preferences and market trends in Massachusetts could provide valuable insights for Northern Grown to bolster their performance across different product categories. This analysis reveals a nuanced picture of Northern Grown's market dynamics, offering a glimpse into their strategic positioning and areas for potential development.

Competitive Landscape

In the Massachusetts Pre-Roll category, Northern Grown has experienced fluctuations in its market position, notably ranking 6th in October and December 2025, but slipping to 8th by January 2026. This shift is significant when compared to competitors like Simpler Daze, which improved its rank from 14th in October to 6th in January, indicating a strong upward trend. Similarly, Tower Three also showed a positive trajectory, moving from 20th to 9th over the same period. Meanwhile, Perpetual Harvest maintained a steady 7th place, suggesting consistent performance. The dynamic shifts in rankings highlight the competitive pressures Northern Grown faces, especially as rivals like Good Chemistry Nurseries made a notable leap from 19th to 10th. These changes underscore the need for Northern Grown to strategize effectively to regain and sustain higher market positions amidst a competitive landscape.

Notable Products

In January 2026, Northern Grown's top-performing product was the Fog Cutter - Cape Cod Cranberry Infused Pre-Roll 2-Pack in the Pre-Roll category, maintaining its number one rank with sales of 4954 units. Cujo's Revenge Infused Pre-Roll 2-Pack rose to the second position, showing a consistent improvement from its third-place ranking in December 2025. The Fog Cutter - Purple Grape Wreck Infused Pre-Roll 2-Pack dropped slightly to third place, despite a steady sales figure of 4286 units. The Fog Cutter - Snozzberry Infused Pre-Roll 2-Pack entered the rankings for the first time, securing the fourth position. The Mystic River Mango variant also made a notable entry into the top five, demonstrating increased popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.