Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

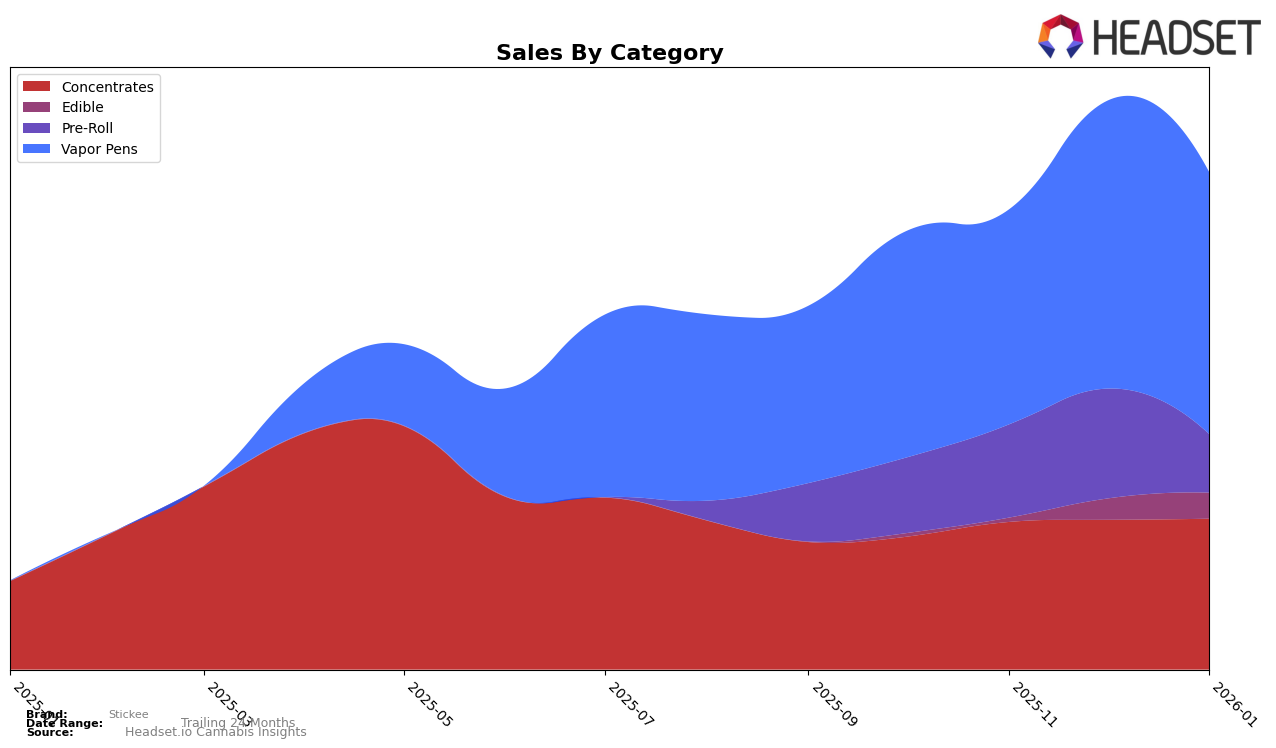

In the state of Michigan, Stickee has demonstrated a consistent presence in multiple cannabis categories, showcasing a particularly strong performance in Concentrates and Vapor Pens. In the Concentrates category, Stickee has seen its rank fluctuate slightly but managed to maintain a position within the top 15, ending January 2026 at rank 10. This suggests a stable demand for their products in this category. The Vapor Pens category also highlights Stickee's competitive edge, where they improved their position from rank 26 in October 2025 to a steady rank 22 in both December and January. Such consistency indicates a solid foothold in the market, likely driven by consumer preference for their vapor pen offerings.

Conversely, Stickee's performance in other categories such as Edibles and Pre-Rolls tells a different story. In the Edibles category, Stickee was not ranked in the top 30 until December 2025, where they emerged at rank 79, improving slightly to rank 69 by January 2026. This late entry into the rankings suggests that while they are gaining traction, they are still in the early stages of establishing a significant market presence in this category. The Pre-Roll category shows more volatility, with Stickee's rank improving from 79 to 54 by December 2025, only to drop back to 78 by January 2026. This fluctuation could indicate challenges in maintaining consistent consumer interest or competition from other brands. Overall, while Stickee has shown strength in certain categories, there are areas where they need to bolster their market strategy to achieve greater penetration.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Stickee has shown a notable improvement in its market position over the past few months. Starting from a rank of 26 in October 2025, Stickee climbed to 22 by December 2025, maintaining this position into January 2026. This upward trend is indicative of a positive reception and growing consumer preference for Stickee's products. In contrast, Redemption and Hyman have experienced fluctuations, with Redemption improving slightly from 30 to 23, while Hyman remained relatively stable around the 21st position. Meanwhile, Dragonfly Cannabis consistently held the 20th rank, suggesting a steady market presence. Although Stickee's sales figures are not disclosed, the brand's improved ranking suggests a competitive edge and potential increase in sales, positioning it favorably against competitors like Humblebee, which also saw a rise but did not surpass Stickee's rank by January 2026.

Notable Products

In January 2026, the top-performing product for Stickee was the Peach Ringz Infused Pre-Roll (1.2g), securing the number one rank with a notable sales figure of 5830 units. Following closely was the Blue Dream Liquid Diamonds Live Resin Cartridge (1g) in the second position, showing a significant rise from its fourth-place position in October 2025. The Sour Apple Diesel Live Resin Liquid Diamonds Cartridge (1g) took the third spot, while the Grape Gas Live Resin Liquid Diamonds Cartridge (1g) and Peach Ringz Live Resin Liquid Diamonds Cartridge (1g) rounded out the top five. Notably, these products in the Vapor Pens category have consistently improved their rankings, indicating a growing consumer preference. Overall, Stickee's focus on live resin liquid diamonds appears to be a successful strategy in the current market.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.