Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

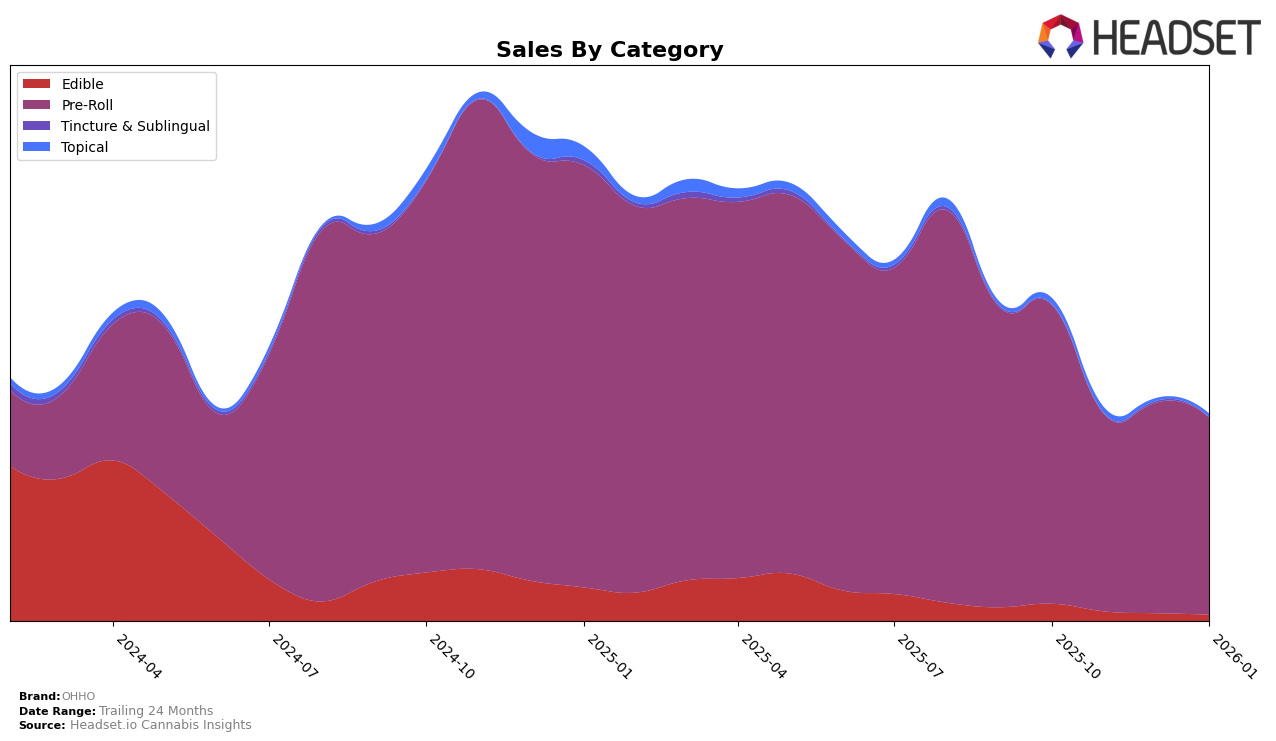

OHHO's performance in the Pre-Roll category in New York has shown some fluctuations over the recent months. Despite not breaking into the top 30 rankings, OHHO's sales have experienced a notable dip from October to November 2025, followed by a slight recovery in December. This suggests that while the brand may not be leading the market, it is maintaining a presence and potentially stabilizing after a period of decline. The sales figures indicate a trend that could be worth watching, especially if the brand continues to adjust its strategies in this competitive market.

While OHHO's ranking in the Pre-Roll category remains outside the top 30, the brand's ability to maintain consistent sales figures suggests a loyal customer base that could be leveraged for future growth. The absence from the top rankings highlights the challenges OHHO faces in gaining a stronger foothold in New York, but it also underscores an opportunity for targeted marketing and product innovation. Observing how OHHO navigates these challenges could provide insights into their long-term strategy and potential shifts in the market landscape.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, OHHO has shown fluctuating performance in recent months. While OHHO's rank remained relatively stable from December 2025 to January 2026, moving slightly from 84th to 82nd, its sales figures indicate a modest recovery from a dip in November 2025. In contrast, Lowell Herb Co / Lowell Smokes experienced a significant drop in rank from 34th in December 2025 to 84th in January 2026, with a corresponding decline in sales, suggesting potential market volatility. Meanwhile, Generic AF showed a steady climb, improving its rank from 82nd in December 2025 to 79th in January 2026, indicating a positive sales trajectory. ghost. also made notable gains, moving from 91st to 80th over the same period, which could signal increasing consumer interest. These dynamics highlight the competitive pressures OHHO faces, emphasizing the need for strategic marketing efforts to enhance its market position and capitalize on the recovering sales trend.

Notable Products

In January 2026, Super Lemon Haze Pre-Roll 0.5g maintained its position as the top-performing product for OHHO, despite a decrease in sales to 915 units. Jack Herer Pre-Roll 0.5g held steady at second place, showing consistency in its ranking from December 2025. OG Kush Pre-Roll 0.5g slipped to third place, having alternated between second and fourth in previous months. Durban Poison Pre-Roll 0.5g remained in fourth place, showing stability but with declining sales figures. A new entry, Super Lemon Haze Pre-Roll 7-Pack 3.5g, debuted in fifth place, indicating potential growth in multi-pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.