Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

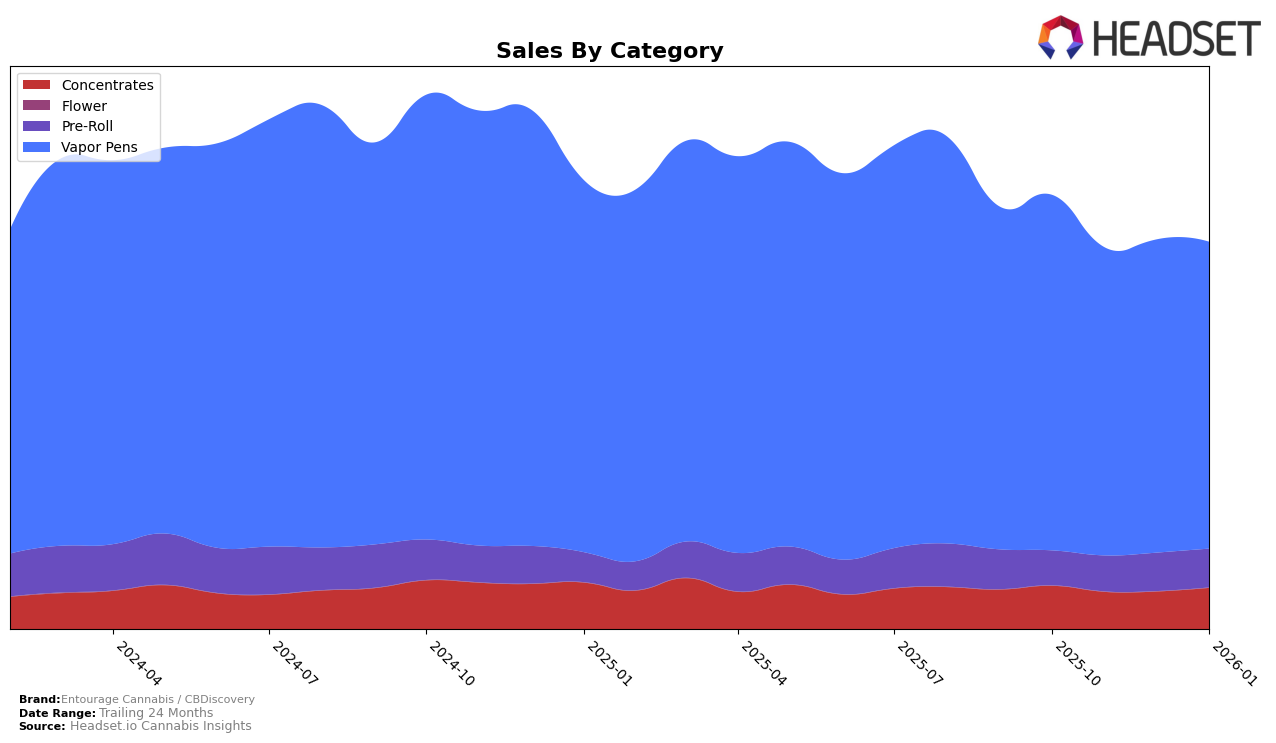

Entourage Cannabis / CBDiscovery has demonstrated notable performance in the Oregon market, particularly within the Vapor Pens category. The brand maintained its top position from October to December 2025, only slightly dropping to the second rank in January 2026. This consistent high ranking underscores their strong presence and consumer preference in this category. In the Concentrates category, Entourage Cannabis / CBDiscovery showed a slight fluctuation in rankings, moving from fifth to seventh place in November and December 2025, before reclaiming the fifth position in January 2026. Such movements suggest a resilient brand strategy that allows them to bounce back effectively in a competitive market.

In the Pre-Roll category, the brand's performance in Oregon also reflects a positive trend, with a steady climb from the 15th position in October to the 13th by December, which they maintained in January 2026. This upward trajectory indicates growing consumer interest and potentially effective marketing or product strategies. However, the absence of Entourage Cannabis / CBDiscovery from the top 30 in other states or categories could imply either a focused strategy primarily targeting Oregon or challenges in scaling their success beyond this market. This selective presence might be a strategic choice or an area for potential growth, depending on their broader market objectives.

Competitive Landscape

In the Oregon vapor pens category, Entourage Cannabis / CBDiscovery experienced a notable shift in its competitive standing from October 2025 to January 2026. Initially holding the top rank for three consecutive months, Entourage Cannabis / CBDiscovery was overtaken by Buddies in January 2026, dropping to the second position. This change in rank is significant as it indicates a competitive pressure from Buddies, whose sales closely trailed those of Entourage Cannabis / CBDiscovery throughout the period. Meanwhile, Hellavated and FRESHY maintained stable positions, with FRESHY showing a positive upward trend by moving from fifth to third place. The competitive landscape suggests that while Entourage Cannabis / CBDiscovery remains a strong player, it faces increasing competition, particularly from Buddies, which could impact its market share and sales momentum if the trend continues.

Notable Products

In January 2026, the top-performing product for Entourage Cannabis / CBDiscovery was the Pineapple Express Live Resin Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 2455 units. The Candy Pave Live Resin Cartridge (1g) followed closely as the second highest seller. Cherry Orange Punch Truly Live Resin Cartridge (1g) and Gush Mints Truly Live Resin Cartridge (1g) held the third and fourth positions, respectively. Notably, Strawberry Gary Truly Live Resin Cartridge (1g) saw a decline from the first rank in December 2025 to the fifth rank in January 2026. This shift indicates a rising preference among consumers for other flavors within the same category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.