Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

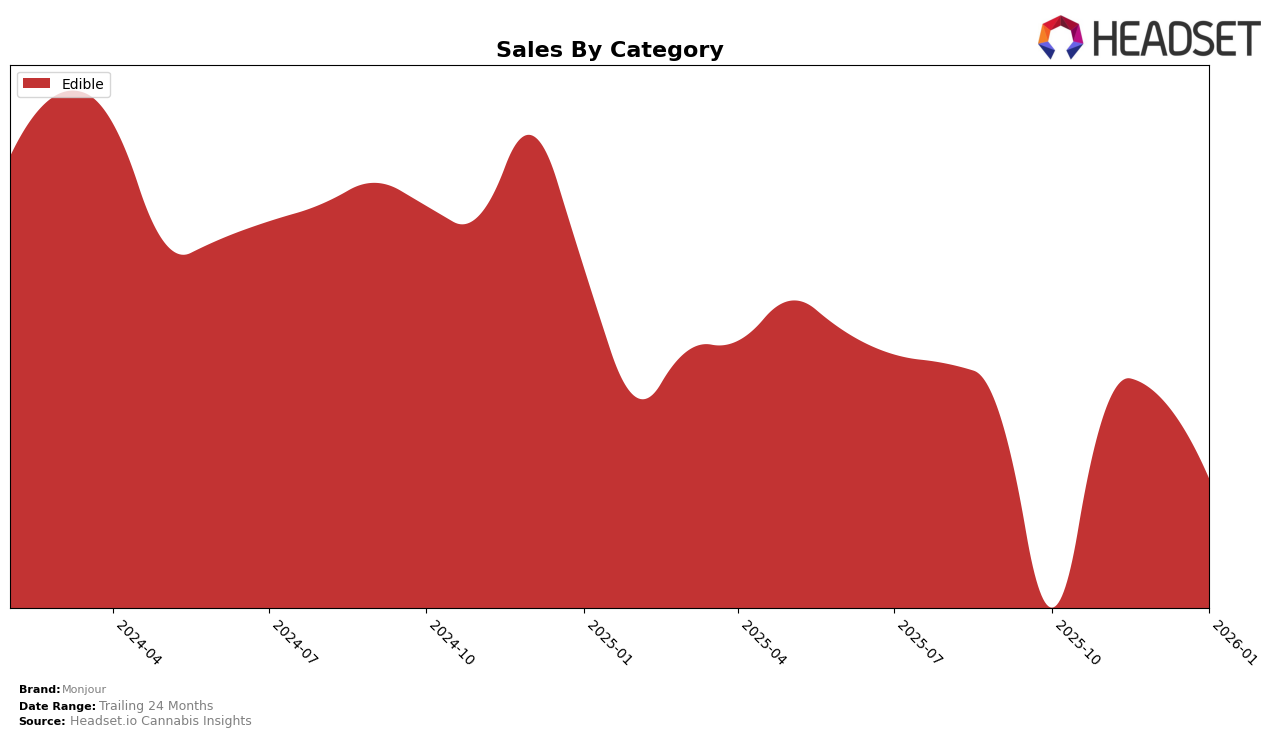

Monjour has shown a consistent presence in the Edible category across several Canadian provinces, with notable performances in Alberta and British Columbia. In Alberta, Monjour maintained its position within the top ten, moving from 9th to 8th place between October 2025 and January 2026, with a slight dip in sales in January after a peak in December. British Columbia saw Monjour holding steady at the 7th rank from November 2025 onwards, following a significant sales increase in November. These movements suggest a stable demand for Monjour's edibles in these regions, although the fluctuations in sales hint at potential market dynamics worth exploring further.

In Ontario, Monjour remained consistently ranked at 8th place from November 2025 to January 2026, despite a notable sales peak in December. This consistency in ranking indicates a strong foothold in the Ontario market. Meanwhile, in Saskatchewan, Monjour entered the top 10 in November 2025 and improved its position to 9th by January 2026. The initial absence from the top 30 in October 2025 suggests a significant upward trajectory, highlighting a growing acceptance and popularity of Monjour's products in this province. These insights offer a glimpse into Monjour's market dynamics, revealing both regional strengths and opportunities for growth.

Competitive Landscape

In the Ontario edible cannabis market, Monjour has maintained a stable position, ranking consistently at 8th place from November 2025 to January 2026, after a slight drop from 7th in October 2025. Despite this steady rank, Monjour faces stiff competition from brands like Olli, which has consistently ranked higher, maintaining a position between 5th and 6th, and No Future, which saw a decline from 4th to 7th but still remains ahead of Monjour. Meanwhile, Woody Nelson and HighXotic are climbing the ranks, with Woody Nelson improving from 12th to 9th and HighXotic making a notable jump from 13th to 10th by January 2026. These shifts indicate a dynamic market where Monjour must strategize to enhance its appeal and sales to climb the ranks, especially as competitors show potential for upward mobility.

Notable Products

In January 2026, the top-performing product from Monjour was CBN:CBD:THC 8:3:1 Bedtime Blueberry Lemon Gummies 4-Pack, maintaining its number one rank for four consecutive months with sales of 36,982. CBD Berry Good Day Gummy 30-Pack continued to hold the second position, following a consistent trend from November 2025. The CBD/CBN/CBG 20:5:5 Twilight Tranquility Sugar-Free Gummies 25-Pack remained in third place, showing stable performance over the past months. CBD Orchard Medley Gummies 30-Pack also kept its fourth position, demonstrating steady sales figures. CBD Me Time Mango Gummies 30-Pack, which had a gap in ranking data for November, retained its fifth position from December to January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.