Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

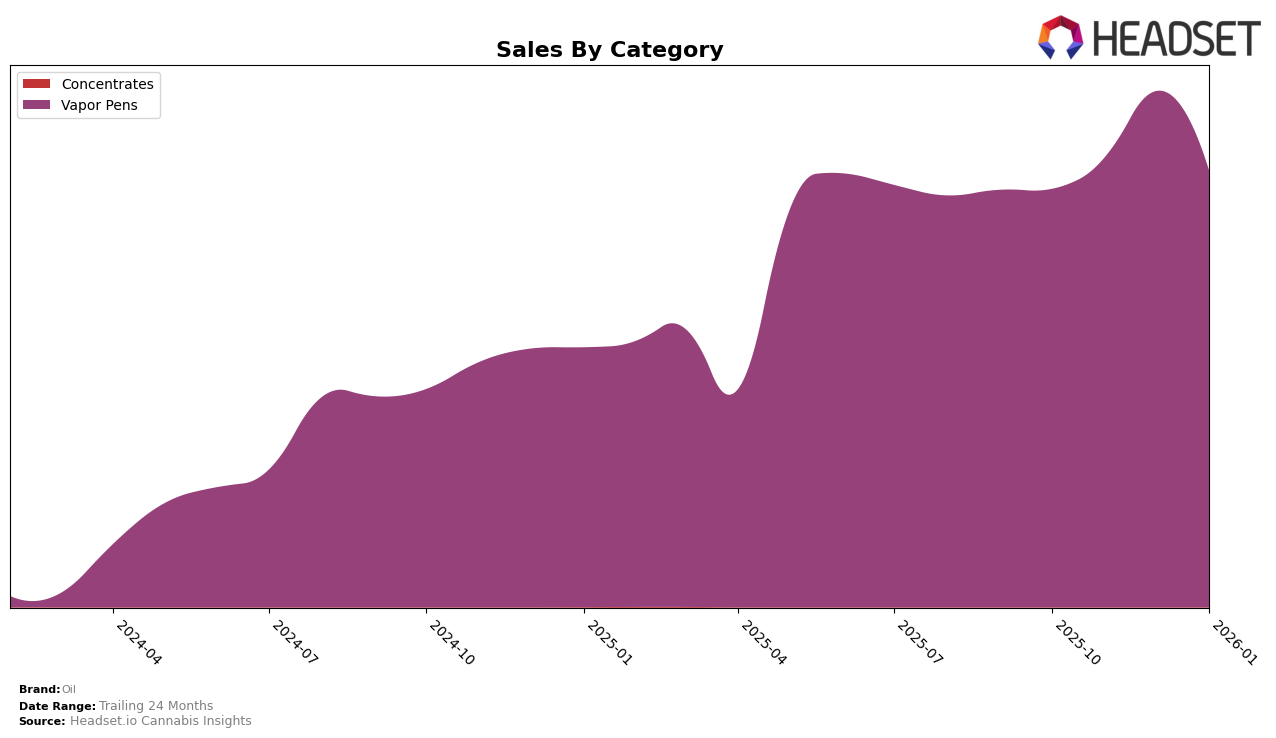

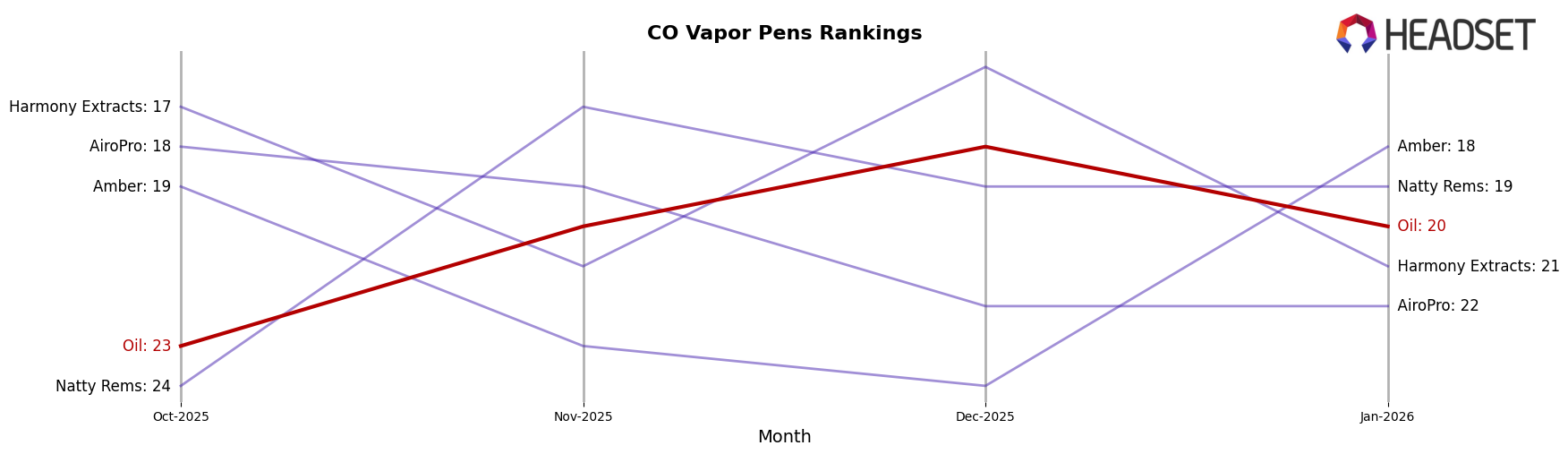

In the state of Colorado, the cannabis brand Oil has shown a consistent presence in the Vapor Pens category. Starting from October 2025, Oil ranked 23rd and improved its position to 20th by November. By December, it climbed further to 18th but fell back to 20th in January 2026. This fluctuation indicates a competitive landscape where Oil is maintaining its foothold within the top 30, a positive sign of resilience. The brand's sales figures also reflect this trend, with a noticeable peak in December, suggesting a potential seasonal influence or successful marketing strategy during that period.

Despite the positive trajectory in Colorado, Oil's absence from the top 30 in other states or categories highlights areas for potential growth. Not being ranked in these markets could be seen as a missed opportunity, especially if the brand aims to expand its footprint beyond Vapor Pens in Colorado. This gap presents both a challenge and an opportunity for Oil to explore strategic initiatives to enhance its presence and capture market share in other categories and regions. Understanding the competitive dynamics and consumer preferences in these untapped areas could be key to Oil's future success.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, Oil has shown a notable fluctuation in its rankings from October 2025 to January 2026. Starting at 23rd place in October, Oil improved to 20th in November and further to 18th in December, before slightly dropping back to 20th in January. This indicates a positive trend in sales performance, especially during the holiday season. In contrast, Harmony Extracts and AiroPro experienced more volatility, with Harmony Extracts dropping out of the top 20 in November and January, and AiroPro consistently ranking lower than Oil during this period. Meanwhile, Natty Rems showed a strong performance by entering the top 20 in November and maintaining its position through January, while Amber had a notable comeback in January, surpassing Oil by securing the 18th rank. These dynamics suggest that while Oil is gaining traction, it faces stiff competition from brands like Natty Rems and Amber, which have shown resilience and growth in the market.

Notable Products

In January 2026, Oil's top-performing product was the Twists Strawberry Shortcake Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales reaching 3705 units. The Baked Banana Distillate Cartridge (1g) also held steady at the second position, indicating consistent demand. The Grand Daddy Purps Distillate Cartridge (1g) returned to the rankings at third place after dropping off in December 2025, showing a slight increase in sales. New entries into the top five included Blueberry Swirl and Cherry Slush Distillate Cartridges, ranked fourth and fifth respectively, suggesting a diversification in consumer preferences. Overall, the rankings show stability at the top with some fresh contenders making their mark in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.