Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

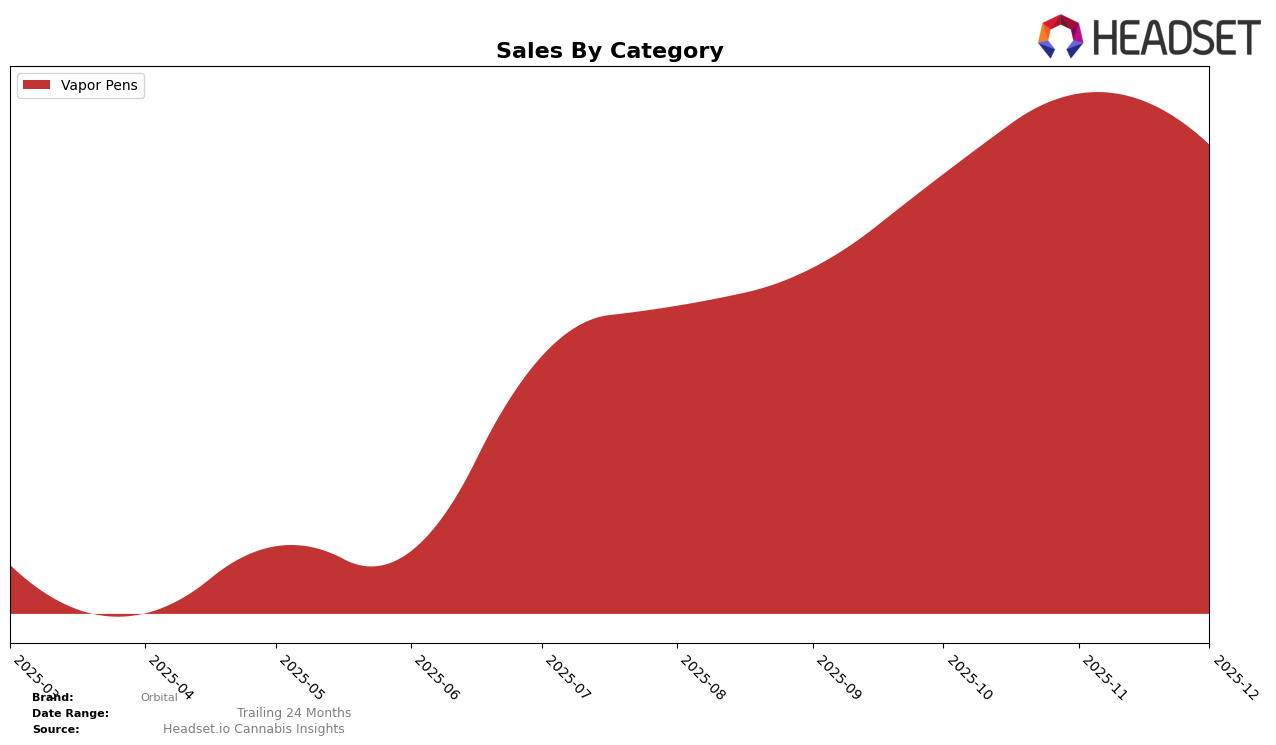

In the state of Colorado, Orbital has shown a notable trajectory in the Vapor Pens category. Starting from a position outside the top 30 in September 2025, Orbital made its way into the rankings by October, reaching the 30th spot. This upward trend continued into November, where they climbed to 27th place, before slightly dropping to 29th in December. This movement suggests a growing presence in the Colorado market, with a peak in November indicating a successful push or campaign during that month. The fact that they were not ranked in September highlights the brand's significant progress over the subsequent months.

Despite the slight dip in December, Orbital's performance in the Vapor Pens category in Colorado reflects a positive trend overall. The increase in sales from September to November, with a peak at over $272,000 in November 2025, underscores the brand's strengthening market position. However, the drop in ranking in December, while minor, could suggest increased competition or a seasonal fluctuation in consumer preferences. Observing these trends provides valuable insights into Orbital's strategic movements and potential areas for future growth within the state.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Orbital has demonstrated a notable upward trajectory in its ranking over the last few months of 2025, indicating a positive shift in market presence. Starting from a rank of 34 in September, Orbital climbed to 27 by November before settling at 29 in December. This improvement in rank is accompanied by a consistent increase in sales from September to November, although there was a slight dip in December. In contrast, 710 Labs experienced a decline, dropping out of the top 20 by October and continuing to fall to 27 by December, with a continuous decrease in sales throughout the period. Meanwhile, Lazercat Cannabis and Revel (CO) have maintained relatively stable positions, with Revel showing a significant jump in December. Bakked has remained steady around the 28-30 rank range. Orbital's rise in rank and sales amidst these shifts suggests a strengthening brand presence and potential for continued growth in the Colorado vapor pen market.

Notable Products

In December 2025, the top-performing product from Orbital was the Cap Junky Live Resin Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 1012 units. Following closely were the Gelato Cake Live Resin Cartridge (1g) and the Orange Glue Live Resin Cartridge (1g), ranked second and third, respectively. Notably, the Black Inferno Live Resin Cartridge (1g), which held the top position in November, dropped to fourth place with sales of 832 units. The GMO Live Resin Cartridge (1g) rounded out the top five. This shift in rankings highlights a competitive market, with Cap Junky Live Resin Cartridge emerging as a new leader in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.