Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

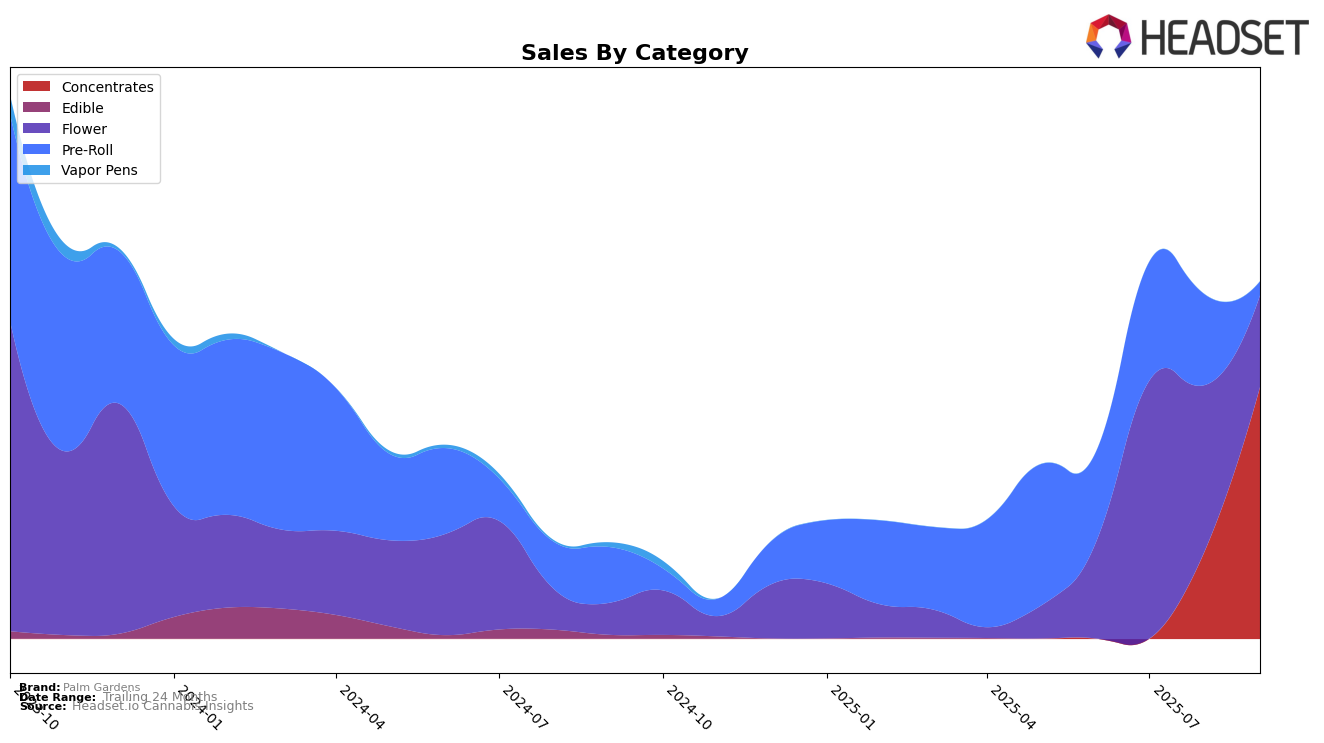

In the province of Alberta, Palm Gardens has seen notable movement in the Concentrates category. After not being ranked in June and July, they made a significant jump to position 40 in August and further improved to rank 25 by September. This upward trend suggests a growing acceptance and possibly an expanding consumer base for their concentrates in Alberta. It's noteworthy that despite being absent from the top 30 in the initial months, Palm Gardens managed to break into competitive rankings by the end of the quarter, indicating a potential shift in market dynamics or successful strategic adjustments.

Conversely, in the Flower category within Alberta, Palm Gardens' performance has been less consistent. The brand entered the rankings at position 84 in July but fell to 100 by August, failing to make it into the top 30 in subsequent months. This decline highlights challenges they may be facing in maintaining a foothold in the Flower market. The absence from top rankings could point to increased competition or a need for product differentiation. Monitoring these trends could provide insights into how Palm Gardens might adjust their strategies to regain or enhance their position in this category.

Competitive Landscape

In the Alberta concentrates market, Palm Gardens has shown a notable upward trajectory in recent months, climbing from outside the top 20 in June and July 2025 to rank 40th in August and further improving to 25th by September. This rise is indicative of a significant increase in sales, as Palm Gardens' sales figures surged from 11,937 in August to 34,288 in September. This growth positions Palm Gardens closer to competitors like Tremblant Cannabis, which ranked 24th in September with slightly higher sales, and Partake, which also saw a rise in rank from 37th in August to 23rd in September. Meanwhile, Phant and Smoke Show experienced fluctuations in their rankings, with Phant dropping from 22nd in July to 27th in September, and Smoke Show peaking at 25th in August before falling to 28th in September. These dynamics suggest a competitive landscape where Palm Gardens is gaining momentum, potentially challenging its rivals in the near future.

Notable Products

In September 2025, Slurricane Pure Cold Cured Live Rosin (1g) emerged as the top-performing product for Palm Gardens, climbing to the number one spot in the Concentrates category with impressive sales of 939 units. Notably, Watermelon Sugar (15g) maintained a strong presence in the Flower category, securing the second position, consistent with its previous ranking in July. The Watermelon Sugar Pre-Roll 10-Pack (5g) experienced a decline, dropping to third place from its consistent first-place ranking in prior months. Meanwhile, the Watermelon Sugar Pre-Roll 3-Pack (1.5g) held steady in third place within the Pre-Roll category. Lastly, Watermelon Sugar (3.5g) remained in fourth place, showing stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.