Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

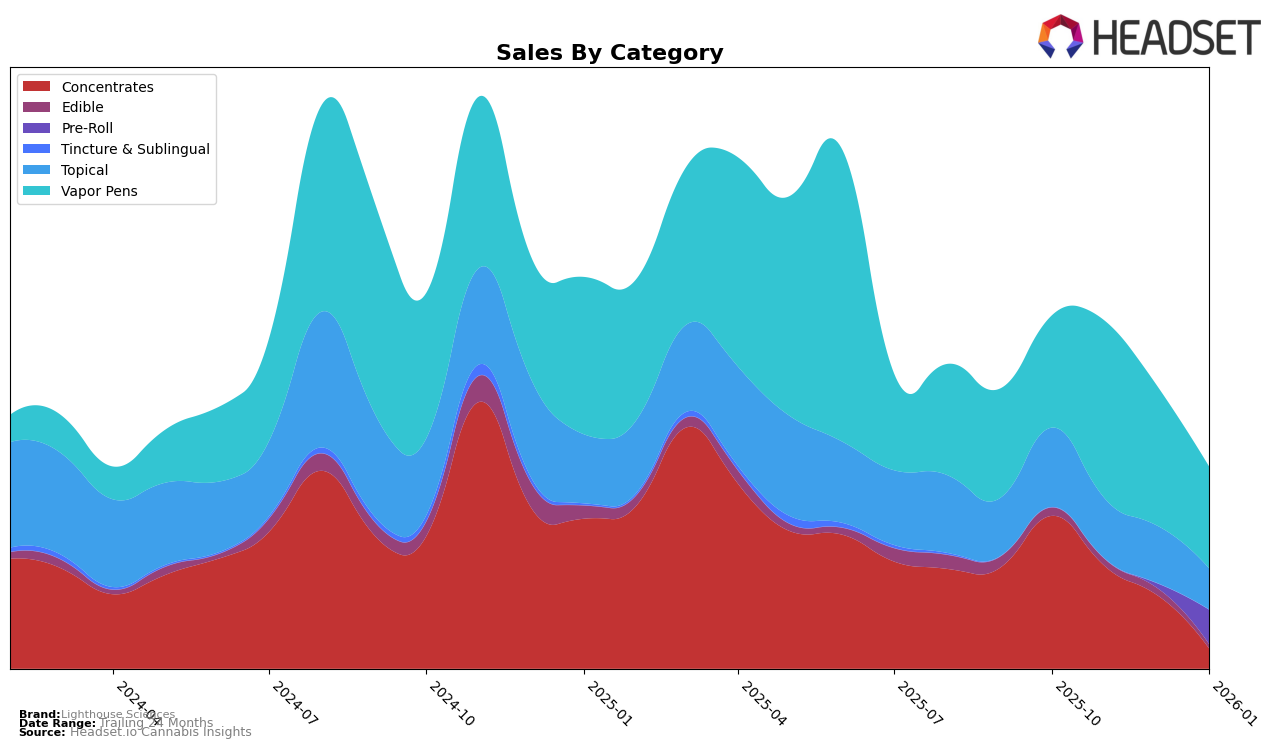

Lighthouse Sciences has demonstrated varied performance across different categories in Ohio. In the concentrates category, the brand experienced a downward trend, starting from a rank of 9 in October 2025 and slipping to 26 by January 2026. This decline in rank correlates with a significant drop in sales, from $161,851 in October to just $20,953 in January. Meanwhile, in the pre-roll category, Lighthouse Sciences made an entry at rank 26 in January 2026, suggesting a new or renewed focus in this segment, although it did not feature in the top 30 in the preceding months. On the other hand, the brand maintained a strong presence in the topical category, holding the number one position consistently until December 2025 before moving to the second spot in January 2026, indicating robust performance in this niche market.

In the vapor pens category, Lighthouse Sciences showed some fluctuations, entering the top 30 in November 2025 at rank 30, only to fall back to 41 by January 2026. This indicates a competitive environment and potential challenges in maintaining a steady position. Despite not being in the top 30 in October 2025, the brand's entry and subsequent ranking changes suggest attempts to capture market share, though the volatility hints at ongoing struggles. The diverse performance across these categories paints a picture of a brand that is both exploring new opportunities and facing challenges in maintaining its standing in established segments. For those interested in further details, Lighthouse Sciences' performance in Ohio provides a compelling case study of strategic movements within the cannabis industry.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ohio, Lighthouse Sciences has experienced notable fluctuations in its market position, impacting its sales trajectory. From October 2025 to January 2026, Lighthouse Sciences saw a significant jump in rank from 39th to 30th in November, which corresponded with a peak in sales during the same month. However, this momentum was not sustained, as the brand's rank fell to 41st by January 2026, indicating a decline in market presence. In comparison, Fuzed maintained a relatively stable position, only slightly declining from 29th to 39th over the same period, with sales reflecting a downward trend. Meanwhile, Riviera Creek and Roll One / R.O. demonstrated more consistent rankings, although they did not surpass Lighthouse Sciences during its peak. These dynamics suggest that while Lighthouse Sciences has the potential to capture significant market share, sustaining this requires addressing the volatility in its rankings and sales performance.

Notable Products

In January 2026, the top-performing product from Lighthouse Sciences was Sweet Jamaican Skunk Infused Pre-Roll (1g), which secured the number one spot with sales of 803 units. Following closely was the CBD/THC 6:1 MJ Muscles & Joint Balm (3000mg CBD, 500mg THC, 2oz) in the second position, maintaining its rank from December 2025. Blu Boi Diamond Injected Infused Pre-Roll (1g) made a notable entry into the rankings at third place. The CBD/THC 6:1 MJ Muscles & Joint Balm (1500mg CBD, 250mg THC, 1oz) dropped from second to fourth place over the months. Vegas Sunset Infused Pre-Roll (1g) rounded out the top five, showing strong performance as a new entrant in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.