Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

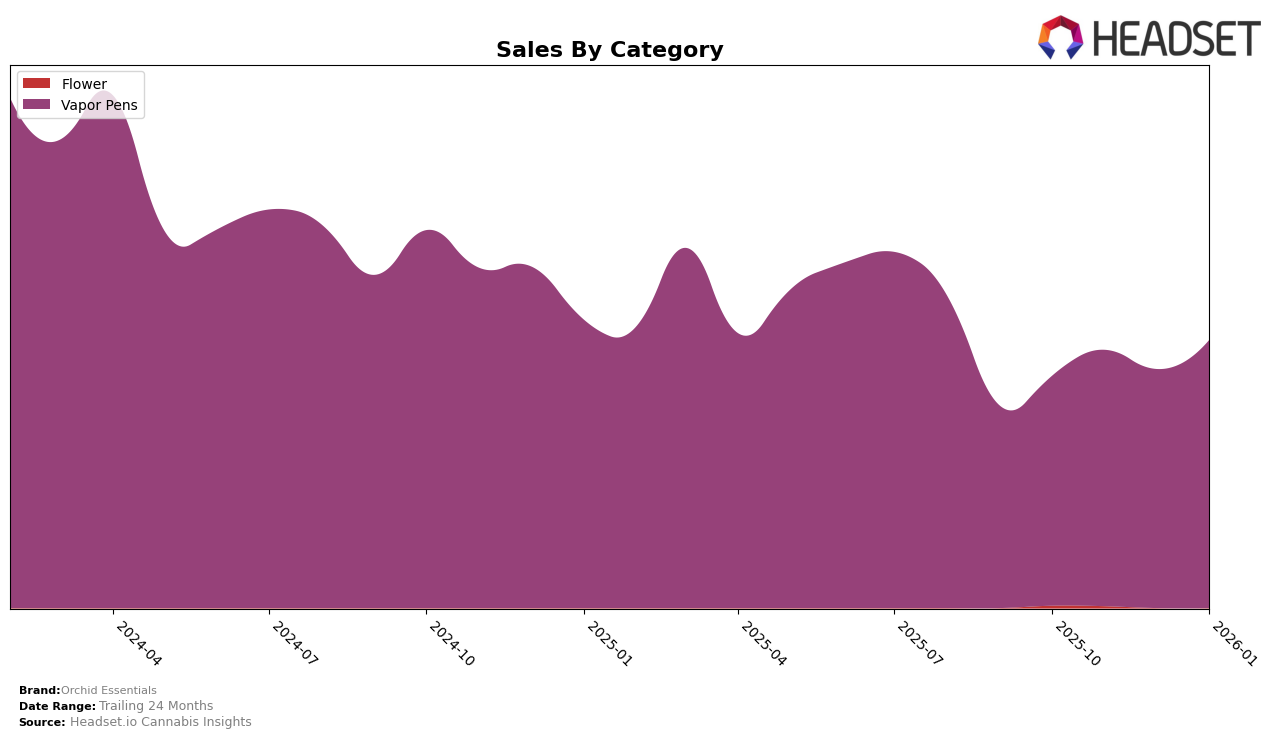

Orchid Essentials has shown a consistent performance in the Vapor Pens category in Oregon. After starting at rank 34 in October 2025, the brand made steady progress, moving up to rank 29 by January 2026. This upward trajectory indicates a positive reception and growing demand for their products in the state, despite not being in the top 30 initially. The sales figures also reflect this trend, with sales increasing from $112,285 in October 2025 to $131,195 in January 2026. This suggests that Orchid Essentials is gaining traction in the Oregon market, potentially due to successful marketing strategies or product offerings that resonate well with consumers.

However, Orchid Essentials' absence from the top 30 rankings in other states or categories might indicate areas where the brand could improve its market presence. The lack of ranking data for other states suggests that the brand has not yet achieved significant visibility or market penetration outside of Oregon in the Vapor Pens category. This could be an opportunity for Orchid Essentials to explore strategic expansions or enhancements in their product lineup to capture more market share. The brand's performance in Oregon could serve as a model for potential growth in other regions, provided they can replicate the factors contributing to their success there.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Orchid Essentials has shown a promising upward trend in rankings over the past few months, moving from 34th in October 2025 to 29th by January 2026. This improvement is noteworthy, especially when compared to competitors like Avitas, which consistently remained around the 31st position, and Fire Dept. Cannabis, which fluctuated slightly but ended at 32nd in January 2026. Orchid Essentials' sales have also seen a positive trajectory, particularly in January 2026, where they surpassed their previous months, indicating a growing consumer preference. Meanwhile, Willamette Valley Alchemy maintained a stronger position, albeit with a slight decline from 25th to 27th, reflecting a competitive edge but also a potential vulnerability. These dynamics suggest that Orchid Essentials is gaining momentum in the Oregon vapor pen market, positioning itself as a brand to watch in the coming months.

Notable Products

In January 2026, the top-performing product for Orchid Essentials was the Classic Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its position at rank 1 with sales of 390 units. The Gold Lemon Sour Diesel Live Resin Cartridge (1g) made a significant entry, securing the second position. The Classic Fizz Old Fashioned Float Live Resin Cartridge (1g) moved up to rank 3 from its previous absence in recent months. The Fizz Cherry Temple CO2 Cartridge (1g) debuted at rank 4, showcasing its growing popularity. Finally, the Gold Galactic Gary Live Resin Cartridge (1g) remained stable at rank 5, slightly improving its sales compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.