Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

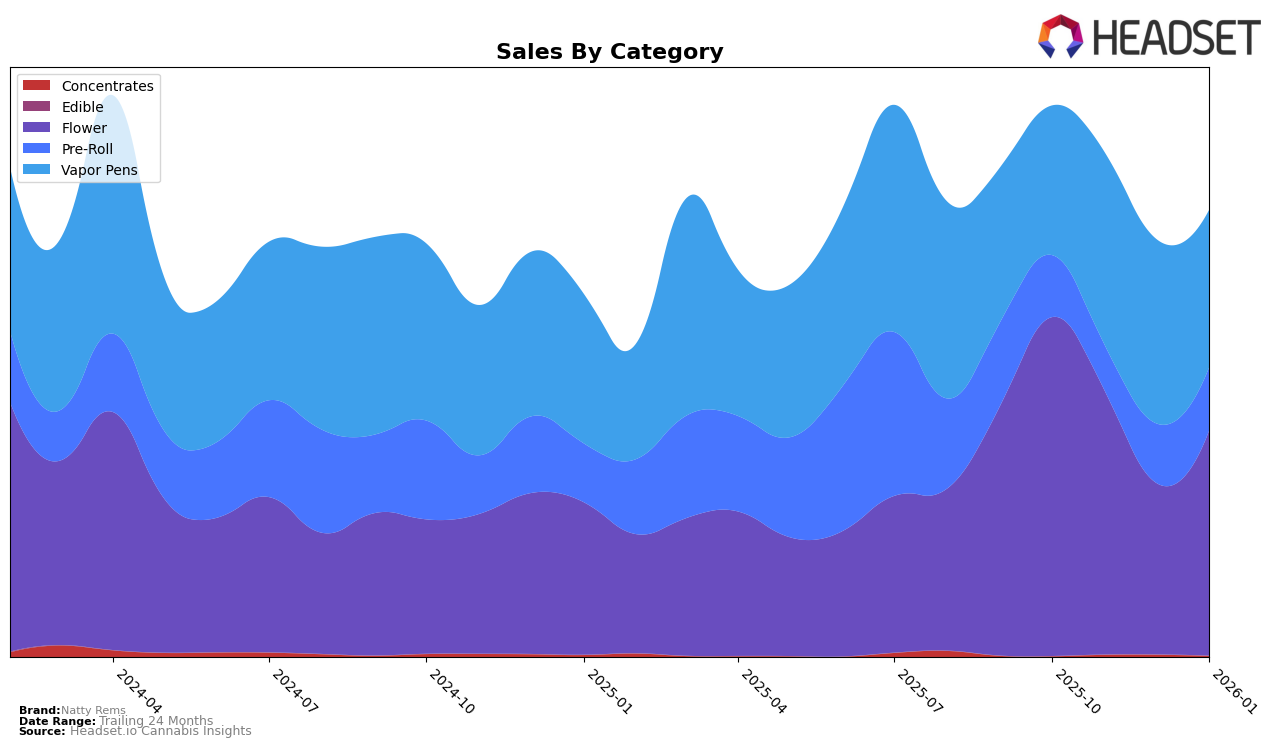

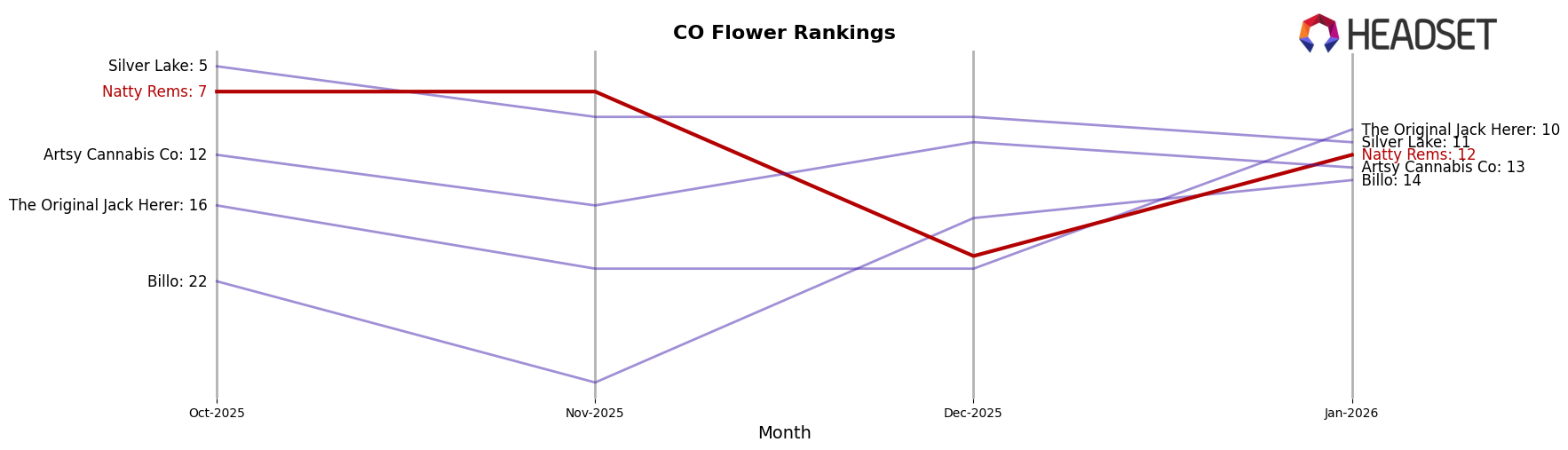

In the Colorado market, Natty Rems has demonstrated notable movements across different cannabis categories. In the Flower category, the brand maintained a strong presence, ranking consistently within the top 20 for the last four months, peaking at 7th place in October and November 2025 before dropping to 20th in December. This fluctuation indicates a dynamic market presence, with a recovery to 12th place by January 2026, suggesting a potential rebound in consumer interest or strategic adjustments. Meanwhile, the Pre-Roll category saw Natty Rems climbing from 21st to 17th place by January 2026, showing a positive trend despite not being in the top 30 in some months prior. Such movements highlight the competitive nature of the market and the brand's ability to adapt and improve its standing.

In the Vapor Pens category, Natty Rems exhibited a relatively stable performance, maintaining a position within the top 30 throughout the observed months. The brand reached its highest rank of 17th in November 2025, although it slightly declined to 19th by January 2026. Despite these minor fluctuations, the brand's consistent presence in the rankings indicates a steady demand for its vapor pen products in Colorado. The sales figures reflect a peak in November, which aligns with the brand's highest ranking during that period, suggesting that market strategies or promotional efforts might have been particularly effective. Overall, Natty Rems' performance across these categories underscores its resilience and ability to maintain a competitive edge in a dynamic market environment.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Natty Rems experienced notable fluctuations in its rankings from October 2025 to January 2026. Starting strong in October and November with a consistent 7th place, Natty Rems saw a significant drop to 20th in December before rebounding to 12th in January. This volatility in rank is mirrored in their sales, which dipped in December but recovered in January. In contrast, Silver Lake maintained a more stable presence, consistently ranking within the top 11, indicating a robust market position. Meanwhile, The Original Jack Herer showed a strong upward trend, climbing from 21st in December to 10th in January, surpassing Natty Rems during this period. Artsy Cannabis Co also demonstrated resilience, with a slight dip in November but quickly recovering to 11th in December. As Natty Rems navigates this competitive environment, understanding these dynamics could be crucial for strategizing future growth and maintaining market share.

Notable Products

In January 2026, Golden Goat (3.5g) maintained its top position for Natty Rems, with sales reaching 6,396 units. Natty Daddy OG (Bulk) climbed to the second rank, improving from its third position in December 2025. Runtz (Bulk) saw a significant rise, moving up from fifth to third place. Garlic Apples (Bulk) entered the charts at fourth place, showing strong initial sales. Golden Goat (Bulk) dropped slightly to fifth position from its consistent fourth rank in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.