Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

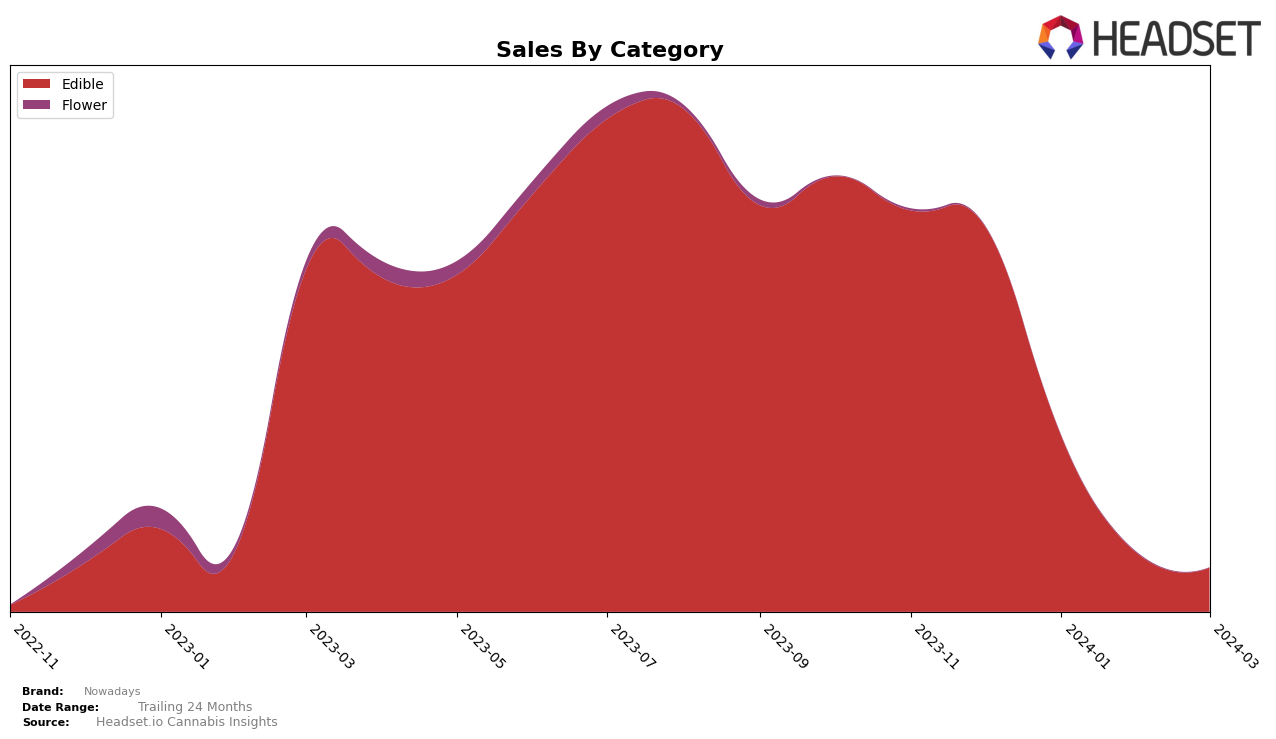

In Alberta, the Nowadays brand has shown a consistent presence in the edible category, albeit with a declining trend in both rank and sales from December 2023 through March 2024. Starting at a rank of 14 in December with sales of $64,323, the brand slipped to the 28th position by March, with sales dropping to just $7,778. This downward trajectory suggests a significant decrease in market share and consumer preference within the province's edible category. In contrast, British Columbia saw Nowadays barely making it into the top 30 in December 2023, with a rank of 29 and sales of $1,600, but failed to maintain its position in the following months, indicating a struggle to capture or maintain market interest in this highly competitive category.

Meanwhile, in Ontario, the brand faced a challenging market environment, with a notable decline from the 26th position in December 2023 to not ranking within the top 30 by March 2024. The sales figures mirror this descent, plummeting from $29,518 in December to a mere $3,053 by March. This indicates a significant loss in traction within Ontario's edible market, potentially attributed to stiff competition or shifting consumer preferences. The absence from the top 30 rankings in the subsequent months after December in both Ontario and British Columbia highlights potential areas for strategic reevaluation for Nowadays, as it suggests a diminishing footprint in these key markets.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Alberta, Nowadays has experienced a notable fluctuation in its ranking over the recent months. Starting from a strong position at 14th in December 2023, it saw a slight decline to 17th in January 2024, followed by a more significant drop to 26th in February and then slightly improving to 28th in March 2024. This trajectory suggests challenges in maintaining its market position amidst fierce competition. Noteworthy competitors include Legend Cannabis, which also saw a decline from 16th to out of the top 20 by March, indicating a shared volatility in the market. On the other hand, Palm Gardens and Wildflower Canada showed improvement or stability in their rankings, hinting at a potential shift in consumer preferences or successful marketing strategies. The entry of Censored Edibles directly into the rankings in March suggests that new entrants can still disrupt the market dynamics. The changes in rank and sales for Nowadays, compared to its competitors, highlight the importance of agility and innovation in staying competitive in the rapidly evolving cannabis edibles market in Alberta.

Notable Products

In March 2024, Nowadays saw its top-performing product remain as the CBD Tropical Mix Gummies 30-Pack (600mg CBD) within the Edible category, maintaining its first-place ranking from previous months with sales figures reaching 339 units. Following closely, the CBD Berry Mix Gummies 30-Pack (600mg CBD), also in the Edible category, secured the second spot consistently across the board. Notably, the CBD Stash Milled (3.5g) from the Flower category, which held the third rank steadily through December 2023 to February 2024, dropped off the rankings in March. This shift indicates a change in consumer preferences or inventory adjustments. The sales figures and rankings reveal a stable demand for Nowadays' Edible products, despite a slight decrease in units sold over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.