Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

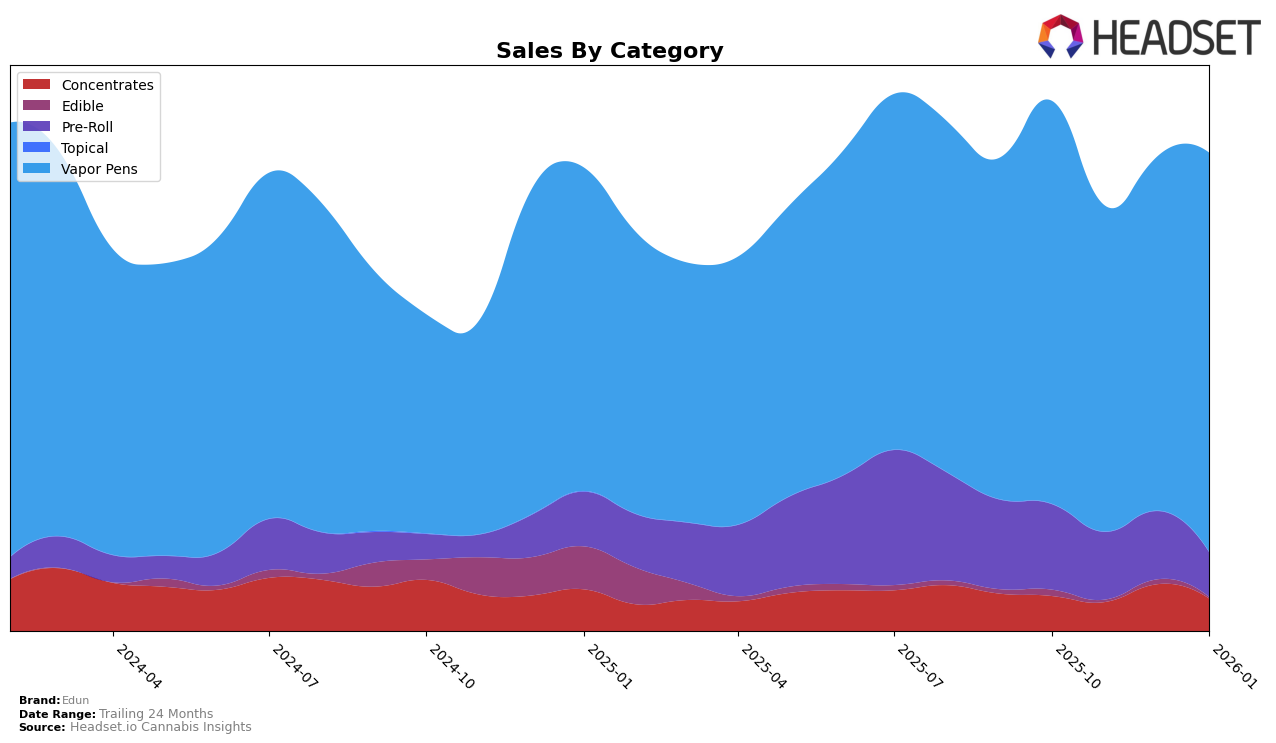

Edun's performance across categories in Colorado reflects a mix of stability and volatility. In the Concentrates category, Edun's rankings have fluctuated, with a notable dip out of the top 30 in October and January, highlighting the competitive nature of this segment. However, in December, the brand managed to break into the top 30, reaching the 29th rank, which indicates a temporary surge in popularity or strategic market penetration efforts. The Pre-Roll category tells a different story, with Edun consistently ranking within the top 30, although its position has gradually declined from 23rd in October to 31st by January, suggesting potential challenges in maintaining consumer interest or facing intensified competition.

In contrast, Edun's presence in the Vapor Pens category in Colorado has shown more resilience and stability. Despite a slight dip in rankings in November and December, the brand has maintained a strong foothold, staying within the top 15 throughout the observed period. This consistent performance is further underscored by a significant sales spike in January, nearly reaching the levels seen in October, which may indicate effective marketing strategies or increased consumer demand. The brand's ability to remain competitive in the Vapor Pens category, despite fluctuations in other segments, underscores its potential strength and consumer loyalty in that particular market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Edun has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 10th in October, Edun's rank dropped to 12th in November and 13th in December, before recovering slightly to 11th in January. This indicates a volatile market presence, with sales peaking again in January after a dip in November. In comparison, Seed & Strain Cannabis Co. consistently maintained a strong position, ranking 9th from November through January, with sales showing an upward trend. Meanwhile, Packs (fka Packwoods) demonstrated resilience, climbing from 14th in October to 10th in January, showcasing a strategic improvement in sales. Olio and Sauce Essentials also showed varying degrees of rank changes, with Olio slipping to 12th in January and Sauce Essentials peaking at 11th in December. These dynamics highlight the competitive pressure Edun faces, necessitating strategic adaptations to regain and sustain a higher market position.

Notable Products

In January 2026, Edun's top-performing product was Chem Dawg Live Rosin Cartridge (1g) in the Vapor Pens category, leading the sales with 803 units. Peanut Butter Breath Live Rosin Cartridge (1g) rose to the second position with sales slightly decreasing to 582 units from December's 586. Strawberry Banana Live Rosin Cartridge (1g) secured the third spot, while Chili Verde Live Rosin Cartridge (1g) followed closely in fourth. Cherry Paloma Live Rosin Cartridge (1g) dropped from third place in December to fifth in January, with sales declining to 525 units. The rankings show a consistent performance from Chem Dawg, while the other products experienced minor shifts in their standings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.