Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

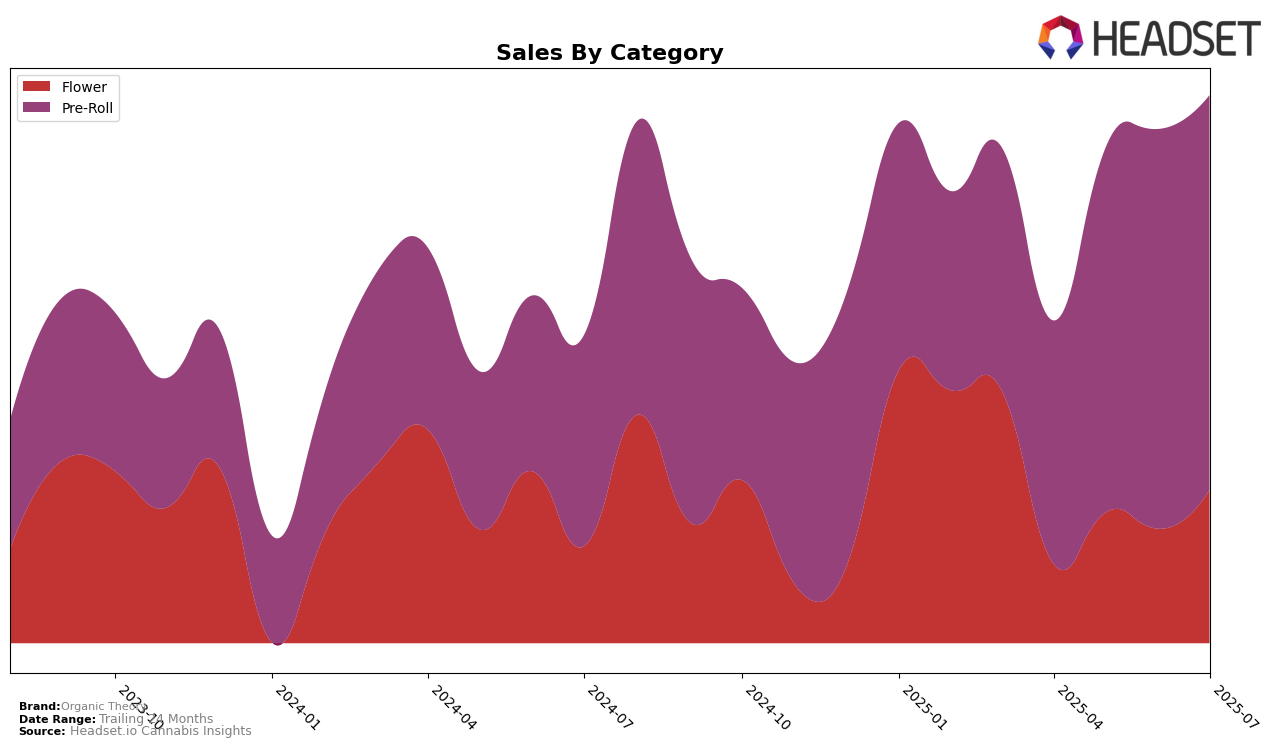

Organic Theory has demonstrated noteworthy progress in the Pre-Roll category within Oregon. In April 2025, the brand was ranked 36th, but by May, it had broken into the top 30, reaching the 30th position. This upward trajectory continued through June and July, where it maintained a steady 28th position. This consistent improvement indicates a strengthening presence in the market, reflecting strategic efforts to enhance their brand visibility and product appeal. Despite not being in the top 30 in April, the brand's ability to climb the ranks suggests a positive reception and growing consumer demand.

The sales figures for Organic Theory in the Oregon Pre-Roll category further highlight this upward trend. From April to May 2025, there was a significant increase in sales, jumping from approximately $77,000 to over $112,000. This growth continued into June, with sales peaking at around $122,000, before slightly decreasing in July. The brand's sustained presence in the top 30 throughout June and July, despite the slight dip in sales, indicates a stable market position. The ability to maintain rank while experiencing minor fluctuations in sales volume suggests potential resilience and adaptability in a competitive market landscape.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Organic Theory has shown a notable upward trend in its rankings from April to July 2025. Initially ranked 36th in April, Organic Theory improved its position to 28th by June and maintained this rank in July. This upward momentum is particularly significant when compared to competitors like East Fork Cultivars, which fluctuated between ranks 29 and 33, and Emerald Fields Cannabis, which saw a decline from 23rd in April to 29th in July. Although Feel Goods consistently outperformed Organic Theory, maintaining a rank between 20th and 26th, Organic Theory's sales growth trajectory suggests a strong competitive potential. Meanwhile, TKO / TKO Reserve also demonstrated improvement, ending July at 27th, just one spot above Organic Theory. These dynamics indicate that while Organic Theory is not yet among the top-tier brands, its consistent sales growth and improved ranking position it as a rising contender in the Oregon Pre-Roll market.

Notable Products

In July 2025, Organic Theory's top-performing product was Razz Cream Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its first place ranking from June with sales of 2126 units. Truffle Snacks Pre-Roll 2-Pack (2g) climbed to second place, improving from its consistent fifth place in the previous months. Unicorn Poop Fuel Pre-Roll 2-Pack (2g) made its debut in the rankings at third place, showing strong initial sales. Super Silver Purple Haze Pre-Roll 2-Pack (2g) re-entered the rankings at fourth place after being unranked in June. Allen Wrench Pre-Roll 2-Pack (1.5g) dropped to fifth place, after a previous high of second place in June, indicating a decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.