Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

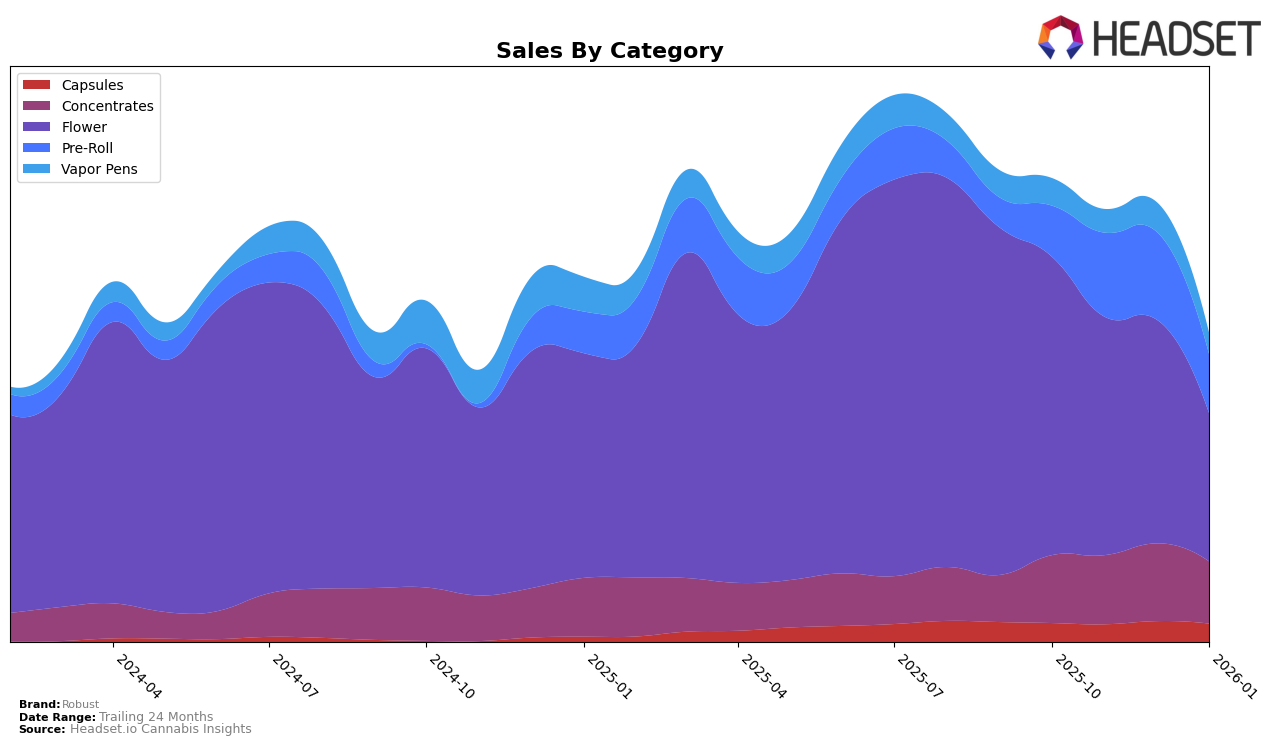

In the state of Missouri, Robust has shown a consistent performance in the Capsules category, maintaining a steady rank of 2nd place from October 2025 through January 2026. This stability suggests a strong foothold in this category, despite a noticeable fluctuation in sales figures during this period. Conversely, in the Flower category, the brand has experienced a decline, dropping from a rank of 17th in October 2025 to falling out of the top 30 by January 2026. This downward trend could indicate increased competition or shifting consumer preferences within the state.

Robust's performance in the Concentrates category within Missouri tells a different story, with the brand climbing to 9th place in December 2025 before slipping back to 14th in January 2026. This upward movement followed by a slight decline suggests a volatile market or potential challenges in sustaining market gains. In the Pre-Roll category, Robust improved its position from 27th to 20th by December 2025, although it slightly regressed to 25th in January 2026. Notably, the brand did not make it into the top 30 for Vapor Pens, indicating either a lack of focus or competitive pressure in this segment.

Competitive Landscape

In the Missouri flower category, Robust has experienced a notable decline in rank and sales over the past few months. Starting at rank 17 in October 2025, Robust fell out of the top 20 by December and further dropped to rank 31 by January 2026. This downward trend is mirrored in its sales, which decreased significantly from October to January. In contrast, CAMP Cannabis showed a positive trajectory, improving its rank from 34 to 30 and increasing sales over the same period, even surpassing Robust in January. Meanwhile, Scout & Seed made a remarkable leap from rank 52 in October to 29 in January, with sales showing a strong upward trend, indicating a growing market presence. These shifts highlight the competitive pressures Robust faces, emphasizing the need for strategic adjustments to regain its market position.

Notable Products

In January 2026, Apples & Bananas #7 (1g) from Robust secured the top spot in the Flower category, maintaining its position from November 2025, with sales reaching 1734 units. Scented Marker #1 (3.5g) climbed to second place, improving from its previous rank of third in November. The Robust FECO Syringe (1g) in the Concentrates category moved up to third place from fourth in December, highlighting a consistent upward trend. Scented Marker Pre-Roll 2-Pack (1g) entered the rankings at fourth place, showing strong sales momentum in the Pre-Roll category. Apples and Bananas #7 (3.5g) debuted at fifth place, indicating a promising start in the Flower category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.