Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

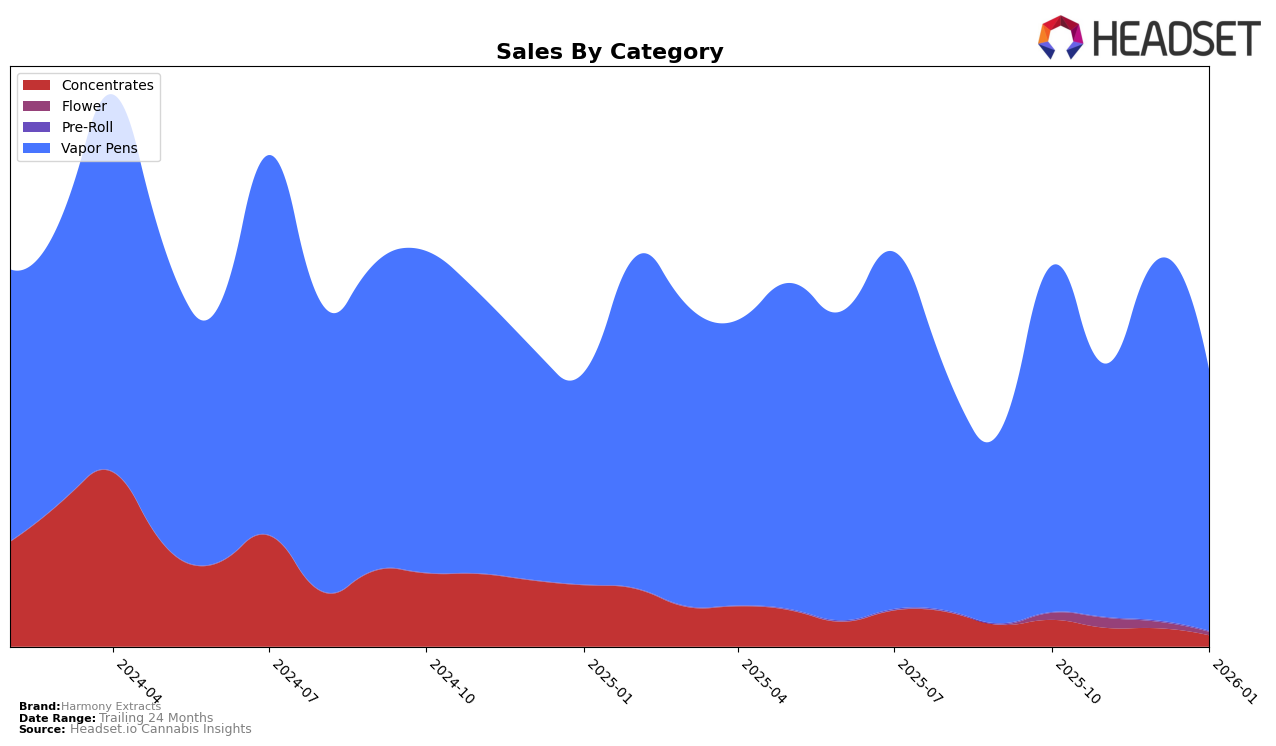

Harmony Extracts has shown varied performance across its product categories in Colorado. In the Concentrates category, the brand has not been able to break into the top 30 rankings over the last few months, with its rank slipping from 41 in October 2025 to 51 by January 2026. This decline is also reflected in the sales figures, which have consistently dropped from $37,624 in October to $15,680 in January. This trend indicates that Harmony Extracts might be facing stiff competition or a shift in consumer preferences within this category in the Colorado market.

Conversely, Harmony Extracts has maintained a stronger presence in the Vapor Pens category in Colorado. Despite some fluctuations, the brand has consistently ranked within the top 30, peaking at 16 in December 2025 before settling at 21 in January 2026. This category has shown a more robust sales performance, with a notable spike in December reaching $501,749. The ability to stay within the top 30 for Vapor Pens suggests a more stable demand and possibly a stronger brand loyalty or product appeal in this segment compared to Concentrates.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Harmony Extracts has experienced fluctuating rankings over the past few months, indicating a dynamic market position. In October 2025, Harmony Extracts ranked 17th, but by November, it had slipped to 21st, only to recover to 16th in December before dropping again to 21st in January 2026. This volatility contrasts with brands like The Clear, which saw a steady improvement from 20th to 13th before falling out of the top 20, and AiroPro, which maintained a more consistent ranking around the lower 20s. Notably, Natty Rems showed a significant rise from 24th to 17th, suggesting a growing market presence. Harmony Extracts' sales figures reflect these ranking shifts, with a notable peak in December 2025, indicating potential for growth if they can stabilize their market position amidst strong competition.

Notable Products

In January 2026, the top-performing product from Harmony Extracts was Flash - Fairy Floss Distillate Disposable (1g) in the Vapor Pens category, maintaining its first-place ranking from December 2025 with sales of 2707 units. Flash - Mountain Blast Distillate Disposable (1g) climbed to the second position, improving from its fifth-place rank in December 2025. Flash - Watermelon Bubblegum Distillate Disposable (1g) secured the third spot, showing a consistent presence in the top three despite a dip in November 2025. New to the rankings, Flash - Strawberry Distillate Disposable (1g) and Flash - Banana Pancakes Live Resin Disposable (1g) debuted at fourth and fifth positions, respectively, indicating a positive reception among consumers. Overall, the Vapor Pens category saw dynamic shifts, with established products maintaining strong sales alongside promising new entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.