Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

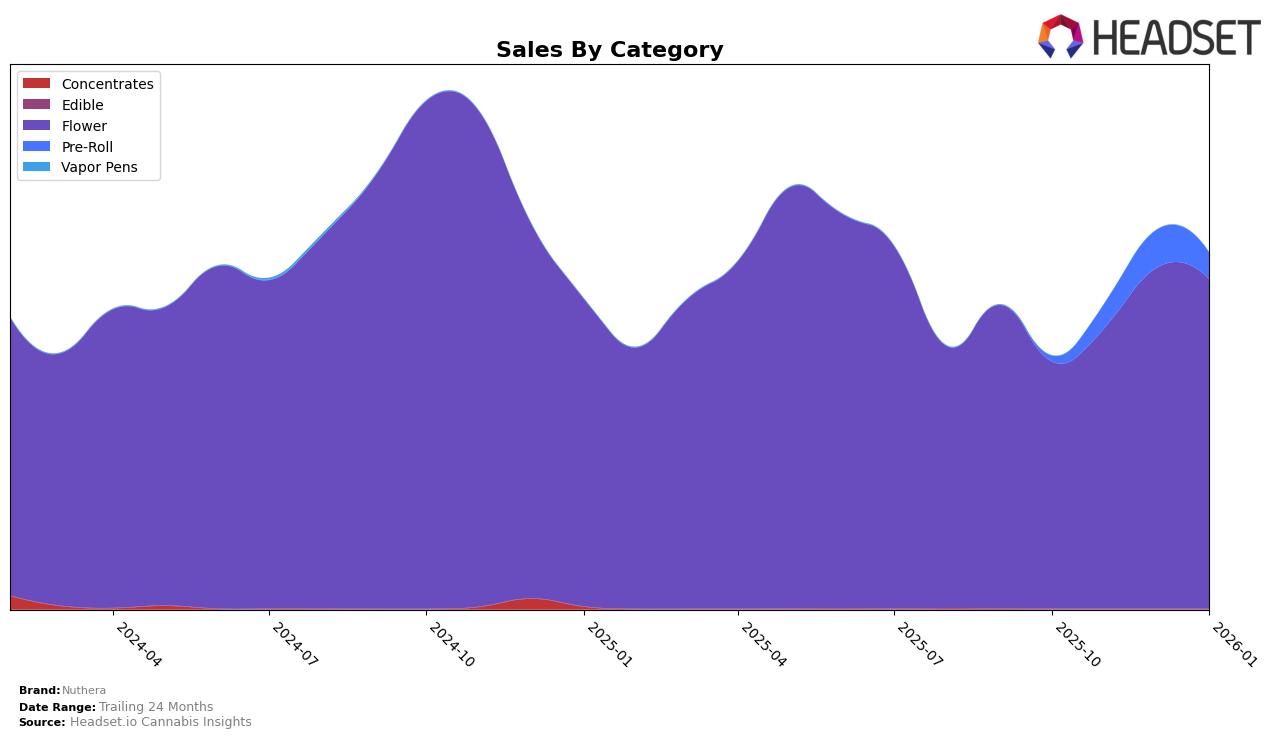

Nuthera has demonstrated a notable upward trajectory in the Missouri market, particularly within the Flower category. Over the span from October 2025 to January 2026, Nuthera improved its ranking from 23rd to 17th, reflecting a consistent increase in sales, peaking in December 2025. This positive movement suggests an effective market strategy and growing consumer demand. However, it's important to note that Nuthera did not make it into the top 30 brands in the Pre-Roll category in October 2025, which could indicate either a strategic focus on other categories or a competitive challenge in this segment.

The Pre-Roll category in Missouri presented a different scenario for Nuthera, as the brand was absent from the top 30 rankings in October 2025, subsequently entering at 44th in November and fluctuating slightly thereafter. This performance suggests a more volatile presence in this category, with sales peaking in November 2025. The fluctuation in rankings and sales indicates that while Nuthera is making strides, there remains room for growth and stability in this segment. The contrasting performances across categories highlight the brand’s varied market penetration and suggest potential areas for strategic improvement or investment.

Competitive Landscape

In the competitive landscape of the Missouri Flower category, Nuthera has shown a promising upward trajectory in terms of rank and sales from October 2025 to January 2026. Initially ranked 23rd in October 2025, Nuthera climbed to 17th by January 2026, reflecting a consistent improvement in market position. This is particularly notable when compared to brands like TwentyTwenty and Rooted, which experienced fluctuations in their rankings, with Rooted dropping from 13th to 16th over the same period. Nuthera's sales growth trajectory, from $626,736 in October 2025 to $835,222 in January 2026, suggests a robust increase, outpacing Greenlight, which maintained a relatively stable rank at the bottom of the top 20. Meanwhile, Galactic saw a more volatile performance, indicating potential instability. Nuthera's consistent rise in rank and sales positions it as a formidable competitor in the Missouri Flower market, signaling a positive trend that could attract more consumer interest and market share.

Notable Products

In January 2026, Nuthera's top-performing product was the GMO Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with sales reaching 2400 units. The Smackin Pre-Roll 2-Pack (1g) debuted strongly in second place, while Buttermilk Biscuit (3.5g) moved up to the third position from fifth in December. Old Family Purple (3.5g) entered the rankings at fourth place, and Sour GMO Cookies Pre-Roll 2-Pack (1g) dropped from third to fifth. This shift in rankings highlights the dynamic nature of consumer preferences within Nuthera's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.